Last updated on Feb 20, 2026

Get the free Business Credit Application template

Show details

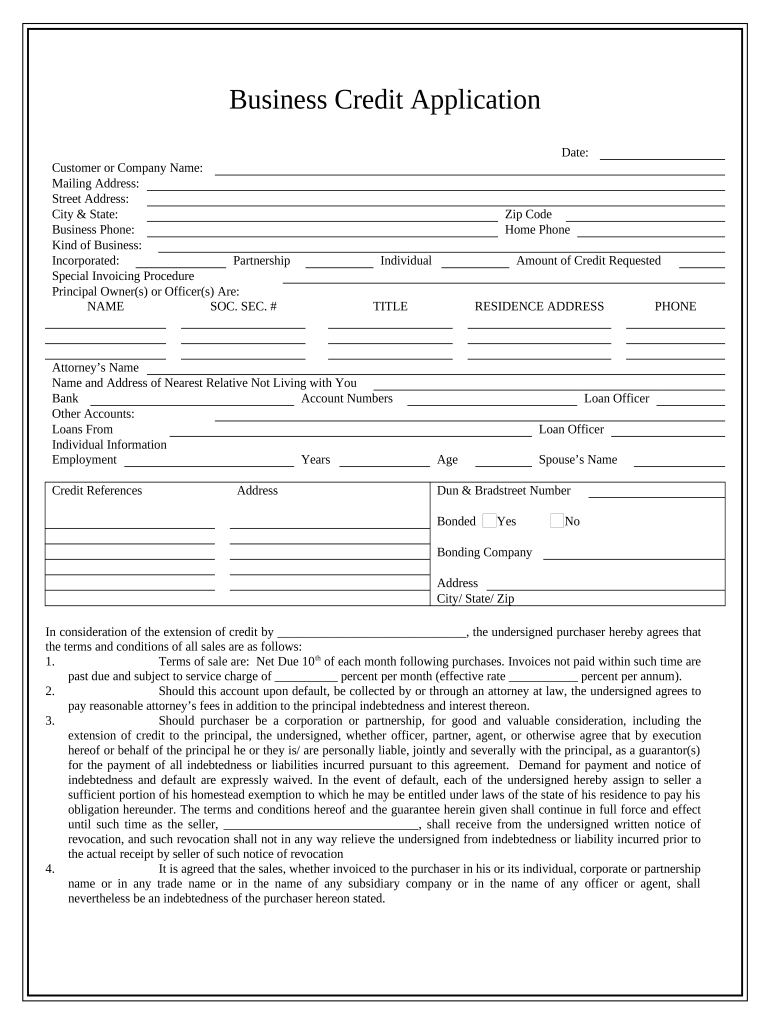

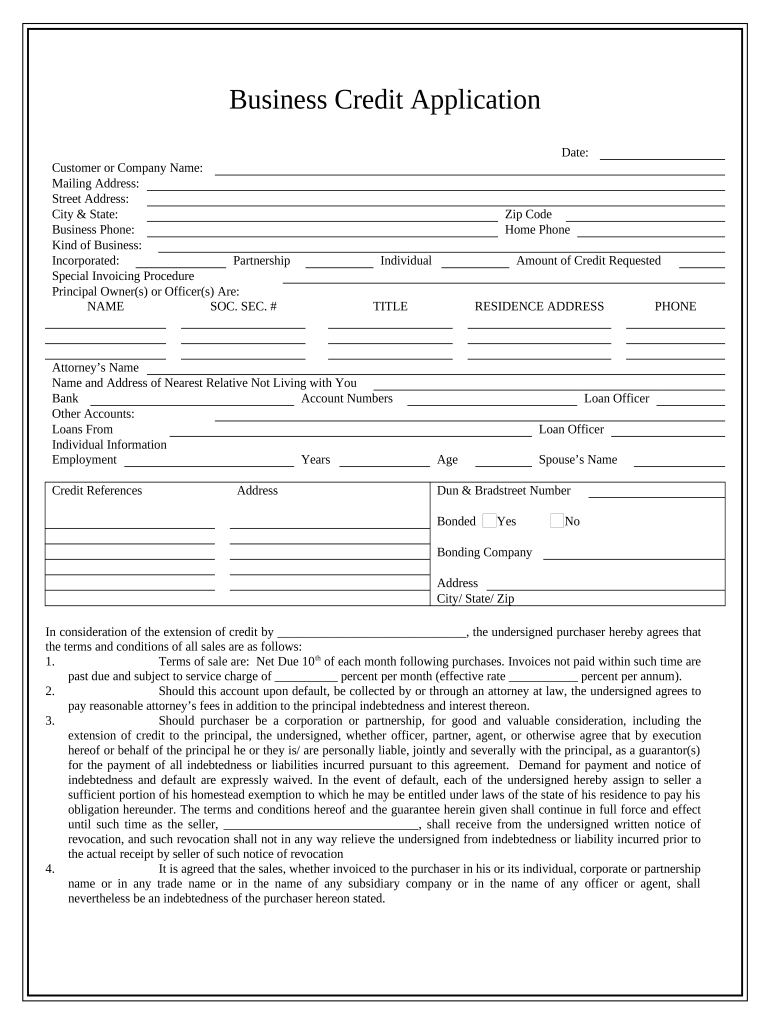

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is business credit application

A business credit application is a formal request submitted by a business to a financial institution or lender to obtain credit or a loan.

pdfFiller scores top ratings on review platforms

Awesome App

Awesome App would highly recommend it

Great tool!

PDF Filler is a great tool!

awesome glad to have it and lots of…

awesome glad to have it and lots of resources and action keys

Great program to help fill in PDF's.

It made filling out documents so much…

It made filling out documents so much easier. Great service

K.I.S.S.

This is a lot easier than I thought it would be.:)

Who needs business credit application template?

Explore how professionals across industries use pdfFiller.

How to fill out a business credit application form: A complete guide

What is a business credit application form?

A business credit application form is a crucial document that companies submit to lenders in order to obtain credit. This form not only collects essential information about the business but also assesses the creditworthiness of the company. Understanding its definition and purpose is vital for ensuring successful applications.

-

A formal request for credit, detailing business specifics and financial health.

-

Secure better terms and limits by providing a complete and accurate depiction of your business.

-

When applying for loans, vendor credit, or business lines of credit.

What are the key components of the business credit application?

Certain fundamental elements must be meticulously included in your business credit application for it to be considered complete. Each component plays a role in verifying the legitimacy and financial stability of the business.

-

Accurate naming establishes clear identity, which is critical for evaluating credit applications.

-

Allows lenders to reach you easily; ensure accuracy to avoid communication issues.

-

Indicates structure—sole proprietorship, LLC, or corporation—and its implications on liability.

-

Disclosure of ownership helps lenders assess personal financial responsibility.

How do fill out essential sections of the application?

Completing your business credit application requires attention to detail. Here are some fundamental guidelines to follow to ensure accuracy and completeness.

-

Follow the guidelines provided within the application form carefully to avoid mistakes.

-

Be honest and transparent; provide legitimate bank account numbers and reliable credit references.

-

Double-check for accuracy to increase your chances of approval.

What should know about terms and conditions?

Understanding the terms and conditions outlined in a business credit application is crucial for compliance and future dealings. Key concepts include payment deadlines and personal liability clauses.

-

Familiarize yourself with terms such as 'Net 30' or 'Net 60' which dictate payment timing.

-

Understand your risks if the business fails to meet credit obligations.

-

Be aware of what may happen—including damages to credit score if the agreement is breached.

What are the guidelines for eSigning and submitting the application?

Using electronic signatures adds a layer of convenience to the business credit application process. Here's how to navigate through it effectively.

-

Learn how to securely sign your credit application documents online.

-

Follow detailed instructions available through pdfFiller to submit your application successfully.

-

After submission, make sure to organize and store your documents safely for future reference.

What are the best practices for managing business credit documentation?

Keeping your business credit documentation organized increases efficiency and improves compliance. Here are some essential practices.

-

Use pdfFiller’s cloud tools to store and track previous credit applications.

-

Ensure your team collaborates effectively; keep everyone updated on changes.

-

Review and update credit files periodically to ensure accuracy and compliance.

What local compliance and legal considerations should be aware of?

Understanding local laws and regulations is vital for drafting a compliant business credit application form. These requirements vary by region and industry.

-

Stay updated on local regulations that may impact the application process.

-

Different industries may have unique compliance requirements; be aware of them.

-

Take steps to confirm your application meets all local legal standards.

How to fill out the business credit application template

-

1.Open the PDF file of the business credit application form located on pdfFiller.

-

2.Begin by entering your business name and contact details in the specified fields.

-

3.Provide the legal structure of the business (e.g., LLC, Corporation) and the date it was established.

-

4.Input tax identification information, including the Employer Identification Number (EIN).

-

5.Fill in the business address and any additional locations if applicable.

-

6.Enter the names and personal information of all business owners or partners.

-

7.Include details about the type of credit being requested and the intended purpose of the funds.

-

8.List any assets owned by the business that may serve as collateral for the loan.

-

9.Provide financial information, such as annual revenue, expenses, and existing debts.

-

10.Review the completed application for accuracy and completeness before submission.

-

11.Finally, save and submit the application directly through pdfFiller, or print it out to send via mail if required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.