Last updated on Feb 20, 2026

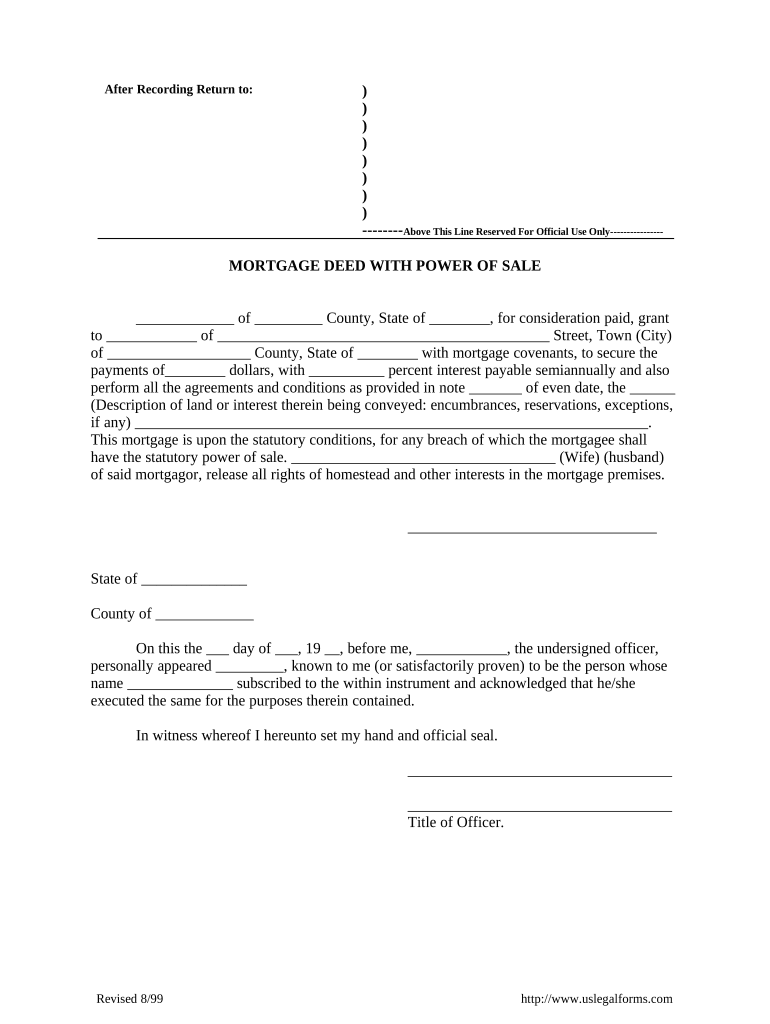

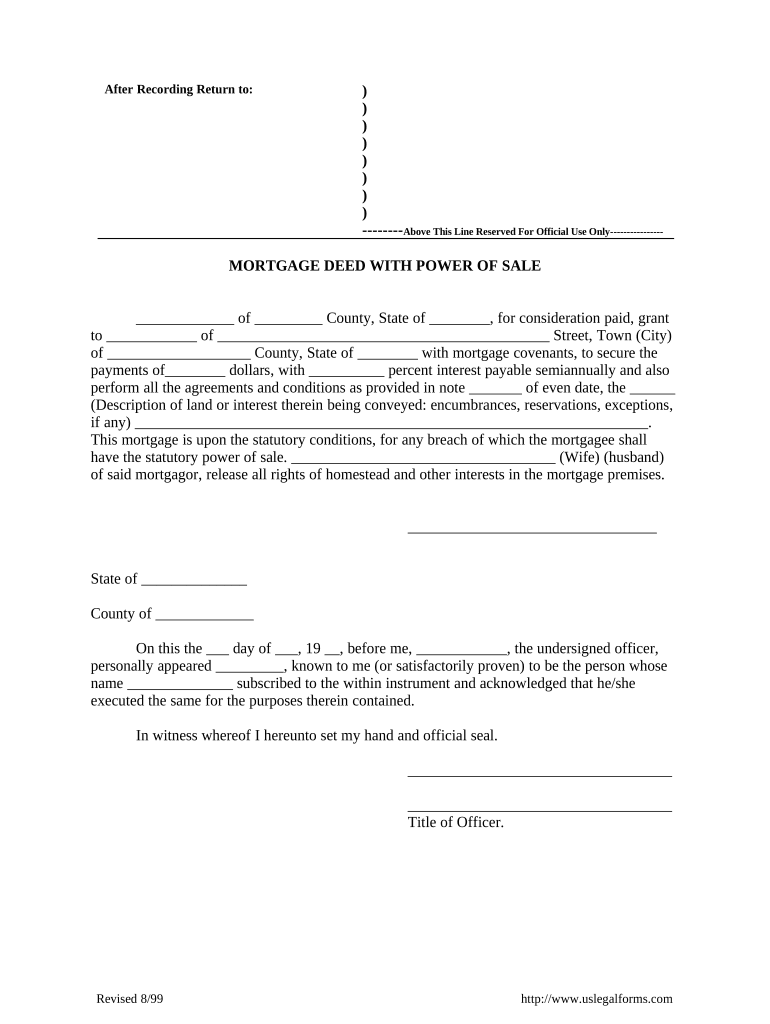

Get the free for Mortgage Deed, with Power of Sale template

Show details

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Form for Mortgage Deed, with Power of Sale, can be used in the transfer process

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is form for mortgage deed

A form for mortgage deed is a legal document that secures a mortgage loan by granting the lender a claim against the property as collateral.

pdfFiller scores top ratings on review platforms

It's useful but time-consuming if it's a large document

good services

Excellent application but not sure if…

Excellent application but not sure if its worth $9 a month for an individual user working on domestic household forms. Definitely worth it if using for a small business.

perfect

I starting now please I need more time to explore ! thanks a lot

Easy to use

Easy to use, tons of useful features, great product.

Great Customer Service

I received excellent customer service from Mark today. My concern was addressed promptly and my issue completely resolved. Thank you for great service!

Who needs for mortgage deed with?

Explore how professionals across industries use pdfFiller.

How to easily fill out a mortgage deed form

TL;DR: How to fill out a mortgage deed form

Filling out a mortgage deed form involves understanding the key components such as the parties involved, property descriptions, and monetary terms. Gather accurate information, follow the template closely, and check for common mistakes to ensure validity.

What is a mortgage deed and why is it important?

A mortgage deed is a legal document that outlines the agreement between a borrower (the mortgagor) and a lender (the mortgagee) regarding a property loan. This deed serves as a security for the mortgage, ensuring the lender has a claim to the property if the borrower defaults. Understanding the importance of this document is crucial, as it protects all parties involved in the transaction.

What are the key elements of a mortgage deed form?

-

Identifies the mortgagor and mortgagee, clarifying their roles in the agreement.

-

Provides detailed information about the property, including its address and legal description.

-

Outlines the monetary terms of the mortgage, including loan amount and interest rates.

-

Explains the lender's rights to sell the property if the borrower defaults.

-

Discusses the impact of homestead laws on the mortgage deed, protecting the borrower's interest.

When should you use a mortgage deed?

A mortgage deed should be used when securing a loan for purchasing property. Legal requirements vary by region, but typically, the deed must be signed in front of a notary public and recorded in local government offices. It's essential to understand the circumstances under which a mortgage deed is necessary to ensure compliance with local laws and regulations.

How do you fill out a mortgage deed form step-by-step?

-

Gather all relevant documents such as property deeds, IDs, and financial statements.

-

Accurately enter details in the pre-defined sections of the form, ensuring no information is omitted.

-

Double-check for errors such as spelling mistakes or incorrect amounts that could invalidate the deed.

-

Use pdfFiller to edit and sign the mortgage deed electronically, enhancing convenience and security.

What do sample mortgage deed templates look like?

Sample mortgage deed templates offer a structured format for documenting the loan agreement. Standard templates typically include sections for personal information, property details, and pertinent clauses. Variations in templates may exist based on local laws and county regulations, and users can customize templates using tools like pdfFiller.

What should you do after signing a mortgage deed?

-

Ensure the signed document is filed in accordance with local guidelines to make it legally binding.

-

Learn the steps needed to release the mortgage deed once the loan is paid off, which may involve additional paperwork.

What are the legal implications of mortgage deeds?

Mortgage deeds carry legal implications, particularly regarding foreclosure processes if the borrower defaults. Both the mortgagor and mortgagee have specific rights and responsibilities outlined in the deed. Additionally, these rights can vary significantly based on state-specific laws, making it vital for all parties to be informed.

How to fill out the for mortgage deed with

-

1.Obtain the form for mortgage deed from a reliable source, such as a legal website or your lender.

-

2.Open the PDF version of the form in pdfFiller.

-

3.Start by entering the borrower's legal name as it appears on official documents in the designated section.

-

4.Fill in the property address, ensuring accuracy to avoid future issues.

-

5.Input the loan amount and include interest rate details if required.

-

6.Provide lender information, including the company name and address.

-

7.Indicate any shared ownership, if applicable, by listing co-borrowers or co-signers.

-

8.Review all entered information thoroughly for errors or omissions.

-

9.Utilize the option to add signatures in the appropriate fields where specified.

-

10.Save the completed form and either print it for physical submission or submit it electronically as per your lender's instructions.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.