Get the free garnishee minnesota

Show details

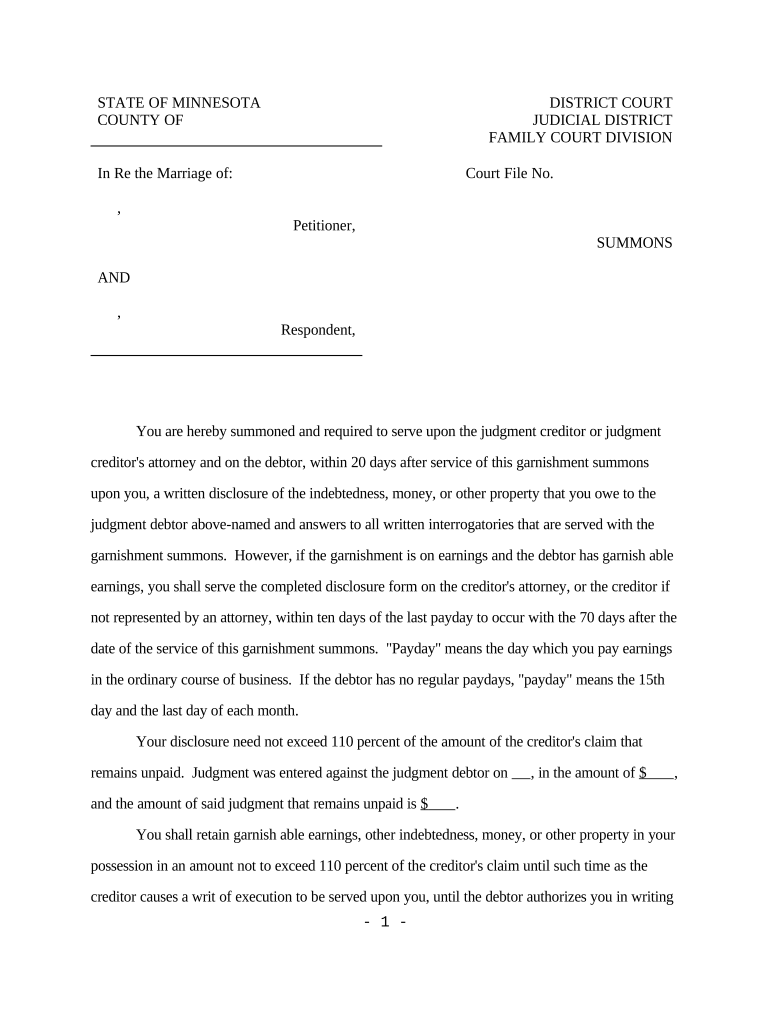

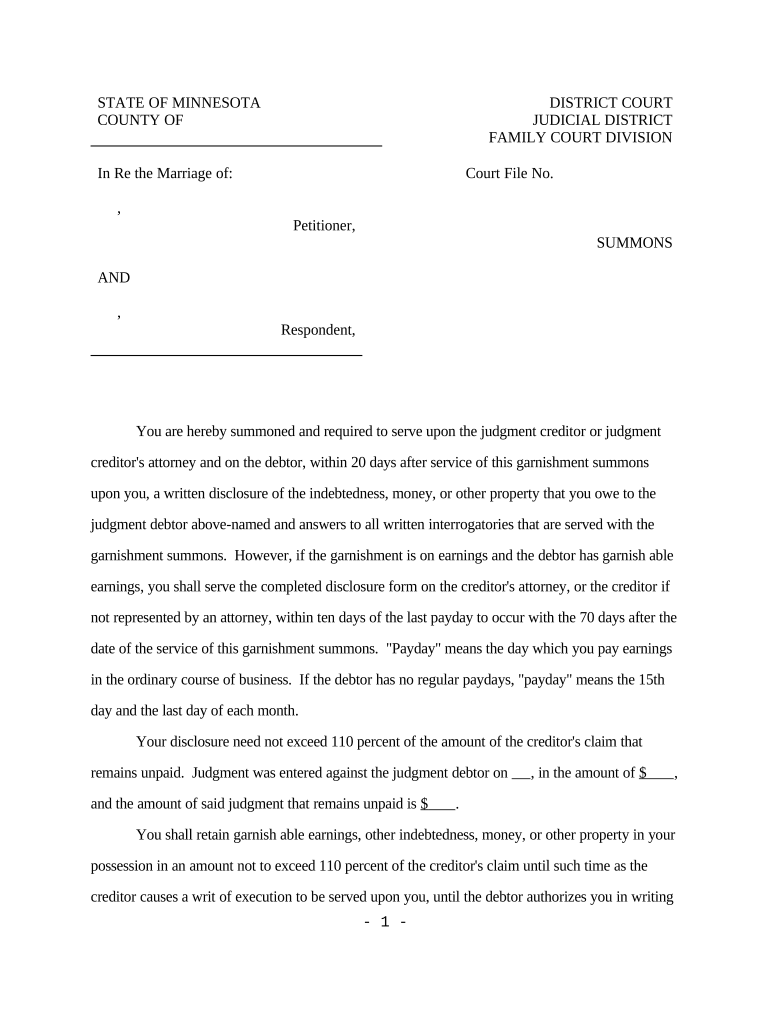

The Garnishee was paid - 3 - DATED Attorney for Petitioner 1 Address City State Zip Telephone Attorney Reg. No. - 4 -. Check applicable box Earnings garnishment see attached Earnings Disclosure Form No earnings garnishment see attached No earnings Disclosure Form Both Earnings and No earnings garnishment see both attached Earnings and No earnings disclosure Form NOTICE TO DEBTOR - 2 - A Garnishment Summons Earnings Garnishment Disclosure form Nonage Garnishment Disclosure form Garnishment...Exemption Notices and/or written Interrogatories strike out if not applicable copies of which are hereby served on you were served upon the Garnishee by delivering copies to the Garnishee. EARNINGS In the event you are summoned as a garnishee because you owe earnings as defined on the Earnings Garnishment Disclosure form attached to this Garnishment Summon if applicable to the debtor then you are required to serve upon the creditor s attorney or the creditor if not represented by an attorney a...written earnings disclosure form within the time limit set forth above. STATE OF MINNESOTA COUNTY OF DISTRICT COURT JUDICIAL DISTRICT FAMILY COURT DIVISION In Re the Marriage of Court File No* Petitioner SUMMONS AND Respondent You are hereby summoned and required to serve upon the judgment creditor or judgment creditor s attorney and on the debtor within 20 days after service of this garnishment summons upon you a written disclosure of the indebtedness money or other property that you owe to the...judgment debtor above-named and answers to all written interrogatories that are served with the garnishment summons. However if the garnishment is on earnings and the debtor has garnish able earnings you shall serve the completed disclosure form on the creditor s attorney or the creditor if not represented by an attorney within ten days of the last payday to occur with the 70 days after the date of the service of this garnishment summons. Payday means the day which you pay earnings in the...ordinary course of business. If the debtor has no regular paydays payday means the 15th day and the last day of each month. Your disclosure need not exceed 110 percent of the amount of the creditor s claim that remains unpaid* Judgment was entered against the judgment debtor on and the amount of said judgment that remains unpaid is. You shall retain garnish able earnings other indebtedness money or other property in your possession in an amount not to exceed 110 percent of the creditor s claim...until such time as the creditor causes a writ of execution to be served upon you until the debtor authorizes you in writing - 1 - to release the property to the creditor or until the expiration of 180 days from the date of service of this garnishment summons upon you at which time you shall return the disposable earnings other indebtedness money or other property to the debtor. In the case of earnings you are further required to retain in your possession all unpaid nonexempt disposable earnings...owed or to be owed by you and earned or to be earned to the debtor within the pay period in which this garnishment summons is served and within all the subsequent pay periods whose paydays defined above occur within the 70 days after the date of service of this Any assignment of earnings made by the debtor to any party within ten days before the receipt of the first garnishment on a debt is void* Any indebtedness to you incurred by the debtor within the ten days before the receipt of the first...garnishment on a debt may not be set off against amounts otherwise subject to the garnishment.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

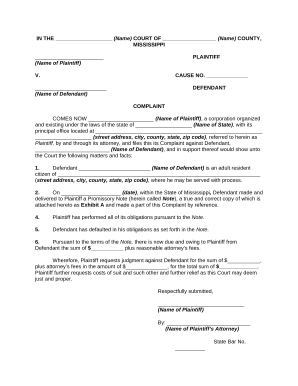

What is summons to employer of

A summons to employer of is a legal document that formally requests an employer to respond to a legal complaint regarding an employee.

pdfFiller scores top ratings on review platforms

excelent

Very Good

Ease of use and clarity of website

Easy to operate

It was very user-friendly and easy to follow directions.

easy to fill out, printable and editable

Who needs garnishee minnesota template?

Explore how professionals across industries use pdfFiller.

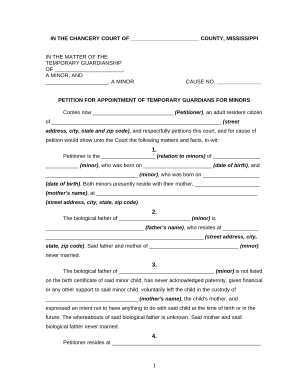

How to Complete the Summons to Employer of Form

What is the summons to employer form?

The summons to employer form is a crucial document in the wage garnishment process. It acts as a legal notification for an employer regarding an employee's debts, directing them to withhold a portion of the employee's earnings. This form not only helps creditors recover debts but also has significant implications for both employers and employees.

-

This form notifies employers of their obligation to withhold wages for debt repayment.

-

It is integral in ensuring that debts are paid through automatic deductions from wages.

-

Employers need to understand their legal responsibilities, while debtors may face financial strain.

What are the key components of the summons to employer form?

Understanding the key components of the summons form is essential for proper completion. Each part of the form includes specific information that ensures the garnishment process is legally compliant and effective.

-

The form distinguishes the petitioner (the creditor) and the respondent (the employer), clarifying their roles.

-

The court file number must be included to identify the specific case related to the debt.

-

Terms like Judgment Creditor and Judgment Debtor are vital in understanding the legal obligations.

How do fill out the summons to employer form correctly?

Filling out the summons to employer form accurately is crucial for its acceptance in court. It can prevent delays and complications during the garnishment process. Here’s a step-by-step guide to ensure you do it correctly.

-

Begin by clearly filling out all fields, ensuring accuracy in names and figures.

-

Double-check information to minimize mistakes that could delay service.

-

Understand how to report amounts owed to avoid legal issues.

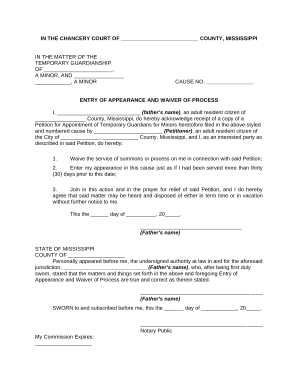

What are the legal requirements for serving the summons?

Serving the summons to employer is a formal process governed by legal guidelines. Ensuring this step is executed correctly is essential, as it impacts the effectiveness of the garnishment.

-

Summons can usually be served via personal delivery or mail, depending on local laws.

-

There are specific deadlines for serving the summons to ensure compliance.

-

Failure to serve correctly can lead to legal dismissals or additional costs.

How should respond to the summons?

After receiving the summons, employers must respond promptly and accurately. This response includes providing disclosures about the employee’s earnings and other relevant financial information.

-

Employers need to provide a detailed report of earnings within the specified deadline.

-

These are questions summonsed employers must answer, which further clarify the financial situation of the employee.

-

Adhering to the timelines ensures compliance with legal directives.

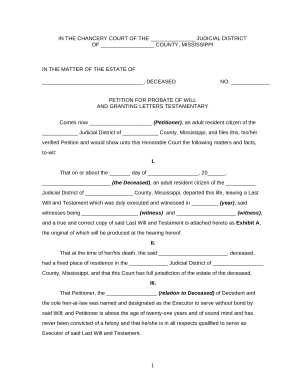

What are the next steps after serving the summons?

Once the summons has been served, employers have specific responsibilities to uphold. This phase is critical for ensuring that the garnishment is handled correctly.

-

Employers must retain the appropriate garnished amounts and report to the court.

-

Careful tracking of what is withheld from wages is essential to avoid penalties.

-

Failure to comply can lead to legal ramifications for the employer.

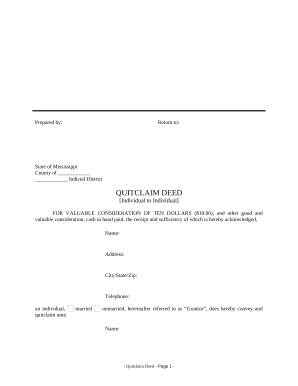

What resources are available for employers and debtors?

Various resources are available to assist employers and debtors in navigating the garnishment process. Understanding these tools can ease the burden that often accompanies legal obligations.

-

Access a library of forms on pdfFiller that can simplify the process.

-

Find information on legal professionals who specialize in garnishment cases.

-

Utilize tools on pdfFiller for effective document management and eSigning.

How can pdfFiller tools assist in this process?

PDF Filler provides a suite of tools designed to streamline the process of managing forms like the summons to employer. From editing to eSigning, these features enhance efficiency and ease of use.

-

Users can easily modify documents to fit their specific needs.

-

Facilitate quicker processing by allowing digital signatures.

-

Teams can work together effectively, ensuring communication throughout the process.

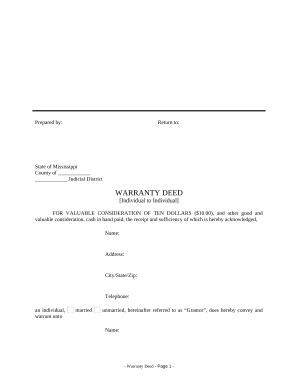

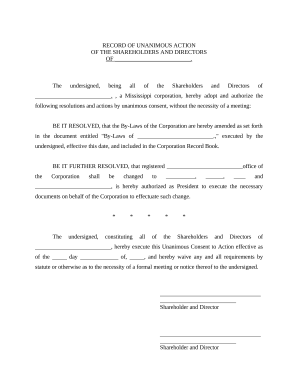

How to fill out the garnishee minnesota template

-

1.Open the PDF filler application on your device and select the 'summons to employer of' template.

-

2.Begin by entering the title of the document in the designated field at the top of the form.

-

3.Fill in the date and location of the summons issuance in the appropriate sections.

-

4.Enter the name and address of the employer and ensure that the information is accurate.

-

5.Provide the name of the employee filing the summons as well as their contact information.

-

6.If applicable, specify the nature of the complaint and any relevant case details in the designated area.

-

7.Review all entered information for accuracy and completeness.

-

8.Finalize the form by signing and dating at the bottom of the document.

-

9.Save the completed summons, ensuring it is in a format suitable for printing and signing if needed.

-

10.Submit the summons to the employer via the appropriate legal channels, such as certified mail or personal delivery.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.