Last updated on Feb 17, 2026

Get the free Michigan Installments Fixed Rate Promissory Note Secured by Commercial Real Estate t...

Show details

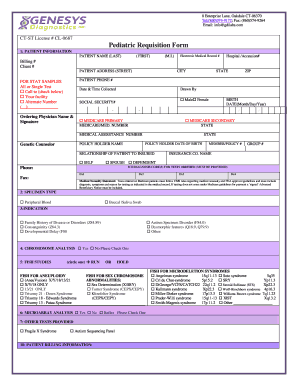

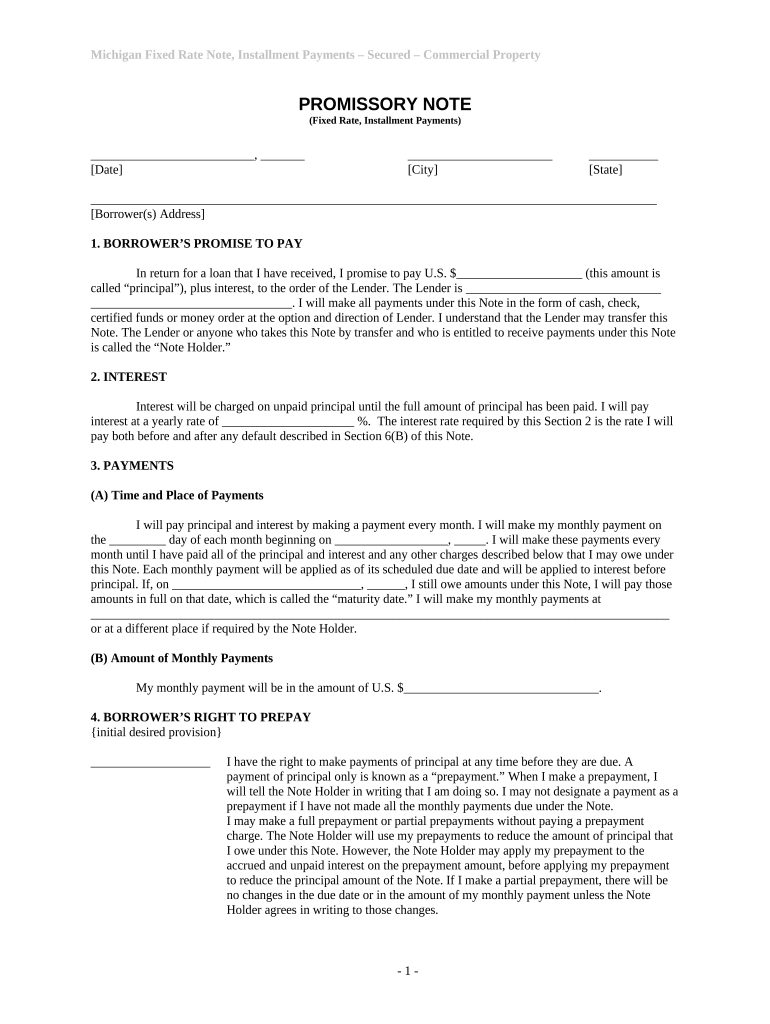

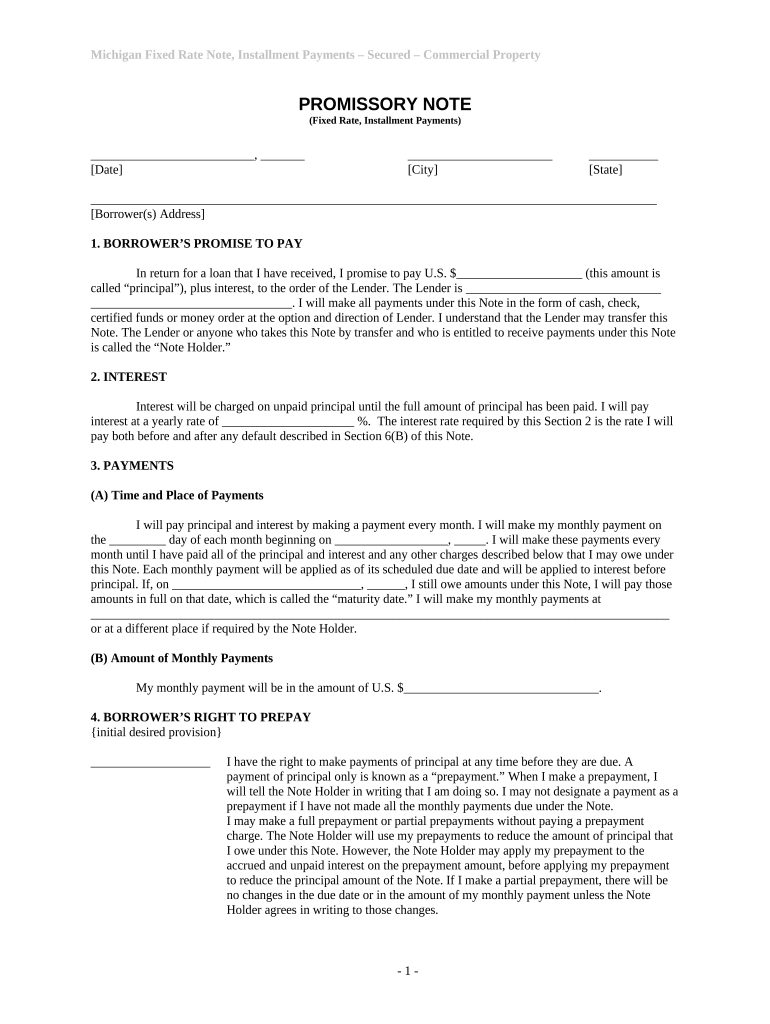

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is michigan installments fixed rate

Michigan Installments Fixed Rate refers to a structured payment plan that allows individuals to repay a fixed loan amount in equal installments over a specified period within the state of Michigan.

pdfFiller scores top ratings on review platforms

I use the web software and the app. I love how it is seamless.

Easy to use once I learned the system. I would recommend to anyone.

So far it works great and has been a real time saver!!

I was disappointed with the services I purchased, but PDF filler made it right and refunded my money. I appreciate how attentive they were to my needs and what I was looking for.

I need a way to name the form entrys for the patient they apply to

you have the forms I need and the website is easy to use

Who needs michigan installments fixed rate?

Explore how professionals across industries use pdfFiller.

A complete guide to Michigan fixed rate installment forms

TL;DR: How to fill out a Michigan installments fixed rate form

Filling out a Michigan fixed rate installment form involves providing accurate personal and property information, ensuring compliance with eligibility requirements, and submitting necessary documentation. Utilize a user-friendly platform like pdfFiller to edit, sign, and manage your application efficiently.

What is a Michigan Fixed Rate Note?

A Michigan Fixed Rate Note is a financial instrument used primarily for securing loans to finance commercial properties within the state. It enables borrowers to make predictable installment payments over a set term. Understanding this note is crucial for anyone looking to engage in real estate financing in Michigan.

-

A fixed rate note is a loan agreement with a predetermined interest rate that remains constant throughout the loan's lifespan, providing stability in repayment.

-

Installment payments allow borrowers to manage their finances better by breaking down the overall loan amount into manageable monthly payments, contributing to financial planning.

-

The note outlines the terms of repayment, interest rates, and the conditions under which the loan must be repaid, making it critical for both lenders and borrowers.

Who is eligible for the Fixed Rate Note?

Eligibility for the Michigan Fixed Rate Note generally rests on specific criteria that prospective borrowers must meet. This includes factors such as creditworthiness, income, and the type of property being financed.

-

Borrowers typically need a stable income and an acceptable credit score. Lenders will assess financial history before approving applications.

-

Commercial properties such as retail spaces, industrial properties, and multi-family dwellings are commonly eligible. Residential properties may not qualify.

-

Lenders will conduct a thorough analysis of the borrower's financial situation to ensure they can meet repayment obligations comfortably.

How to apply for the Michigan Fixed Rate Note?

Applying for the Michigan Fixed Rate Note involves a systematic approach that ensures all necessary details are accurately captured in the application form.

-

Access the application form on pdfFiller, fill out required fields, and submit electronically for faster processing.

-

Prepare essential documents such as proof of income, identification, and details about the property to support your application.

-

Carefully review your application for inaccuracies and ensure all required fields are completed to prevent delays.

What does the Michigan Fixed Rate Note include?

Understanding the components of the Michigan Fixed Rate Note can assist borrowers in managing their loans effectively.

-

The principal is the original loan amount, while interest is the cost of borrowing, typically expressed as a percentage of the principal.

-

Payments are usually a fixed amount due monthly, calculated based on the interest rate and loan term.

-

Late payments can incur fees and potentially lead to default, impacting the borrower's credit rating.

What are the repayment terms and conditions?

Repayment terms are critical to understanding your obligations as a borrower and ensuring timely payment throughout the loan period.

-

Typically, repayments are structured over several years, concluding at a specified maturity date when the loan must be fully repaid.

-

Borrowers can often make payments through various methods, including cash, check, or online transactions.

-

It is crucial to review your loan status and consider refinancing options or preparing for final payment to avoid lapses.

How does pdfFiller enhance your Fixed Rate Note experience?

pdfFiller provides a robust platform to assist users in managing their Michigan Fixed Rate Notes efficiently, streamlining both application and ongoing management.

-

Users can easily access their documents and make necessary edits online through pdfFiller's intuitive interface.

-

The eSign feature allows multiple parties to sign documents electronically, simplifying the process of securing agreements.

-

With pdfFiller’s tracking capabilities, users can monitor payments and manage documents from anywhere, ensuring better organization.

What are the state-specific compliance and regulations to consider?

Michigan has specific regulations governing fixed rate loans that borrowers must comply with to avoid penalties.

-

Regulatory requirements dictate how fixed rate loans are issued, safeguarded, and managed within the state.

-

It's essential for borrowers to familiarize themselves with state laws to ensure compliance and avoid financial repercussions.

-

Failing to adhere to regulations can lead to significant penalties, hence awareness and adherence are critical.

How can find resources and assistance?

Resources and assistance are vital for individuals navigating the fixed rate loan process in Michigan.

-

CDCs can be found through the Michigan economic development website, which often lists local financing partners.

-

Various government and nonprofit organizations provide grants or assistance to help mitigate financing costs.

-

It's recommended to seek advice from financial advisors or real estate experts to assist with the nuances of fixed rate notes.

How to fill out the michigan installments fixed rate

-

1.Open the PDF document containing the Michigan Installments Fixed Rate form.

-

2.Review the requirements and gather necessary documentation such as proof of income and identification.

-

3.Begin by filling in your personal information at the top of the form, including name, address, and contact details.

-

4.Next, specify the loan amount you are requesting and the purpose of the loan in the designated sections.

-

5.Select the fixed interest rate option and enter the agreed-upon rate.

-

6.Indicate the proposed repayment period—how long you plan to pay back the loan.

-

7.Carefully review all filled sections for accuracy to prevent mistakes.

-

8.Sign and date the form where indicated, confirming your agreement to the terms.

-

9.If applicable, provide any required witnesses or co-signers by having them sign in the designated areas.

-

10.Once completed, save the document and submit according to the provided instructions—either online or via mail.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.