Last updated on Feb 20, 2026

Get the free New Hampshire Dissolution Package to Dissolve Limited Liability Company LLC template

Show details

The dissolution package contains all forms to dissolve a LLC or PLLC in New Hampshire, step by step instructions, addresses, transmittal letters, and other information.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

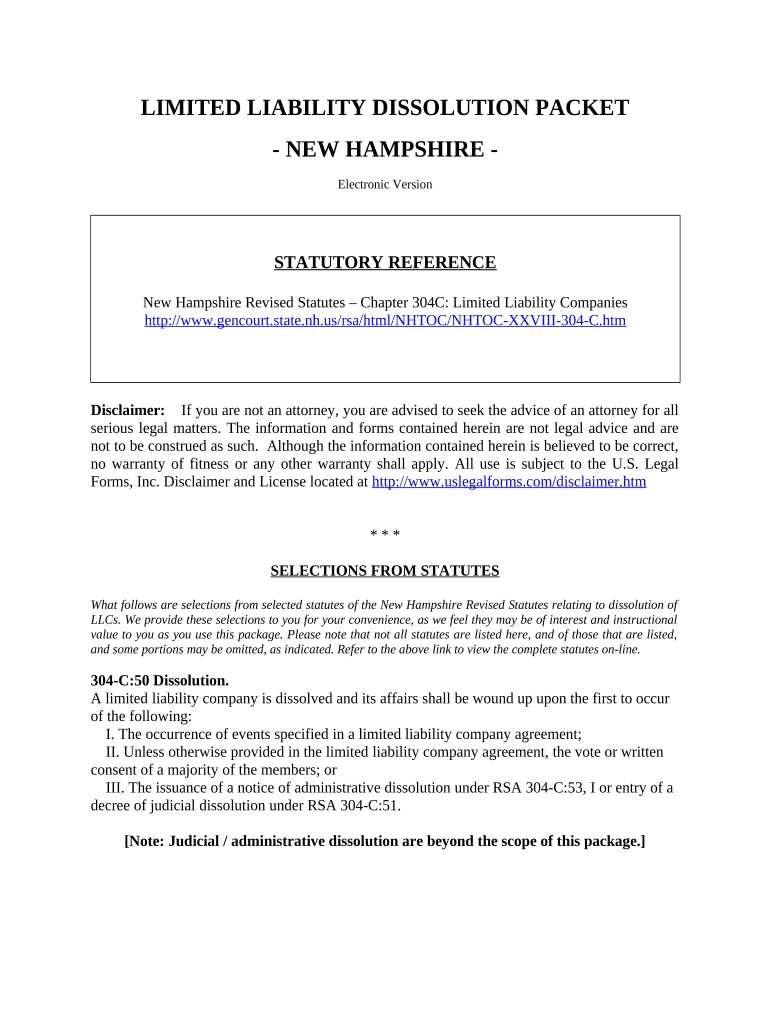

What is new hampshire dissolution package

The New Hampshire dissolution package is a legal document set used to formally dissolve a business entity in New Hampshire.

pdfFiller scores top ratings on review platforms

Great so far...done all I could have wanted and all in one place.

Very helpful, all forms I needed you have

initially some difficulty in lining up words in the correct graphic format Roman etc., but generally good experience but still a lot to learn

it happened so fast i did not realize that i had sent a fax

It was very good. I did not know that a prescription was involved until I completed my 8 page form. This was a little deceptive.

The service form filling out forms and faxing documents is great

Who needs new hampshire dissolution package?

Explore how professionals across industries use pdfFiller.

New Hampshire Dissolution Package Form Guide

How to fill out a New Hampshire dissolution package form?

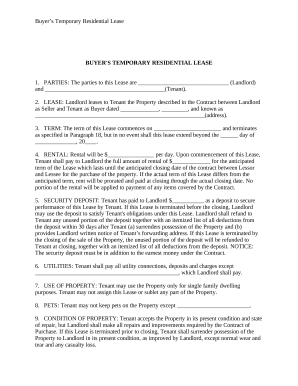

Completing a New Hampshire dissolution package form is a straightforward process. First, gather your LLC's ownership documents and ensure the dissolution decision aligns with your operating agreement. Then, carefully fill out the forms according to state guidelines, and finally, review before submission.

What is dissolution and why is it important?

LLC (Limited Liability Company) dissolution is the formal process of closing down a business entity legally. This step is essential for signaling the end of operations and ensuring that liability protection continues until all obligations are settled.

-

Dissolving the LLC properly ensures that personal assets of the owners are safeguarded against any business debts.

-

Following the dissolution process is crucial to avoid penalties from state authorities for failure to formally close the business.

Why are LLCs dissolved in New Hampshire?

-

Many LLCs decide to dissolve when the business becomes unprofitable.

-

Disagreements among members can lead to dissolution, especially if the operating agreement doesn't provide a path for conflict resolution.

-

Some owners may choose to pivot to different types of business structures or ventures entirely.

What is the legal process of dissolving an in New Hampshire?

Dissolving an LLC in New Hampshire begins with meeting specific criteria under state law. Generally, this involves a clear decision by the members, often documented through a vote or a written agreement.

-

Typically, dissolution requires a majority vote from the LLC members, which should be recorded in meeting minutes.

-

The state may initiate dissolution if the LLC fails to meet specific legal obligations, prompting a notification to members.

-

Essential paperwork, including the dissolution form, must be filed with the New Hampshire Secretary of State.

What does winding up entail?

Winding up refers to the process of settling accounts and dissolving the LLC’s remaining affairs. This step is crucial to ensure that all financial obligations are met before the business is officially closed.

-

Creditors must be paid off, and outstanding invoices should be settled as part of winding up.

-

After all debts are settled, any remaining assets are distributed among the LLC members based on their ownership interests.

How to navigate the limited liability dissolution packet?

The limited liability dissolution packet includes essential forms and instructions for officially dissolving your LLC.

-

Typical components include the dissolution application, a final tax return, and clearance certifications if needed.

-

Prepare by writing down all necessary references from the company’s operating agreements and then fill out the forms accurately.

-

Platforms like pdfFiller assist in editing and eSigning the dissolution forms, making the completion process more efficient.

What are common mistakes when filing for dissolution?

Filing for dissolution can be daunting, and common pitfalls exist which can lead to delays or legal issues.

-

Failing to provide all required forms can result in rejection by the state.

-

Ensure adherence to New Hampshire Revised Statutes regarding LLC dissolution to avoid complications.

-

Many leave out legal advice, which could prove invaluable in navigating complex dissolution scenarios.

What ongoing compliance is needed after dissolution?

Post-dissolution, it’s vital to maintain compliance with state requirements even after ending operations.

-

Businesses are advised to retain records of business dealings for a minimum of five years following dissolution.

-

Ensure that any outstanding contracts and debts are fully addressed, preventing legal complications in the future.

What state resources are available for dissolution?

New Hampshire provides several resources for those looking to dissolve their LLCs, helping streamline the process.

-

The New Hampshire Secretary of State’s website offers downloadable forms and guidelines.

-

For assistance, state agencies can be reached directly to clarify filing requirements.

-

Local legal aid organizations offer guidance on navigating the dissolution process when needed.

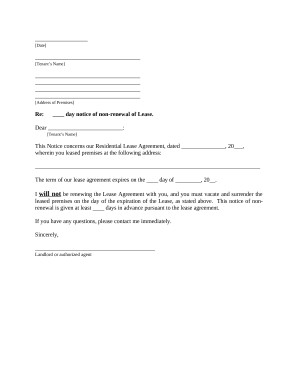

How to fill out the new hampshire dissolution package

-

1.Visit pdfFiller and create an account or log in.

-

2.Search for the New Hampshire dissolution package template in the document library.

-

3.Download the template to your workspace.

-

4.Start filling out the form with the required information, including the name of the business, the dissolution date, and the reason for dissolution.

-

5.Ensure that all fields are completed accurately to avoid delays in processing.

-

6.Review the information to confirm it is correct and complete.

-

7.Sign the document electronically where required, noting that certain sections may require an authorized signature.

-

8.Once completed, save the document within pdfFiller or export it in your preferred format.

-

9.Follow the instructions for filing the completed dissolution package with the New Hampshire Secretary of State, either online or by mail.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.