Get the free General Notice of Default for Contract for Deed template

Show details

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is general notice of default

A general notice of default is a formal document indicating that a borrower has failed to meet the legal obligations of a loan agreement.

pdfFiller scores top ratings on review platforms

easy to use and keeps all doc in the dashboard for future usage.

Excellent. Does everything and reasonable price. Use if for work and business!

Thanks to PDFfiller and all my documents are sign

Karl was very helpful and he resolved my query very quickly

I hated to pay for this ... I hate paying for anything ... but you guys got me .... it is well well weworth it!!!!!!!!!!!!!

honestly its sooooooo helpful for its price point

Who needs general notice of default?

Explore how professionals across industries use pdfFiller.

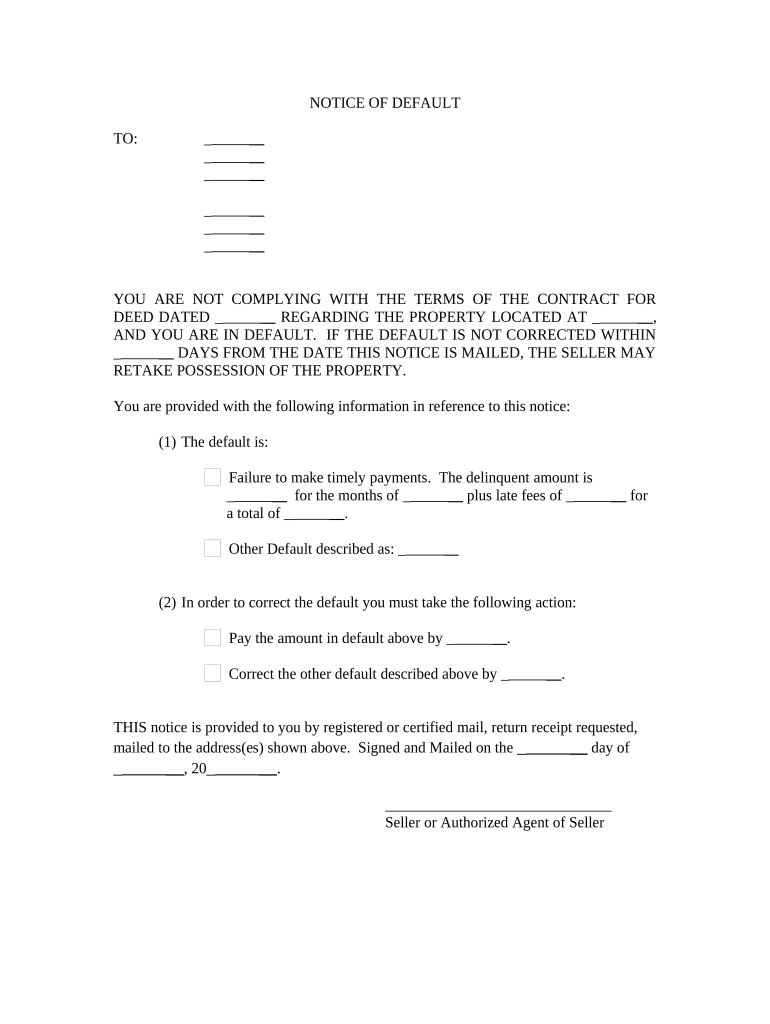

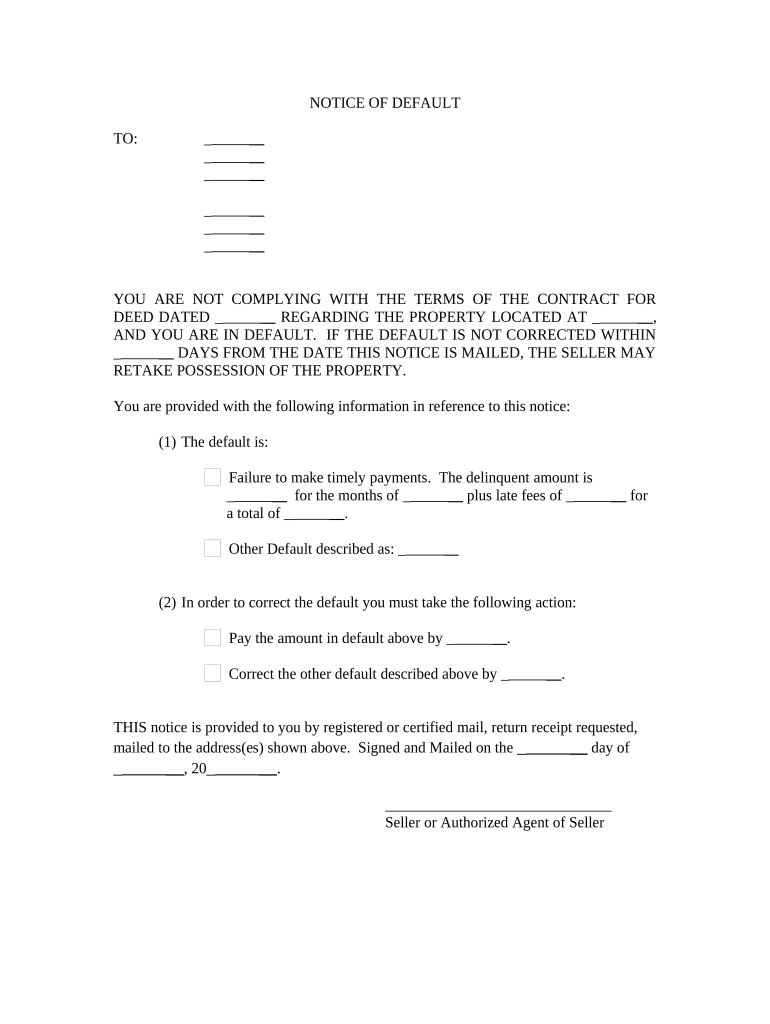

General Notice of Default Form Guide

A general notice of default form is crucial in the realm of real estate transactions, often serving as a preliminary step before further legal actions are taken. This guide offers an overview of its significance and essential components.

-

The form notifies the borrower of their default on payment obligations, making it a formal step in the process of recovering owed amounts.

-

Filing a general notice of default can protect the lender's rights and provide grounds for potential foreclosure if the issue is unresolved.

What are the key components of the general notice of default form?

Understanding the essential components of the general notice of default form is vital for accurate completion.

-

Includes the names of all parties receiving the notice, ensuring accurate delivery.

-

References the specific contract that is in default, aiding in clarity and legal referencing.

-

The physical address and legal description of the property must be included.

-

Clearly state why the borrower is considered in default.

-

Outlines the steps the borrower can take to remedy the default situation.

How do you fill out the general notice of default form?

Filling out this form correctly is crucial to ensure validity and compliance with legal standards.

-

Ensure that all names are spelled correctly and all parties are included.

-

This should reflect the original contract accurately to avoid disputes.

-

Clearly state missed payments and any other defaults.

-

Provide step-by-step guidance for rectifying the situation.

-

Ensure that all required parties have signed before sending.

How can pdfFiller assist with form management?

Using pdfFiller can enhance the process of managing a general notice of default form, making it simplified and efficient.

-

Users can easily modify the document online, ensuring timely updates.

-

Fast-track the signing process to improve compliance and efficiency.

-

Share documents seamlessly with relevant parties for input and review.

-

Access your documents anywhere with cloud-based solutions.

What are the legal considerations and compliance notes?

Understanding legal compliance is essential when filling out a general notice of default form.

-

Be aware of your state's requirements for legal notices as they may vary significantly.

-

Ensure adherence to any local regulations in [region], if applicable.

-

Recommend certified mail for proof of delivery and compliance.

-

Familiarize yourself with legal timelines for addressing defaults to avoid complications.

What are common mistakes when filling out a general notice of default?

Being aware of common pitfalls can prevent potential legal issues.

-

Leaving out necessary details can invalidate the notice.

-

Mistakes in referencing laws can undermine your case.

-

Failing to use certified or registered mail may result in non-receipt.

-

Neglecting to inform the recipient about their rights can lead to challenges.

What are real-world examples of notices of default?

Absorbing real-life scenarios can provide valuable insights into the use of general notices of default.

-

A completed form can serve as a reference for accurate filling.

-

Explore scenarios where defaults led to foreclosure or legal disputes.

-

Learning from others' mistakes can guide you toward best practices.

How to fill out the general notice of default

-

1.Open the PDFfiller website and log in to your account.

-

2.Navigate to the 'Forms' section and search for 'General Notice of Default'.

-

3.Select the appropriate template and click on 'Fill Now' to start editing.

-

4.Begin by entering the borrower's name and contact information in the designated fields.

-

5.Next, provide details about the loan, including the loan number and the amount owed.

-

6.Complete the section outlining the default, specifying the duration of delinquency and any missed payments.

-

7.If applicable, add any penalties or fees that have accrued during the default period.

-

8.Include the lender's name, contact information, and address where the notice should be sent.

-

9.Review the document for accuracy and completeness before proceeding.

-

10.Finally, save your changes and choose to either print the notice or send it electronically.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

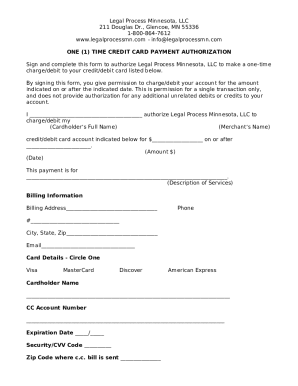

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.