Last updated on Feb 20, 2026

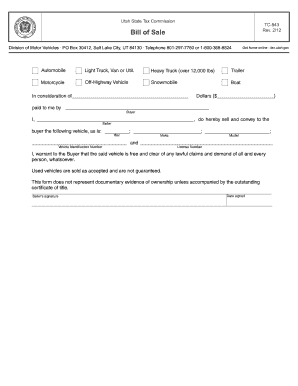

Get the free Individual Credit Application template

Show details

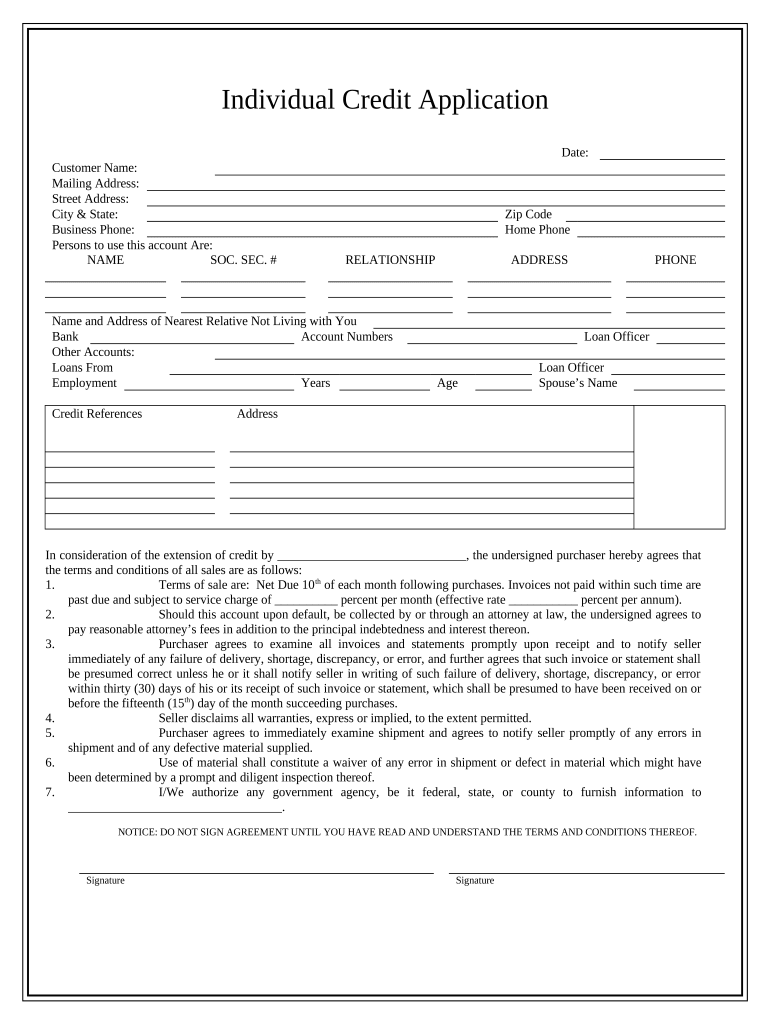

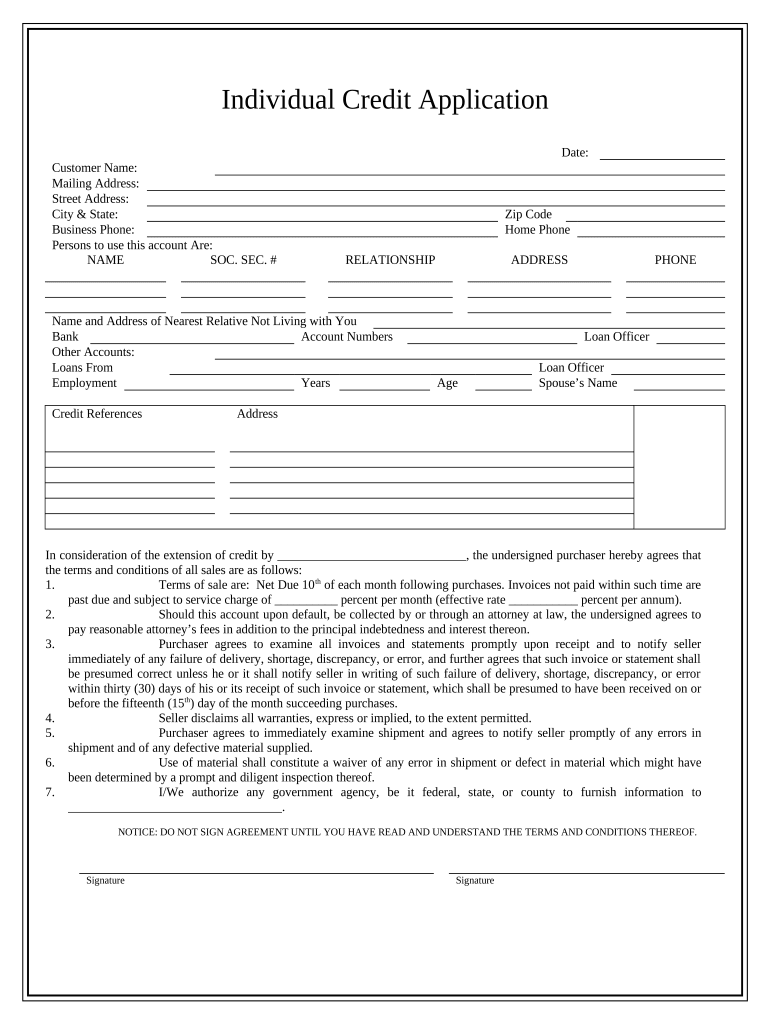

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is individual credit application

An individual credit application is a document used to request credit from lenders, containing personal and financial information to assess creditworthiness.

pdfFiller scores top ratings on review platforms

Do not like the prompts for each field. Can they be removed???

I was in a total jam and needed forms right away. I was so afraid my only option was to type all these required forms and then have to write in the answers with a pen. It would have taken me days to complete! When I discovered PDFfiller online it was like my guardian angel had guided me to the site! The user friendly site was easy to navagate and had easy to understand instructions. I'm very much impressed with your product and when I need another PDF form, I most certainly will use your product again. Thank you so much!

Good except I have trouble figuring out how to pull up forms and save them with a different name after filling them with new information so I can save them all.

Very surprised that I could do this PDF filler so easy

One big feature that is missing, as is from many of these types of editing / fill in forms, is the basic "Cut","Copy", "Paste" functions. However once I got use to the program's idiosyncrasies, It has been quite helpful. Oh, one more thing, I think more detailed instruction by some useful examples of how the features can benefit in everyday design of a fill-able forms would make it that much more useful.

Very easy to use. Big time saver when you need a template that is not used everyday

Who needs individual credit application template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Individual Credit Application Forms

How to fill out an individual credit application form

Filling out an individual credit application form involves providing accurate personal and financial information to seek credit from lenders. This guide outlines each section of the form, tips for accuracy, and the importance of thoroughness in this process, ensuring you can navigate your next credit application with confidence.

Understanding the individual credit application form

An individual credit application form is a document used by lenders to assess an applicant's creditworthiness. This form collects essential information about the applicant's finances, employment history, and personal details.

-

The form serves to evaluate an applicant's ability to repay a loan or credit facility.

-

Correct details help lenders make informed decisions and affect the loan terms and conditions offered.

-

Besides personal loans, businesses use this form when applying for credit to purchase goods or services.

What are the key components of the form?

The individual credit application form consists of several crucial sections that assess your financial situation and credit history.

-

Includes your name, address, Social Security number, and contact information.

-

Requires details about your income, savings, debts, and assets.

-

Provides insights into your job stability and reliability.

-

Details about the lending institution and the proposed loan terms.

How do you fill out the individual credit application form?

Filling out the form accurately ensures your application is processed smoothly and efficiently.

-

Start by gathering necessary documents to provide comprehensive information on each section.

-

Double check your numbers and dates to avoid clerical errors that can lead to processing delays.

-

Do not leave any fields blank unless stated. Keep your information updated to reflect your current status.

How can you edit and manage your application with pdfFiller?

pdfFiller provides a suite of tools to edit and manage your credit application easily, enhancing your user experience.

-

Utilize pdfFiller to make changes to your application instantly without needing to print it.

-

Keep digital copies of your application for future reference directly in your pdfFiller account.

-

Sign your application electronically to streamline the submission process.

What are some sample scenarios and case studies?

Learning from real-life examples of credit applications can illustrate the process's nuances.

-

Analyze a case where an applicant provided thorough documentation and received favorable loan terms.

-

Discuss frequent errors such as incorrect social security numbers that led to application delays.

-

Evaluate different methods of applying for credit, like through local banks versus online lenders.

What are the legal considerations and compliance related to this form?

Understanding regulations surrounding individual credit applications is vital for protecting your rights.

-

The Equal Credit Opportunity Act prohibits discrimination in credit transactions based on race, gender, or other characteristics.

-

As an applicant, you have the right to receive a copy of your credit report and to know the reasons for any adverse actions taken.

-

It's crucial to understand what's at stake if you default on a loan or fail to meet application terms.

How do you finalize your application?

Successfully submitting your individual credit application requires organization and confidence.

-

Ensure that all sections are complete and accurately filled before sending your application to the lender.

-

Track the status of your application and be ready to provide additional information if requested.

-

pdfFiller allows you to monitor your application status anytime from your mobile device.

How to fill out the individual credit application template

-

1.Obtain the individual credit application form from pdfFiller.

-

2.Open the form in pdfFiller using your web browser.

-

3.Carefully read the instructions provided on the form.

-

4.Start filling in your personal information, including your full name, address, and contact details.

-

5.Enter your Social Security number and date of birth for identification purposes.

-

6.Provide details about your employment situation, including employer information and income.

-

7.Include your financial information, such as bank accounts, debts, and assets.

-

8.Review the completed application for accuracy and completeness.

-

9.Sign and date the application in the designated area.

-

10.Save the completed form and download or submit it as per the lender's requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.