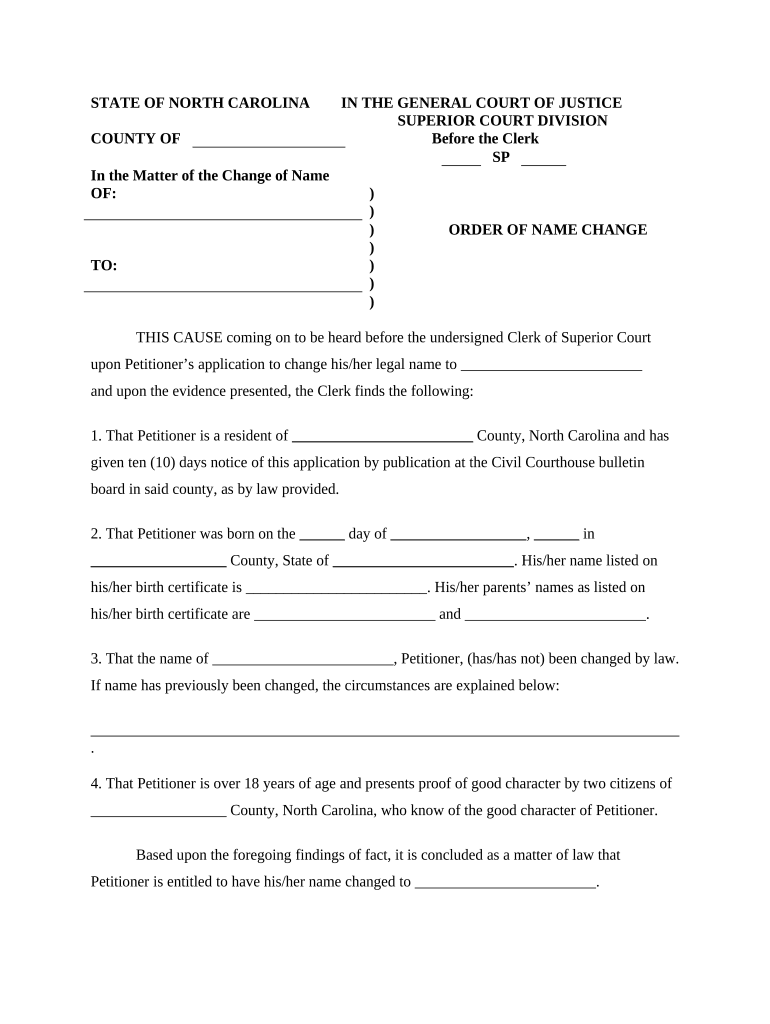

NC-NC-104 free printable template

Show details

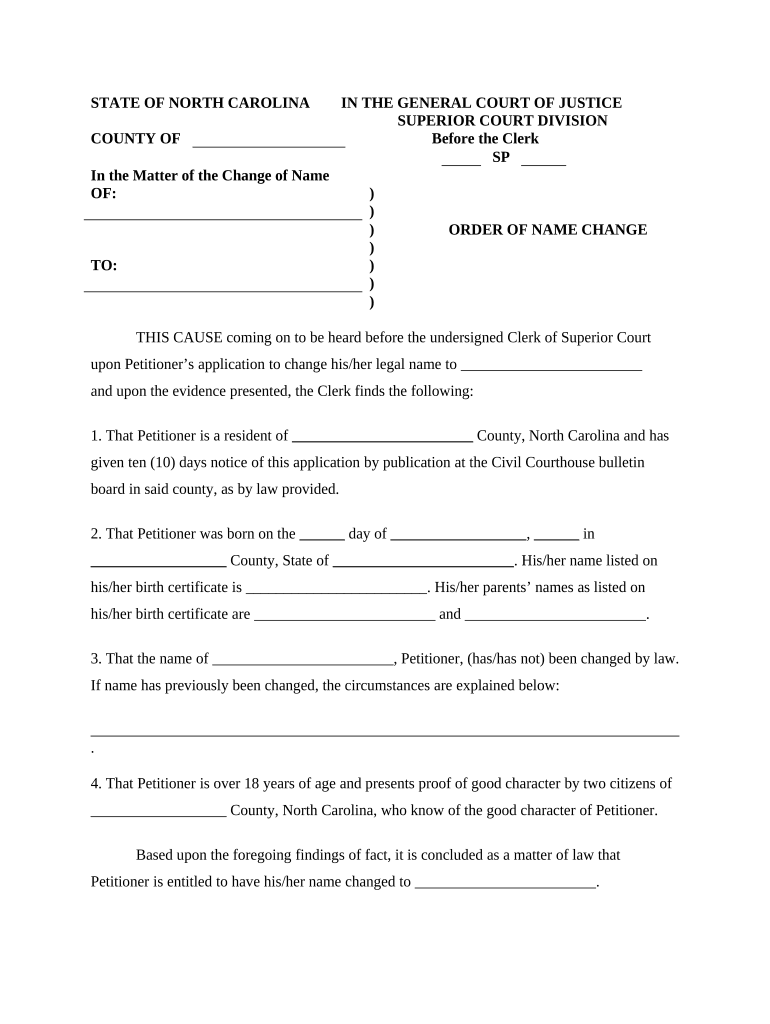

This document finalizes the requested name change and provides proof that the adult's name has been changed.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is NC-NC-104

NC-NC-104 is a North Carolina form used for the reporting of income tax withheld for non-resident employees.

pdfFiller scores top ratings on review platforms

Good quality

Fast, easy and reliable!

Having to make the check boxes into…

Having to make the check boxes into check marks instead of x takes while when you have twenty on the page. It would be nice if you could decide for the whole page.

Amazing

Amazing. It works perfectly and is so useful.

I love this app

I love this app. Easy to use and convenient.

Great product

Great product, easy to use and gives a great result, definitely recommend.

I HAVE NOT USED THE PDFFILLER…

I HAVE NOT USED THE PDFFILLER COMPLETELY. SO I AM NOT SURE HOW I FILL ABOUT IT. SO FAR NO PROBLEMS

Who needs NC-NC-104?

Explore how professionals across industries use pdfFiller.

How to fill out the NC-NC-104

-

1.Open the PDF of NC-NC-104 using pdfFiller.

-

2.Begin with the 'Employer Information' section, entering your name, address, and EIN (Employer Identification Number).

-

3.Proceed to the 'Employee Information' section, where you will enter the non-resident employee's name, Social Security Number, and address.

-

4.In the next section, input the total wages paid to the employee, ensuring accuracy to avoid issues with tax reporting.

-

5.Enter the total North Carolina tax withheld from the employee's wages in the respective field.

-

6.Double-check the information for any typos or missing data, as accuracy is essential for tax compliance.

-

7.Once everything is filled out and accurate, proceed to electronically sign the form if necessary or print it for manual signature.

-

8.Finally, save the completed form to your account and submit it as required by North Carolina tax authorities.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.