Get the free Business Credit Application template

Show details

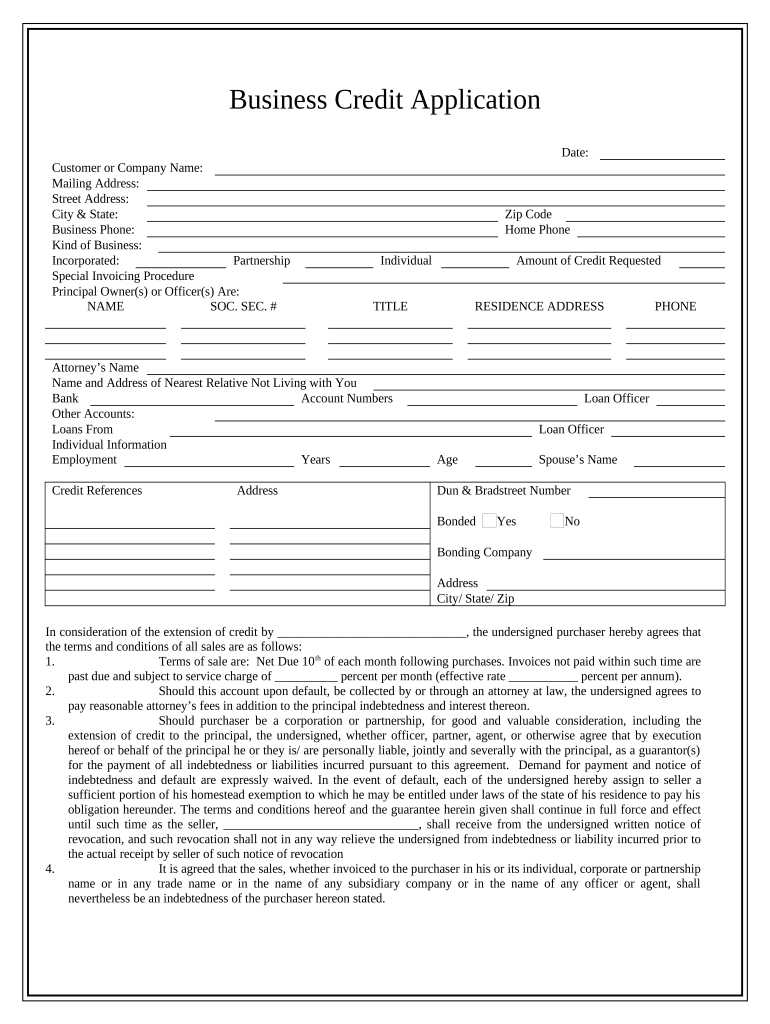

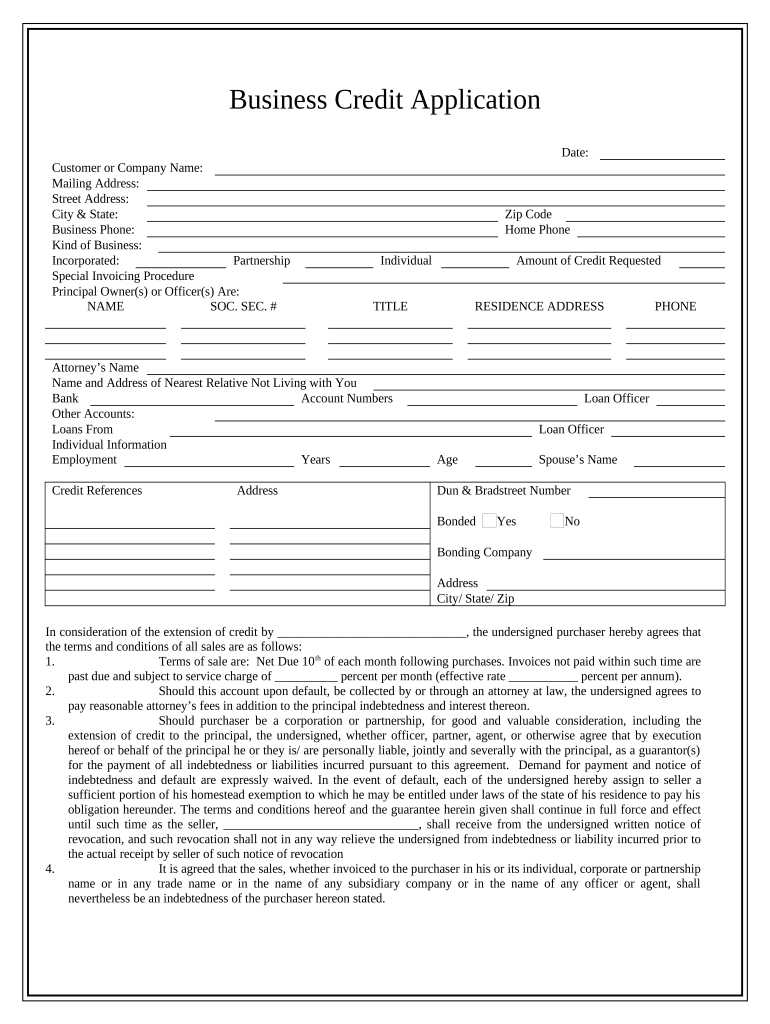

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is business credit application

A business credit application is a formal request for credit from a creditor to evaluate the financial stability and creditworthiness of a business.

pdfFiller scores top ratings on review platforms

Overall pretty great program website to…

Overall pretty great program website to have. Especially, if you looking for hard to find forms, and documents.

Customer Support

I contacted the team instantly and they arranged the matter that occured in between an hour top. Very kind and helpful

New Review 7.23

So far, it was very user friendly, I am old so I was not to sure, but I was able to create 3 menu weeks in a matter of minutes.

This was the easiest software to use

This was the easiest software to use. Perfect!! Very impressed! A lot better than microsoft office

It was a little tricky but I eventually figured it out. Some boxes automatically checked both yes and no when trying to choose no.

FINE

Who needs business credit application template?

Explore how professionals across industries use pdfFiller.

Understanding Business Credit Application Forms

Filling out a business credit application form is crucial for establishing your company’s creditworthiness. This guide outlines everything from the significance of these applications to common pitfalls to avoid.

Why are business credit applications significant?

Business credit applications are essential for understanding your company's financial health. Building a credit history contributes to creditworthiness, which is vital for financing and business growth.

-

Establishing a credit history helps in obtaining loans or credit lines in the future.

-

A good credit rating can lead to better interest rates and terms.

-

Demonstrating financial responsibility can enhance your public reputation.

What are the key components of a business credit application?

A comprehensive business credit application contains critical information which lenders assess for risk. Key fields include Customer or Company Name, Mailing Address, and Business Phone.

-

Principal Owner's Information: This includes identifying details about the person responsible for the business.

-

Bonding Company Details: This is essential for ensuring business reliability.

-

Geographical information which may impact credit terms.

How should you fill out your business credit application?

Completing your business credit application accurately is vital to avoid delays. Start with a step-by-step guide for each section, ensuring you gather necessary documentation in advance.

-

Gather documentation: Prepare financial statements, tax returns, and identification beforehand.

-

Fill in all required fields carefully, making sure to double-check for accuracy.

-

Complete supplementary questions that may provide additional context about your business.

How can you edit and sign your application with pdfFiller?

pdfFiller makes editing and signing your business credit application straightforward. With its eSignature capabilities, you can securely finalize your documents.

-

Edit form fields: Use pdfFiller to modify sections directly.

-

Utilize the eSignature tool to sign the document digitally.

How can you manage your application documents?

Organizing your applications is crucial for efficient document management. pdfFiller allows you to save and manage these files in the cloud.

-

Save completed applications directly into your cloud storage for easy access.

-

Use collaborative features to allow team members to review and provide input on applications.

What common mistakes should you avoid in your application?

Many applications face rejection due to simple errors. Understanding these common pitfalls can help you submit a successful credit application.

-

Inaccurate information can lead to immediate rejection; always verify details before submission.

-

Neglecting to provide complete documentation can delay processing.

-

Failing to read terms and conditions may result in unintentionally agreeing to unfavorable terms.

What should you understand about the terms and conditions?

Thoroughly understanding credit extension terms, fees, and liabilities is fundamental when agreeing to a credit application. Misinterpretation can lead to financial constraints later.

-

Credit extension: This refers to the agreement between a lender and borrower regarding loan limits.

-

Fees can include service fees, late fees, and penalties for non-compliance.

What financing options follow your application?

After submitting your application, various credit lines and loans become available. Your business credit score plays a significant role in determining these options.

-

Types of financing options include term loans, lines of credit, and merchant cash advances.

-

Your business credit score impacts not only the available options but also the terms and interest rates on these loans.

What are the long-term benefits of maintaining good credit practices?

Maintaining good credit practices yields long-term benefits, including easier financing access. Utilizing tools like pdfFiller can greatly enhance your document management process.

-

Reliable credit practices establish a positive credit history essential for future growth.

-

Encouraging continual use of pdfFiller’s features can simplify ongoing document management.

How to fill out the business credit application template

-

1.Download the business credit application from pdfFiller.

-

2.Open the downloaded PDF using pdfFiller's platform.

-

3.Begin by entering your business name in the designated field.

-

4.Input the business address, including street, city, state, and ZIP code.

-

5.Provide contact information, including phone number and email address.

-

6.Fill in your business type and structure (e.g., LLC, Corporation).

-

7.Enter your federal tax ID or Social Security number as required.

-

8.Complete the owner or principal information, including names and percentages of ownership.

-

9.Include details of your bank references and financial institutions.

-

10.Specify the amount of credit you wish to apply for.

-

11.Review all provided information for accuracy.

-

12.Sign the application electronically using pdfFiller's signing option.

-

13.Submit the completed application through pdfFiller to the creditor.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.