Get the free 497312249

Show details

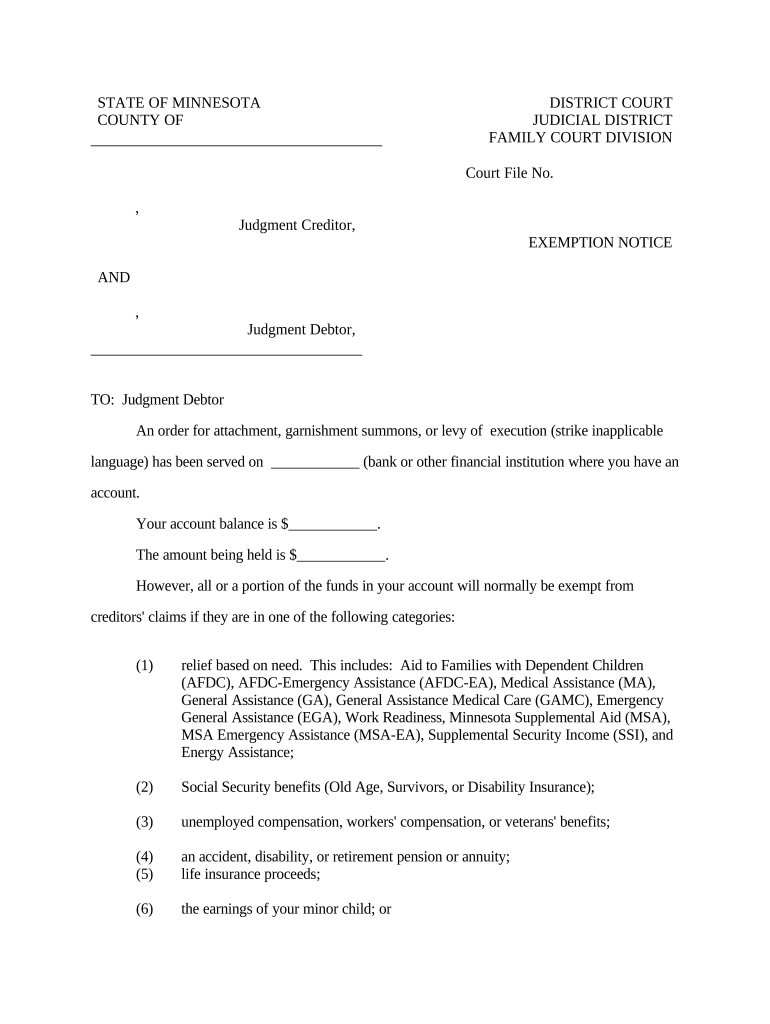

This form is an Exemption Notice. The notice provides that an order for attachment, garnishment, or levy has been served upon the judgment debtor's banking institution where he/she has an account.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice to garnishee regarding

A notice to garnishee regarding is a legal document informing a third party that their assets or payments to a debtor may be subject to garnishment.

pdfFiller scores top ratings on review platforms

Great! Easy to use.

great

Easy to use.

Best Software ever!!

Very good

Easy, convenient

Who needs 497312249 template?

Explore how professionals across industries use pdfFiller.

Complete guide to notice to garnishee regarding form form

What is a notice to garnishee?

A notice to garnishee is a legal document served to a third party, typically a bank or employer, informing them that they are required to hold certain funds or properties of a judgment debtor. This process is essential in the garnishment procedure, allowing creditors to collect debts directly from a debtor's pay or bank accounts.

-

Definition of Notice to Garnishee: It is a formal legal process initiated by the creditor to secure funds owed by the debtor.

-

Purpose and Importance: This document is crucial for protecting the rights of creditors and facilitating the collection of debts.

-

Who Issues the Notice? Generally issued by a court or the creditor who has obtained a judgment against the debtor.

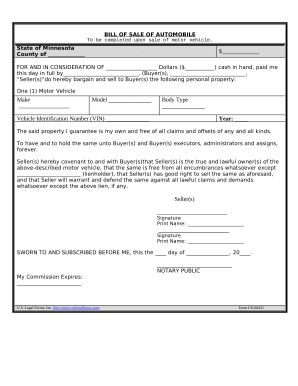

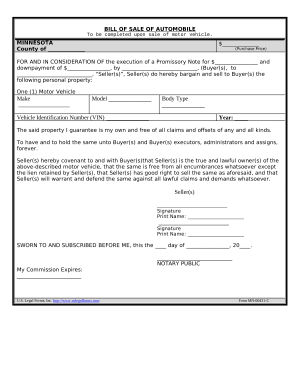

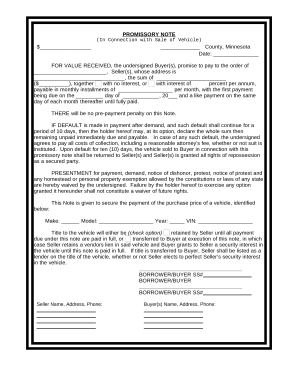

What are the key components of the notice to garnishee?

Understanding the components of the notice to garnishee is vital for ensuring compliance with the legal obligations it entails. These components help clarify the roles of involved parties and outline the steps necessary to comply with the garnishment.

-

Court File Number: This unique identifier connects the garnishment to the corresponding court case.

-

Involved Parties: Details about the judgment creditor (the one owed money) and the judgment debtor (the one who owes money) should be clearly stated.

-

Specifics of the Garnishment Process: The document should outline how the garnishment procedure will be conducted.

-

Legal Obligations of the Garnishee: It must be clear what responsibilities the garnishee has upon receiving the notice.

What is the legal framework for exemption notices?

Exemption notices are critical in garnishment cases as they protect certain funds from being seized. Understanding the categories of exempt funds allows judgment debtors to identify what resources they can retain despite legal actions.

-

Understanding Exemptions: Certain wages, public benefits, and retirement funds may be exempt from garnishment.

-

Categories of Exempt Funds: Funds could be preserved based on need, such as basic living expenses or support for dependents.

-

Specific Examples: Common exempt sources include Social Security disability payments and unemployment benefits.

-

Time Limits on Exemptions: There can be specific durations after which the exemption may no longer apply once funds are deposited in a bank.

How do you navigate the garnishment process?

Upon receiving a notice to garnishee, it is crucial to act promptly and follow the specified steps. This not only protects the rights of the garnishee but also ensures compliance with the law.

-

Initial Steps: Start by reviewing the notice thoroughly to understand its contents and your obligations.

-

Filling Out the Notice to Garnishee Form: Accurately complete all sections, providing the required information outlined.

-

Submitting Necessary Documentation: Ensure that all required documents are submitted on time to avoid penalties.

-

Responding to Obligations Timely: Maintain communication with legal counsel or authorities to comply with timelines and regulations.

What interactive tools can assist with the notice to garnishee form?

Utilizing interactive tools can streamline the process of completing and managing the notice to garnishee form, making it more efficient.

-

Utilizing pdfFiller: A powerful platform that enables users to edit and sign PDF documents seamlessly.

-

Collaborating with Colleagues: The capability to share documents fosters teamwork, especially in a business environment.

-

Accessing Cloud-Based Storage: Users can safely store and share their completed forms through cloud integrations.

What are common challenges faced in this process?

Navigating the garnishment process can present various challenges, and being aware of these helps individuals prepare effectively.

-

Common Issues: Mistakes in filling out the notice can lead to legal repercussions for both the garnishee and the debtor.

-

Misunderstandings About Exemptions: Debtors may be unaware of their rights concerning exempt sources of income.

-

Resources for Legal Assistance: It's advisable to seek professional legal help when in doubt to navigate these challenges.

How does garnishment compliance apply to Minnesota residents?

Minnesota has specific garnishment laws that residents must adhere to, making it essential to understand local regulations.

-

Understanding Minnesota Garnishment Laws: Familiarity with state laws helps ensure compliance and the protection of one's rights.

-

Local Resources: Many resources are available through state websites that provide guidance on the garnishment process.

-

Impact of Judgment Creditor's Location: The jurisdiction of the creditor can influence how the process unfolds for the debtor.

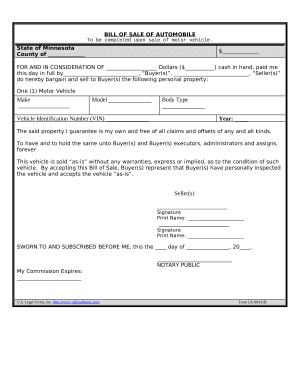

How to fill out the 497312249 template

-

1.Open the ‘notice to garnishee regarding’ template on pdfFiller.

-

2.Identify the relevant fields that need to be filled in, including the creditor's name, debtor's name, and garnishee's information.

-

3.Enter the creditor's name and contact information in the designated section.

-

4.Provide the debtor's details, including their full name and address.

-

5.Fill out the garnishee's information, ensuring to include their name and address accurately.

-

6.Include specifics about the debt to ensure clarity, such as the amount owed and the basis for the garnishment.

-

7.Ensure any necessary legal references or case numbers related to the garnishment are included.

-

8.Review the form for accuracy and completeness before submission.

-

9.Save the document and print if necessary for delivery to the garnishee and associated parties.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.