Last updated on Feb 17, 2026

Get the free Missouri Unsecured Installment Payment Promissory Note for Fixed Rate template

Show details

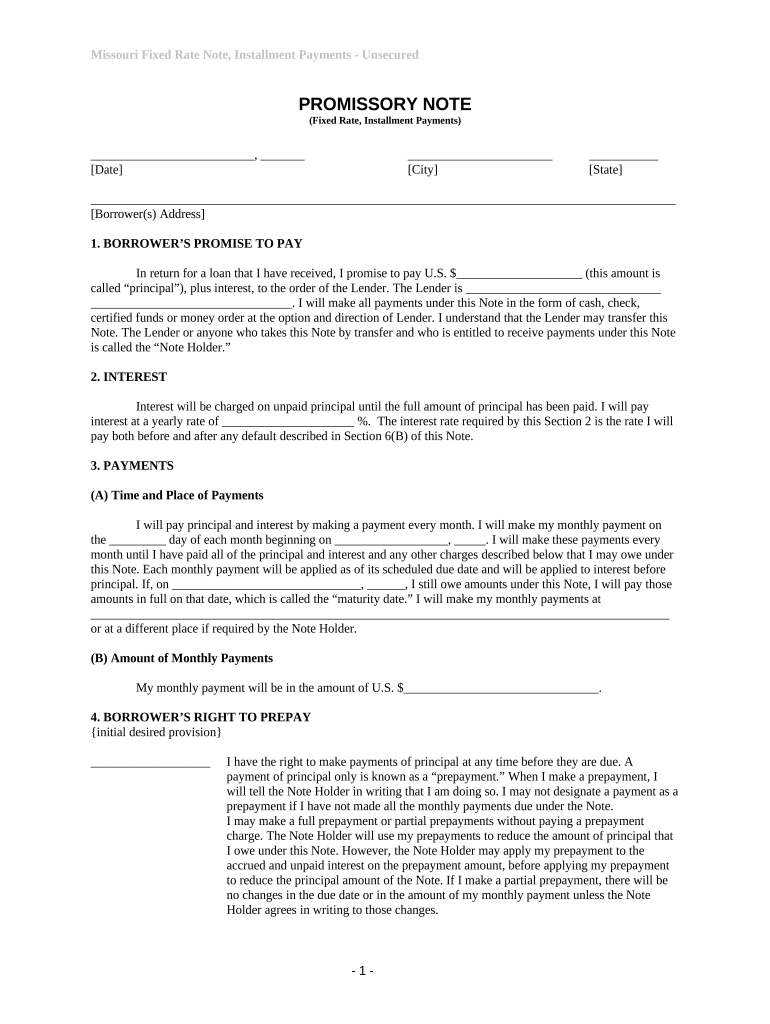

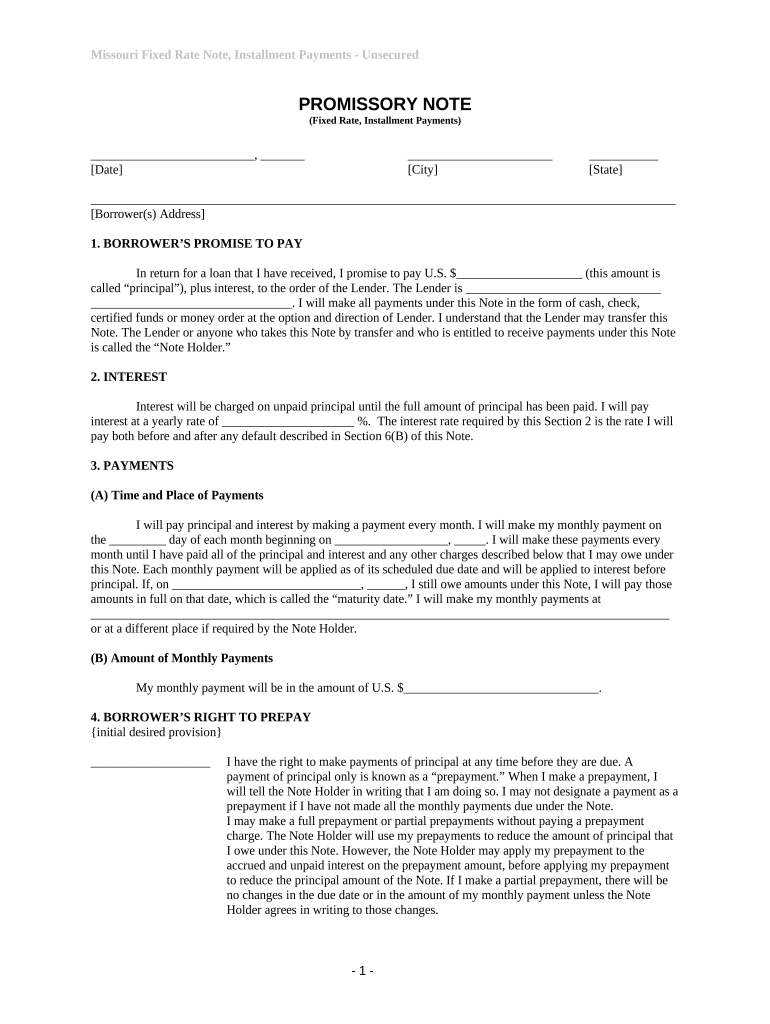

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is missouri unsecured installment payment

Missouri unsecured installment payment refers to a type of loan agreement in which borrowers can repay funds over time, without the need for collateral.

pdfFiller scores top ratings on review platforms

It is great

Works awesome!

most of it is pretty simple and works wonderfully

I have just begun using pdfFiller. It appears very user-friendly and just what I have needed.

Convenient and easy to convert docs

EXCELLENT I LOVE IT.

Who needs missouri unsecured installment payment?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to Completing the Missouri Unsecured Installment Payment Form

What is the Missouri unsecured installment payment form?

The Missouri unsecured installment payment form is essential for individuals taking out loans without collateral. It outlines the terms and obligations of both the borrower and lender, making it a crucial document for anyone entering into such agreements. Understanding how to fill this form properly is vital in ensuring transparent loan management.

This document often includes details about monthly payment schedules, interest rates, and borrower responsibilities. For many borrowers, utilizing this installment payment form can facilitate better financial practices while complying with state regulations.

Understanding the unsecured installment payment form

-

These payments are not secured by an asset, meaning lenders cannot claim property if the borrower defaults. Instead, the borrower's creditworthiness plays a significant role.

-

This note establishes a fixed interest rate, providing clarity on future payments and ensuring that borrowers are not subject to fluctuating rates.

-

Anyone in Missouri who is borrowing money without collateral must utilize this form, which is particularly popular among individuals seeking personal loans.

How do you break down the form fields?

-

These fields confirm the location and timing of the agreement, essential for legal clarity.

-

Providing a complete address ensures that all parties can be reached for any correspondence regarding the loan.

-

Using electronic tools can expedite the signing process, particularly for those managing multiple forms.

-

This crucial section enforces the borrower's obligation towards repayment, ensuring both parties understand their commitments.

What are the key financial terms to understand?

-

The principal is the original sum borrowed, exclusive of interest. Understanding this amount is vital for calculating true repayment costs.

-

Interest rates affect how much extra will be paid over the loan's lifespan, influencing financial decisions significantly.

-

The lender provides the funds, while the note holder possesses the legal document outlining the terms. Each plays a crucial role in securing the loan.

-

Defaulting can lead to serious financial repercussions, including damage to credit scores and potential legal action.

What should you know about payment schedules and obligations?

-

It is essential to set clear monthly payment dates to avoid late fees and maintain good standing.

-

Understanding how payments are allocated can help borrowers manage their finances more effectively.

-

Maturity dates indicate when the loan is fully paid off. It's crucial to track this date to know when obligations end.

-

Providing various payment options enhances borrower convenience and encourages timely payments.

How can interactive tools help complete your form?

-

pdfFiller offers intuitive editing tools to facilitate smooth completion of the Missouri unsecured installment payment form, reducing errors.

-

These features enhance teamwork, allowing multiple users to work on the form simultaneously, ensuring everything is filled correctly.

-

Once completed, the form can be securely saved or exported, maintaining data integrity and user access.

-

pdfFiller provides user-friendly guidance, making the form-filling process simple for all borrowers.

Why is it important to navigate Missouri specific regulations?

-

These laws ensure that both parties are aware of their rights and obligations.

-

Understanding these compliance notes can prevent legal issues and promote responsible lending.

-

Borrowers should be aware that regulations can differ widely among states, affecting their agreements.

-

Noncompliance can lead to severe consequences, including lawsuits and financial loss.

What are common issues when filling out the form?

-

Typical errors include incorrect personal information or omitting crucial details, which can delay processing.

-

In case of denial, it is important to understand the reasons and address any issues before reapplying.

-

pdfFiller’s customer support can assist in troubleshooting and correcting issues swiftly.

-

Always double-check your entries and follow all instructions carefully to avoid complications.

How can you secure your financial future with smart choices?

-

Smart management of unsecured loans can lead to better financial standings and improved credit scores.

-

Utilizing this form can help formalize agreements, paving the way for responsible borrowing.

-

Establishing a budget and setting reminders can significantly enhance payment punctuality.

-

With pdfFiller, users gain access to ongoing document management tools that support a variety of forms and needs.

How to fill out the missouri unsecured installment payment

-

1.Begin by downloading the Missouri unsecured installment payment form in PDF format from the official source or pdfFiller website.

-

2.Open the document in pdfFiller to access the editing tools.

-

3.Start at the top of the form and fill in your personal information, including your name, address, and contact details.

-

4.Next, provide the loan amount you are requesting and the purpose of the loan.

-

5.Specify the repayment terms, including the number of installments and the duration of the payment period.

-

6.Fill in your employment details, including your employer's name and your income.

-

7.Review all sections to ensure all information is accurately entered.

-

8.Use the 'signature' field to sign the document electronically.

-

9.Once completed, save the document and choose the option to print or submit it electronically based on your instructions.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.