Get the free Special Durable Power of Attorney for Bank Account Matters template

Show details

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is special durable power of

A special durable power of attorney is a legal document that allows a person to designate another individual to make decisions on their behalf, even if they become incapacitated.

pdfFiller scores top ratings on review platforms

ONCE i SIGNED UP FOR IT MADE IT SOMEWHAT EASY TO PRINT AND FAX

Worked as expected

very easy to use

Finds me every document I need! Easy to use this website. Love it.

For the things I use PDF Filler for it is great. I'm usually in a rush so don't know about all the things you can do with it.

I just started so give me time and i will state exp.

Who needs special durable power of?

Explore how professionals across industries use pdfFiller.

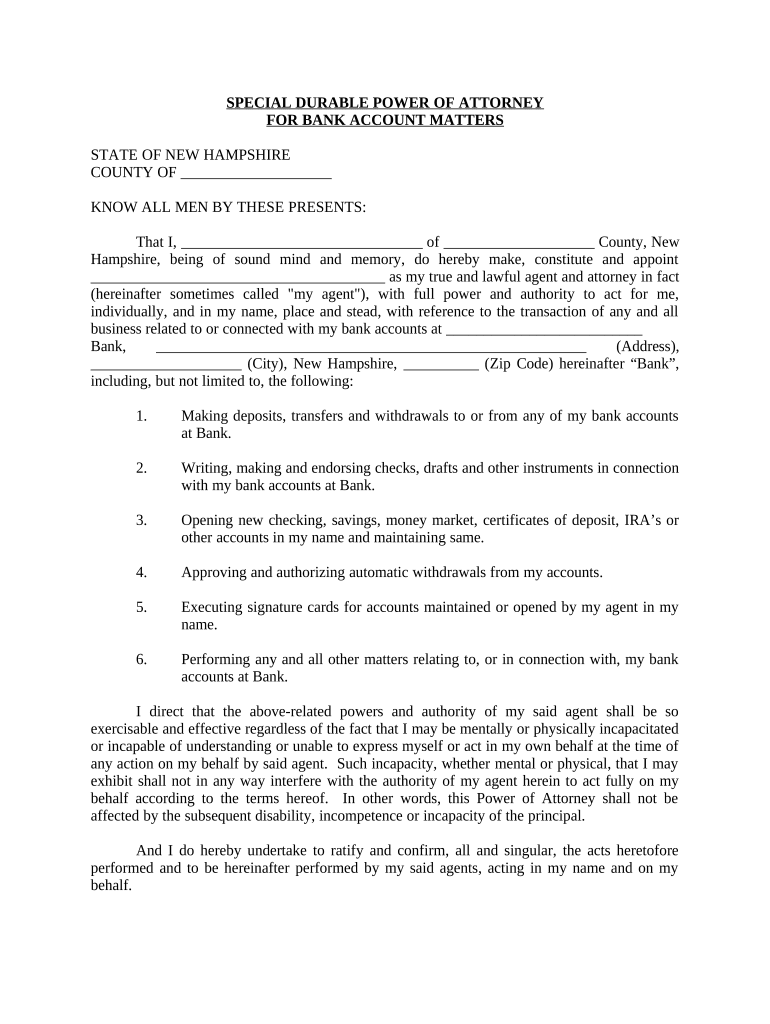

Special Durable Power of Attorney for Bank Account Matters

How does a special durable power of attorney work?

A special durable power of attorney (POA) is a legal document that authorizes someone to act on your behalf regarding specific matters, such as bank account management. This document remains effective even if you become mentally or physically incapacitated, ensuring your financial decisions are handled without interruption. In this article, we explore the crucial aspects of the special durable power of attorney form, particularly focusing on its relevance to bank account matters.

What is a special durable power of attorney?

A special durable power of attorney is distinct from a general power of attorney in that it specifically pertains to specified actions, such as managing bank accounts. In New Hampshire, a POA can encompass a range of legal authorities, from making deposits to authorizing withdrawals. Understanding this type of POA is vital for effective financial management.

-

A special durable power of attorney permits someone you trust to manage your bank account matters, providing a safety net for your finances.

-

This document grants specific powers depending on state laws, ensuring your chosen agent can act swiftly and appropriately.

-

While a durable power stays effective during incapacity, a non-durable power ceases upon the principal's incapacitation.

What are the key elements of a special durable power of attorney?

The key elements of a special durable power of attorney revolve around agent designation and the powers granted. Choosing a trusted individual as your attorney-in-fact is essential, as they will make significant financial decisions on your behalf.

-

Consider selecting a spouse, partner, or someone who is financially savvy to act as your attorney-in-fact.

-

The POA must clearly state the powers related to bank accounts, including making transactions, handling debts, and managing inheritance details.

-

Any limitations regarding actions your agent may take should be explicitly outlined in the document.

How do execute a special durable power of attorney?

Executing a special durable power of attorney involves specific steps, especially when using platforms like pdfFiller. By following a guided process, you can ensure that all legal requirements are met for New Hampshire.

-

Utilize the pdfFiller platform for an intuitive step-by-step form completion process.

-

Ensure that signatures from both the principal and the agent are included, followed by notarization to meet New Hampshire's legal requirements.

-

Create a checklist of essential items to include in your POA for proper completion.

What can my agent do with my bank accounts?

Once a special durable power of attorney is established, the agent is empowered to manage transactions efficiently. This authority encompasses critical actions required for the family's financial health.

-

Your agent can make regular deposits and withdrawals to maintain cash flow and handle unexpected expenses.

-

Managing transfers between accounts or even to third parties can be facilitated smoothly by your agent.

-

Opening new accounts or approving direct debits becomes simpler through your designated agent, ensuring all aspects are managed.

What should know about incapacity?

Understanding the implications of incapacity is vital for effective POA management. The durability of the special durable power of attorney means it continues to function even if you become incapacitated, which can be crucial during unforeseen circumstances.

-

When mental or physical incapacity occurs, the POA remains valid and effective, allowing your financial affairs to proceed seamlessly.

-

The special durable power of attorney stays in effect, affording your agent necessary authority to act.

-

Consider scenarios where sudden illness or accidents can disrupt finances; having a POA in place ensures management continuity.

How do review or revoke my power of attorney?

Reviewing and potentially revoking your special durable power of attorney can be crucial at different life stages. Knowing when and how to make changes ensures that your POA remains relevant and effective.

-

Revoking your POA is straightforward. You can terminate it anytime, especially if relationships change or your chosen agent is no longer suitable.

-

Regularly assess your power of attorney to affirm that it still aligns with your current needs and familial structure.

-

To revoke a POA in New Hampshire, follow a formal process using pdfFiller, which simplifies the necessary documentation.

What tools does pdfFiller offer for creating and managing my POA?

pdfFiller provides various interactive tools that enhance the creation and management of your special durable power of attorney. Users can edit, eSign, and collaborate on documents with ease, highlighting pdfFiller’s value in document management.

-

Utilize pdfFiller's user-friendly editing tools to create or modify your POA document as needed.

-

Experience the convenience of electronically signing your durable power of attorney, reducing paperwork and streamlining the process.

-

Collaborate seamlessly with family members or legal advisors to prepare your document efficiently on pdfFiller.

What compliance considerations should keep in mind?

Creating a special durable power of attorney in New Hampshire involves specific legal requirements that must be adhered to. Ensuring compliance will facilitate acceptance by financial institutions and help validate the legality of your document.

-

Familiarize yourself with New Hampshire’s requirements for durable powers of attorney, including required language and signatures.

-

Important compliance points must be noted, mainly for financial institutions accepting your POA.

-

Employ pdfFiller resources to review the legal soundness of your form, ensuring proper adherence to New Hampshire regulations.

How to fill out the special durable power of

-

1.Visit pdfFiller and login to your account or create a new one if you don't have an account.

-

2.Search for 'special durable power of attorney' in the template library or upload your own document.

-

3.Open the document and read through its sections to understand what information is required.

-

4.Begin by filling in your full name and contact information at the top of the form.

-

5.Identify and fill in the name and contact information of the individual you are appointing as your agent.

-

6.Clearly specify the powers you wish to grant your agent, ensuring they align with your needs and preferences.

-

7.Include specific limitations, if any, regarding the decision-making authority of your agent.

-

8.Review all entered information for accuracy and completeness, ensuring that it represents your intentions.

-

9.If necessary, add witness or notary sections—complete these with the appropriate individuals as required in your state.

-

10.Save your completed document and download it for printing; ensure to sign it appropriately according to legal requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.