Get the free Notice to Judgment Debtor of Creditor's Intent to Levy Upon Earnings in 10 Days temp...

Show details

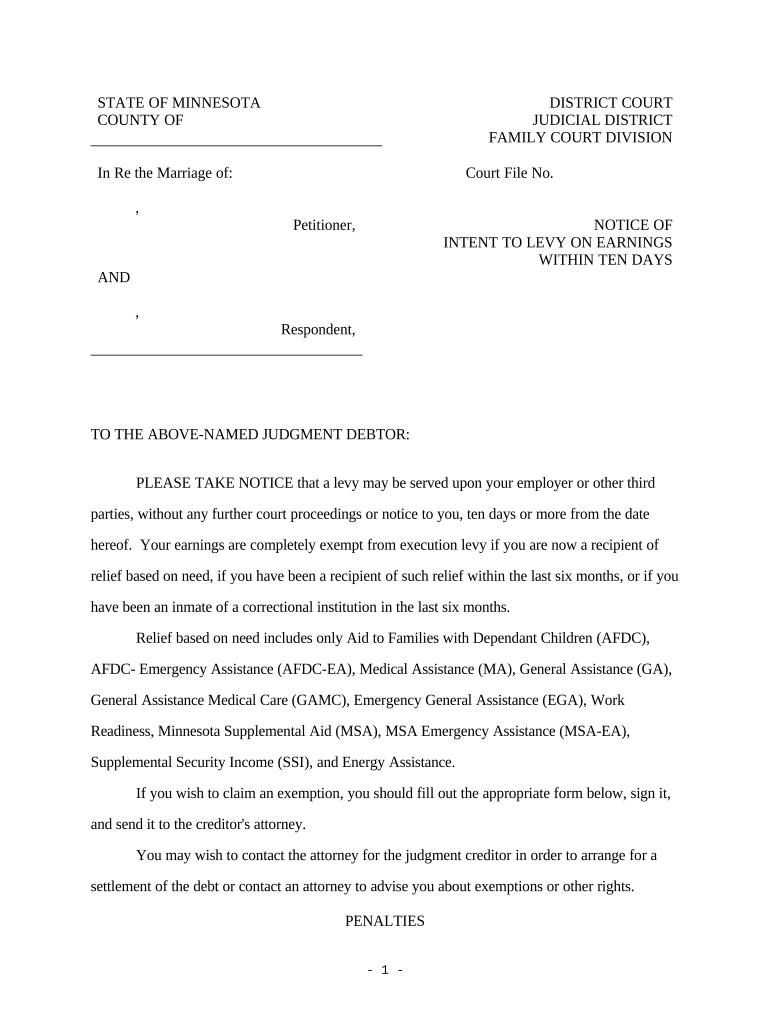

This notice to Debtor indicates that creditor will levy upon earnings in 10 days time if debt is not paid.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice to judgment debtor

A 'notice to judgment debtor' is a legal document informing a debtor of a judgment against them and their obligations.

pdfFiller scores top ratings on review platforms

Very useful tool, makes internet business so much easier.

it was great for what I needed at the time.

i Love this easy to use have all the forms for me to do my billing and saves my 1500 CMS forms which is super helpful

It is great it saves my work and I can come back to it whenever I need to.

liking what I see, but still a new subscriber and getting to know the product

Easy to alter documents and save the changes. Really worthwhile.

Who needs notice to judgment debtor?

Explore how professionals across industries use pdfFiller.

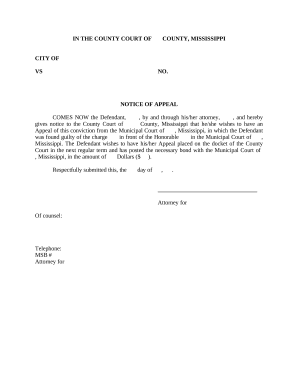

Notice to Judgment Debtor Form Guide

Filling out a notice to judgment debtor form form can seem daunting, but understanding the process is key to managing your debts effectively. This guide provides a comprehensive overview of the notice, its components, and your rights.

What is a notice to judgment debtor?

A Notice to Judgment Debtor is a legal document that informs a debtor of their outstanding debt and outlines the creditor's right to collect. This notification serves multiple purposes, primarily to ensure that debtors are aware of their financial obligations and the ensuing steps if the debt remains unpaid.

-

It's a formal communication regarding the debt.

-

Helps establish communication and potential resolution.

-

Ignoring this notice may lead to further legal actions.

What are the key components of the notice?

The notice typically includes crucial identifiers such as the judicial district and court file number, enabling an accurate reference. Additionally, it contains the details of both the petitioner and respondent, ensuring that the notice is legitimate and traceable.

-

This indicates the specific court handling the case.

-

A unique identifier for the case, important for records.

-

Specifics include information on earning levies and payment terms.

How do you fill out the notice: Step-by-step guide?

To complete the notice, start by gathering all required personal and case information. It's essential to accurately fill in each section of the template, as errors can lead to delays or further complications.

-

Ensure you have relevant personal details and case specifics.

-

Follow instructions carefully for accuracy.

-

Adhere to document formatting standards and include any necessary annotations.

What exemptions are available: Your rights?

As a judgment debtor, you may qualify for certain exemptions that can protect your income or assets from collection. Understanding these exemptions and the related qualification criteria is essential for your financial protection.

-

Learn about the types of income and assets that may be exempt.

-

Certain programs, such as government assistance, may qualify you for exemptions.

-

Detailed steps to claim your exemptions correctly.

What are the penalties and consequences of default?

Ignoring a notice to judgment debtor can result in severe penalties such as additional legal fees and wage garnishment. Understanding the potential consequences of inaction is vital to make informed decisions.

-

Ignoring the notice may incur extra fees and legal fees.

-

Incorrectly served levies can lead to mismanagement of debts.

-

Options available if your rights are not respected during the collection process.

How can you manage your documents with pdfFiller?

pdfFiller enhances the document management experience by providing tools for seamless editing, electronic signatures, and secure storage. Utilizing these features can simplify your interactions with legal documentation.

-

Easily modify content and structure of your legal documents.

-

Work with others by sharing documents for digital signature and input.

-

Keep your documents organized and accessible from any location.

What are your next steps?

Upon receiving a notice to judgment debtor, carefully review the document and understand your rights. Preparing for possible legal consultations can be crucial in navigating potential disputes, ensuring you act in a timely manner is essential.

-

Familiarize yourself with the content and implications.

-

Seek professional legal advice if necessary.

-

Understand deadlines for responding to the notice.

How to fill out the notice to judgment debtor

-

1.Open the pdfFiller platform and search for 'notice to judgment debtor' template.

-

2.Select the appropriate template to begin the filling process.

-

3.Enter the creditor's full name and contact information at the top of the document.

-

4.Input the judgment debtor's name and address in the designated fields.

-

5.Provide details of the judgment, including the date, amount, and court information.

-

6.Specify any terms related to the payment or compliance with the judgment.

-

7.Review the document for accuracy, ensuring that all information is correct.

-

8.Use the 'fill & sign' feature if applicable to add your signature to the document.

-

9.Download or print the completed 'notice to judgment debtor' for distribution.

-

10.Send the notice to the debtor via certified mail or through a legal service as required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.