Last updated on Feb 17, 2026

Get the free Minnesota Installments Fixed Rate Promissory Note Secured by Commercial Real Estate ...

Show details

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is minnesota installments fixed rate

Minnesota installments fixed rate refers to a structured payment plan in Minnesota that allows borrowers to repay their loans in fixed, scheduled installments.

pdfFiller scores top ratings on review platforms

Works fast and easy

Works fast and easy, great service!I had signed up very briefly to edit some pdfs for work. The program worked smoothly, but then I foolishly forgot to end my membership, and was billed for a years' worth of their service, which I did not need. Their customer support was top-notch and had my problem resolved in just a few minutes. I'd recommend them for anyone looking for a company that is responsive to their customers.

I couldn't find 2018 W2 forms in the…

I couldn't find 2018 W2 forms in the library. I looked for an hour. I could find 2016 W2s, 2019 W2s, but, not 2018. I found all kinds of IRS forms, but, not 2018 W2s. Finally I gave up after 2 days and emailed support. They responded immediately with form. It was awesome. I was shocked. They get A+ in my book !!!!! Jeff R.

I love pdffiller

I love pdffiller. So easy to use. As a Realtor I work with pdf's frequently and this app is the best.

Awesome website

Awesome website, support staff are super helpful and extremely responsive.

They have great customer service I was…

They have great customer service I was refunded when I didn’t realize i paid for a years subscription upfront and I only had to pay the first month. Very happy companies like this still exist. The file editing is easy and can be done from iPhone.

PDFfiller

PDFfiller, is a great web and help everyone to making any documents better. oline file, sign and send.

Who needs minnesota installments fixed rate?

Explore how professionals across industries use pdfFiller.

Minnesota Installments Fixed Rate Form Guide

Filling out the Minnesota installments fixed rate form is essential for borrowers and lenders alike. This guide will help you understand the process involved in these forms, providing instructions and best practices to ensure compliance with Minnesota's regulations.

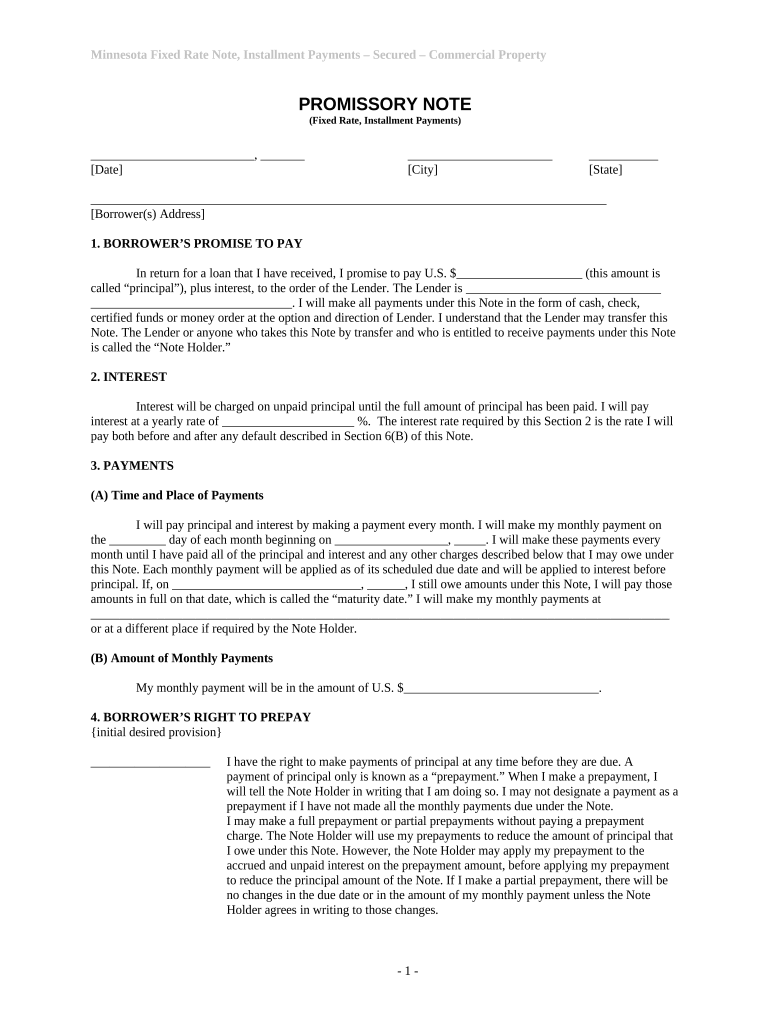

What is the Minnesota fixed rate note?

The Minnesota fixed rate note is a legal document that outlines the terms of a loan which has a fixed interest rate over its duration. This ensures that the borrower's payments remain consistent, offering financial predictability.

-

The primary purpose of the fixed rate note is to create a binding agreement between the borrower and lender, stipulating the loan terms.

-

Key terms include borrower (the party receiving the loan), lender (the party providing the loan), and note holder (the entity holding the debt obligation).

-

Installment payments ensure that the loan is repaid over time, reducing the risk of default and allowing for easier financial planning.

How do you fill out the Minnesota installments fixed rate form?

Filling out this form requires attention to detail and adherence to legal standards. Missing information can lead to issues later on.

-

You must provide the date, city, and state alongside the borrower’s address to establish the location of the agreement.

-

Include critical loan information such as the principal amount, interest rate, and terms to define the agreement.

-

This section outlines your commitment to repay the loan amount as specified. Neglecting this can lead to legal repercussions.

-

Different payment methods may affect the terms of your loan, so choose the one that suits your financial situation best.

How are interest calculations and payment structures determined?

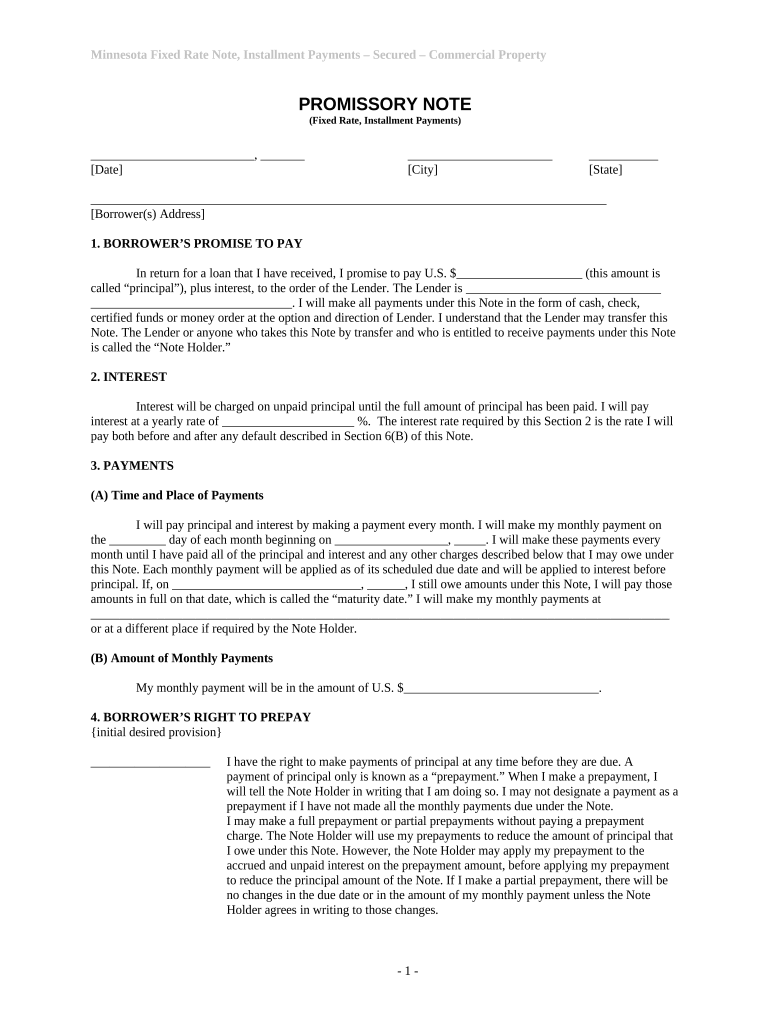

Interest on loans can be calculated in various ways, significantly impacting your total repayment amount and monthly payments.

-

Fixed interest rates remain the same throughout the loan period, whereas variable rates can change based on market conditions.

-

Payments typically consist of both principal and interest; ensuring accurate breakdown helps borrowers understand their long-term commitment.

-

Late payments may incur fees or lead to default, which can greatly affect your credit score and overall financial health.

What are payment schedules and maturity dates?

A clear payment schedule is vital for managing loan repayments effectively, equipping borrowers with the knowledge of when payments are due.

-

Budgets are more manageable when you have a monthly payment plan, which this form can help you establish.

-

The maturity date marks when the final payment is due, and comprehending this helps borrowers plan for loan repayment completion.

-

If you need to change where payments are sent, it’s crucial to follow the correct legal procedures outlined in your fixed rate note.

What compliance and regulatory considerations should you be aware of?

Compliance with state-specific regulations is crucial to avoid legal complications when executing loan agreements.

-

Different states have unique laws affecting fixed rate loans, so it’s vital to familiarize yourself with Minnesota’s specific regulations.

-

Both borrowers and lenders must comply with the law to protect their rights and ensure that the loan is valid.

-

Online resources and legal consultation can clarify Minnesota's lending laws and compliance requirements.

How can pdfFiller tools assist with your fixed rate note?

pdfFiller provides an innovative approach to managing your documents related to Minnesota installments fixed rate forms.

-

Easily edit and sign your Minnesota fixed rate note online, speeding up the process significantly.

-

You can collaborate with your lender using pdfFiller’s features, ensuring transparent communication throughout the process.

-

Keep track of all your documents in one cloud-based platform, making it easier to access your notes anytime, anywhere.

What common challenges and troubleshooting tips exist?

Dealing with installment payment changes, late payments, or form issues can be challenging, but knowing how to troubleshoot can make a difference.

-

Understand the procedures for requesting modifications in payment amounts or schedules, as these need to be documented properly.

-

Common scenarios include missed payments and changes in personal circumstances affecting loan performance.

-

In case of form assistance, contacting pdfFiller support can guide you through issues efficiently.

How to fill out the minnesota installments fixed rate

-

1.Open the PDF form of the Minnesota installments fixed rate on pdfFiller.

-

2.Begin by entering your personal information, such as your name, address, and contact details in the designated fields.

-

3.Next, provide the specific loan amount you are requesting in the appropriate section.

-

4.Indicate the fixed interest rate you have agreed upon and the duration of the installment plan, ensuring you check for accuracy.

-

5.Fill in the payment schedule by detailing the frequency of payments (e.g., monthly, quarterly) and the exact due dates.

-

6.Include any additional required information, such as income verification or co-signer details if applicable.

-

7.Review the completed form for any errors or missing information.

-

8.Save your progress and submit the form through pdfFiller according to the instructions provided, ensuring to comply with any submission deadlines.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.