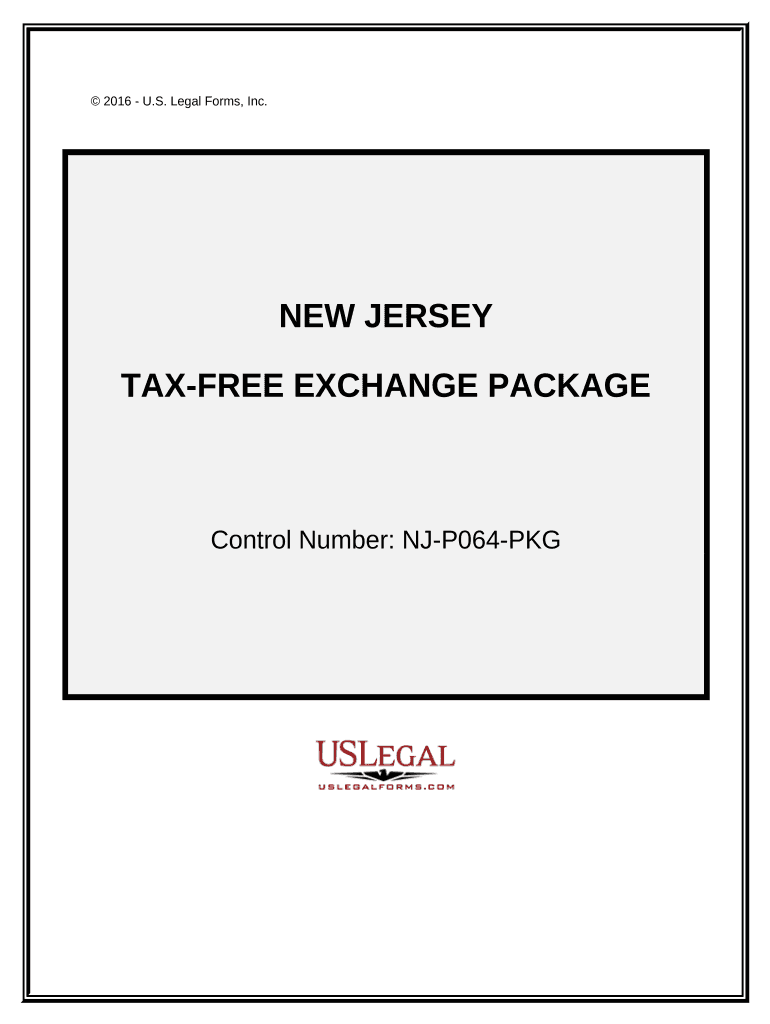

Get the New Jersey Tax Free Exchange Package template

Show details

The Tax-Free Exchange Package contains essential forms to successfully complete a tax-free exchange of like-kind property.

This package contains the following forms:

(1) Exchange Agreement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is new jersey tax exchange

The New Jersey Tax Exchange is a platform that facilitates information sharing and transactions related to tax credits and liabilities between taxpayers and the state of New Jersey.

pdfFiller scores top ratings on review platforms

was able to find the form i needed. But still studying the benefits of pdffiller.

een great so far. Support staff very helpful.

I am in a struggle with the Home Office. I have to fill out multiple forms repeatedly. I bought Adobe but it did not work. This software is very straightforward and I am sharing the document with my Barrister, which saves me money, time and avoids confusion

It is good but it took my time because of lack of instructions for account before filling.Thank you to Ray for his help and guidance.

I have numerous departments to send the same form to with minor changes and this is allowing me to not have to complete each form individually

find it easy enough to use as a first time use

Who needs new jersey tax exchange?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to New Jersey Tax Exchange Form on pdfFiller

What is the significance of tax exchanges in real estate?

Tax exchanges are vital for real estate investors, offering a means to defer taxes while fostering their investment strategies. By utilizing tax-free exchanges, investors can reinvest proceeds from the sale of a property without incurring immediate tax liabilities, specifically avoiding capital gains taxes and depreciation recapture. This strategy enhances cash flow and encourages further investment.

-

Understanding tax-free exchanges and their benefits. Tax-free exchanges allow investors to defer tax payments and increase their financial resources for future investments.

-

How tax exchanges support real estate investment strategies. These exchanges promote strategic reinvestment by allowing the continuation of an investment lifecycle without tax penalties.

-

Avoiding capital gains taxes and depreciation recapture. This can significantly enhance an investor's ability to grow their real estate portfolio.

What is included in the New Jersey Tax-Free Exchange Package?

The New Jersey Tax-Free Exchange Package comprises several components essential for executing tax-free exchanges. Each form included in this package serves distinct functions, facilitating a smoother transaction process and ensuring compliance with local laws.

-

Components of the Tax-Free Exchange Package, which typically includes critical forms necessary for completing a compliant tax exchange.

-

Explanation of included forms and their functions, such as the Exchange Agreement, which establishes the intent to exchange.

-

How this package facilitates successful tax-free exchanges by streamlining documentation and ensuring all legal requirements are met.

What key forms are necessary for tax-free exchanges?

Completing a tax-free exchange involves several key forms, each designed for specific transactional purposes, ensuring that all parties fulfill their legal requirements.

-

Exchange Agreement: Establishes the intent to enter into an exchange, critical for legal compliance.

-

Exchange Addendum: Allows modifications to existing real estate contracts and clarifies rights assignability.

-

Certification of No Information Reporting: Necessary for tax reporting compliance, ensuring accurate tax return submissions.

-

Like-Kind Exchanges: Defines and differentiates between eligible property types that qualify for tax-free exchanges.

-

Sale of Business Property: Special considerations apply when tax exchanges are utilized for commercial real estate.

-

Personal Planning Information and Document Inventory Worksheets: Useful for personal and financial organization related to tax exchanges.

How can you ensure successful completion of tax exchange forms?

Filling out tax exchange forms correctly is crucial for a successful exchange. This section provides detailed guidance to navigate the intricate process and avoid common pitfalls.

-

Step-by-step guidance for filling out the forms accurately promotes compliance and reduces the risk of delays.

-

Common pitfalls and how to avoid them include missing signatures and not adhering to deadlines.

-

Utilizing pdfFiller's tools for ease of form completion, including editing and electronic signing features.

Why is legal document storage and management important?

Secure document storage is paramount for managing tax exchange documents. Proper management ensures easy access and protection from unauthorized use or loss.

-

Importance of secure document storage in the cloud to protect sensitive information from theft or loss.

-

pdfFiller’s solutions for organizing and managing tax exchange documents, offering a user-friendly interface.

-

Accessing and sharing your forms safely through controlled permissions and secure sharing options.

What additional considerations should you keep in mind for New Jersey tax exchanges?

Tax exchanges involve more than just completing forms. There are local regulations and best practices to consider to ensure compliance and efficiency.

-

Local regulations affecting tax exchanges in New Jersey can significantly impact the overall process.

-

Best practices for compliance and legal advice provide a guideline to ensure that all transactions adhere to applicable laws.

-

Using tax exchanges as part of broader investment strategies can provide long-term financial benefits.

How to fill out the new jersey tax exchange

-

1.Start by visiting the pdfFiller website and search for the New Jersey Tax Exchange form.

-

2.Once you find the appropriate form, click on it to open it in the pdfFiller editor.

-

3.Begin filling in your personal information, such as your name, address, and Social Security Number, in the designated fields.

-

4.Provide details regarding your income, deductions, and any applicable tax credits as required by the form.

-

5.Review the completed form carefully to ensure all information is accurate and all necessary sections are filled out.

-

6.Use the tools available in the pdfFiller editor to add any required signatures or initials where indicated.

-

7.Once the form is complete, save your progress, and then choose to either print the document or submit it electronically if that option is available.

-

8.Follow any additional instructions provided on the form regarding submission to the New Jersey Tax authorities.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.