Last updated on Feb 20, 2026

NJ-020-SC free printable template

Show details

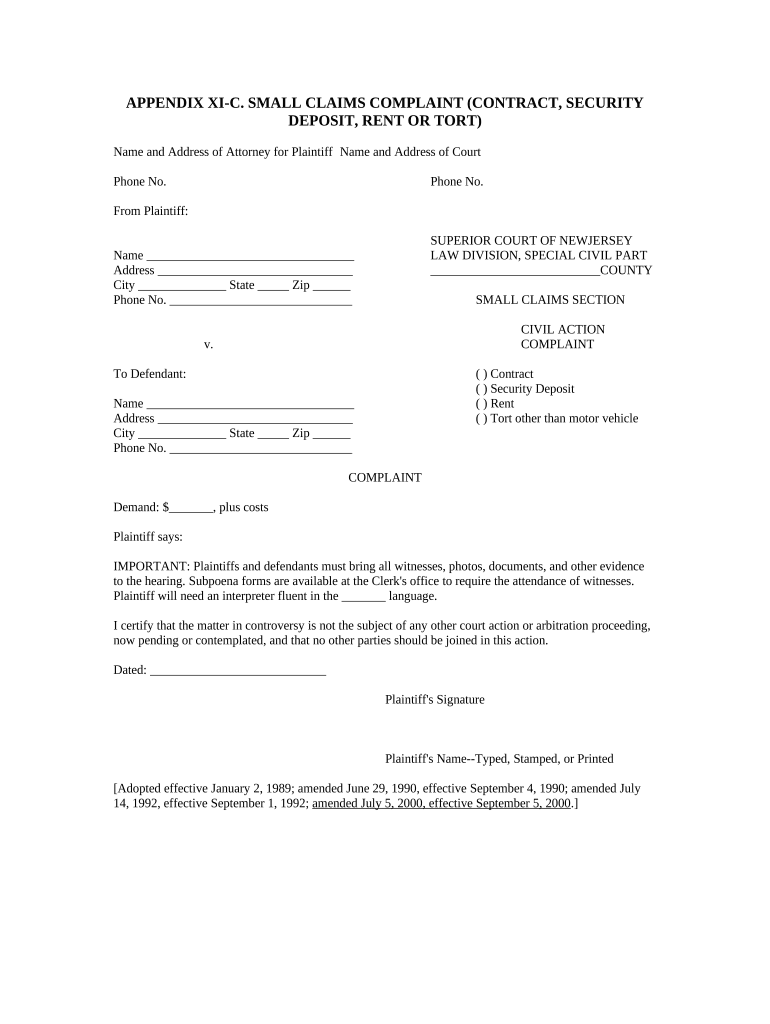

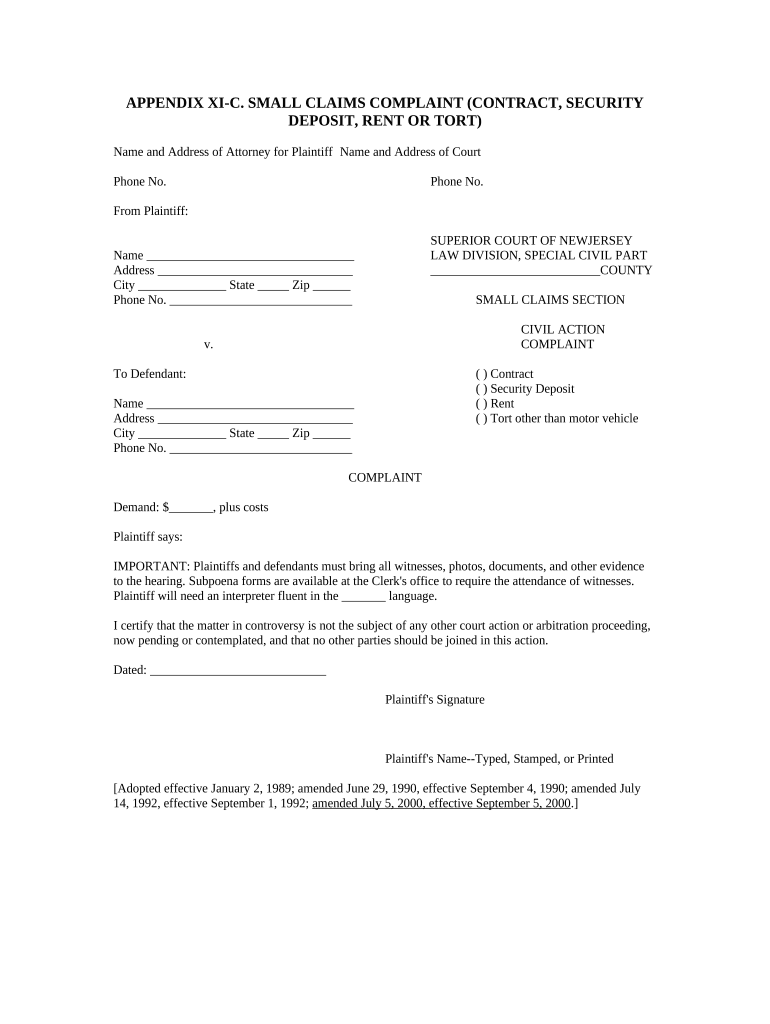

Small Claims Court handles small matters usually not exceeding a certain dollar amount in value. This form, a Small Claims Complaint (Contract, Security Deposit, Rent, or Tort), can be used to accomplish

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is NJ-020-SC

NJ-020-SC is a form used in New Jersey for the request of a Small Claims Court hearing.

pdfFiller scores top ratings on review platforms

Very helpful and easy to navigate awesome program

Need to be able to copy and Paste when needed

I am just beginning to work with it so I don't have much feedback yet

Found it an excellent programme for floor plan mark-up

Useful inexpensive way to file back year forms. Wish the forms auto calculated fields but it's free so I can't complain to much

My Experience With PDF Filler Was Great Easy To Learn Easy To Use.

Who needs NJ-020-SC?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Completing the NJ-020-SC Form

What is the NJ-020-SC form?

The NJ-020-SC form is a legal document used for filing small claims in New Jersey. This form is essential for individuals or entities seeking to resolve disputes valued at $15,000 or less through the small claims court system. It aims to streamline the process of entering a complaint formally with the court.

-

Small claims courts in New Jersey offer a simpler way for individuals to address disputes without complex legal procedures.

-

Filing may arise from disputes over unpaid debts, property damage, or breach of contract.

What are the key components of the NJ-020-SC form?

Understanding the key components of the NJ-020-SC form is crucial for successful filing. This includes knowing the critical fields that must be filled out accurately to ensure that your claim is considered by the court.

-

Ensure you provide accurate attendee details, complaint specifics, and the demand amount for your claim to proceed.

-

It's important to understand which county court has the jurisdiction over your claim, as this can affect where you file the form.

-

Fill out the required information for both parties involved in the dispute to facilitate proper court processing.

How do you fill out the NJ-020-SC form?

Filling out the NJ-020-SC form correctly is essential to avoid delays in processing your claim. A methodical approach can help ensure that all necessary details are accurately entered.

-

Follow a detailed process to enter personal information, defendant details, and claim specifics seamlessly.

-

Be aware of common mistakes like incomplete information or incorrect demand amounts that can hinder your claim.

-

Ensure that all entries comply with New Jersey state requirements to guarantee your claim is accepted.

How can you edit and sign the form with pdfFiller?

Video or visual tools available through pdfFiller simplify editing your NJ-020-SC form. These features enhance the ability to submit error-free forms electronically.

-

Utilize pdfFiller to adjust fields, add notes, or correct errors on your form before submission.

-

With pdfFiller, you can easily add eSignatures to your form, complying with legal standards for electronic submissions.

-

Share your form with team members for review and collective input, streamlining the completion process.

What are the steps to submitting your NJ-020-SC form?

Once your NJ-020-SC form is completed and signed, understanding the submission process is critical to ensuring your claim is filed correctly and on time.

-

Know where to present your form, whether it's in-person at the local court or online, as per New Jersey's filing guidelines.

-

Be prepared to pay the necessary filing fees, which can vary by jurisdiction and the nature of the claim.

-

Timeliness is key; ensure your form is submitted within the specified deadlines to avoid delays in court proceedings.

What happens after you submit the NJ-020-SC form?

After submitting your NJ-020-SC form, the court will schedule a hearing. Familiarizing yourself with the typical processes will prepare you for the next steps.

-

Understand how your claim will be processed and the timeframes you can expect for various steps in the court's agenda.

-

Gathering all supporting documents and evidence will be crucial in making your case stronger during the hearing.

-

Be ready to address any claims made by the defendant effectively, maintaining a professional and calm demeanor.

Where can you find resources and support for NJ-020-SC form users?

Accessing available resources can significantly enhance your experience while navigating the small claims process.

-

Locate local legal services in New Jersey that can provide guidance and support throughout your claims process.

-

Explore pdfFiller’s resources for supplementary materials and templates that can aid you in filing.

-

Engage with court services for detailed explanations of procedures and resources that help you prepare your claim.

What are real-life applications of the NJ-020-SC form?

There are numerous examples of successful claims made using the NJ-020-SC form, illustrating its effectiveness for various disputes.

-

Review case studies where users have effectively resolved disputes through small claims, showcasing the form’s utility.

-

Identify more frequent types of disputes handled via small claims court, including tenant-landlord issues and small business debts.

-

Read firsthand accounts from individuals about how the NJ-020-SC form helped them achieve a successful resolution.

How to fill out the NJ-020-SC

-

1.Download the NJ-020-SC form from the New Jersey court website or obtain a hard copy from the court.

-

2.Open the PDF using pdfFiller or upload the downloaded form to the platform.

-

3.Begin by filling out the petitioner’s information, including your full name, address, and contact information at the top of the form.

-

4.Provide the respondent's details, including their name, address, and any other required identifying information.

-

5.Clearly state the nature of the claim and the amount you are requesting, ensuring the information is accurate and concise.

-

6.If applicable, include any supporting documents or evidence with your claim. Use the 'attach' feature on pdfFiller to upload necessary files.

-

7.Review all entries for accuracy, checking for spelling errors and clarity in the numbers provided.

-

8.Once completed, save the form and proceed to print it out for signing.

-

9.Sign the form where indicated and make copies for both yourself and the respondent.

-

10.File the completed form at your local Small Claims Court along with the necessary filing fee.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.