Get the free new mexico withholding template

Show details

4A341 STATE OF NEW MEXICO COUNTY OF JUDICIAL DISTRICT, Petitioner. No. , RespondentWAGE WITHHOLDING ORDER1This matter having come before the court for entry of a wage withholding order. The parties

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is new mexico withholding

New Mexico withholding refers to the state-required deduction from an employee's wages for income tax purposes in New Mexico.

pdfFiller scores top ratings on review platforms

Their customer service is great! Joyce helped me out and was super helpful and considerate! Best customer service experience I’ve had. Thanks for the quick response!

This was a good experience, I thought that I would not easily find legal forms from previous years, and it was easier than I thought, THANK YOU

great

Great software for old fed tax forms

Easy to understand

Great

Who needs new mexico withholding template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to New Mexico Withholding Form

Wage withholding is a critical aspect of payroll processing in New Mexico, ensuring compliance with state tax obligations and other financial responsibilities. Understanding how to complete a New Mexico withholding form is essential for employers and employees alike.

This guide will provide an overview of the New Mexico withholding form process, including employer responsibilities, calculations, and submission details to help streamline your operations.

What is wage withholding, and why is it important?

Wage withholding refers to the practice of deducting a portion of an employee's earnings to fulfill various obligations, such as state income tax, child support, or other legal obligations. It serves a crucial role in ensuring that employees meet their financial responsibilities before receiving their net pay.

-

Provides a systematic method for enforcing tax collection.

-

Helps ensure compliance with child support payments and legal orders.

-

Assists in managing state income tax liabilities effectively.

Who is responsible for withholding wages in New Mexico?

In New Mexico, various types of employers are mandated to withhold wages from their employees. Employers must understand the circumstances that require them to withhold wages to comply with state regulations.

-

All employers managing employees must withhold wages if required by law.

-

Court-ordered withholding must be adhered to by employers and can include cases for child support.

-

Failure to comply may result in penalties and legal action against the employer.

How is a wage withholding order initiated?

A wage withholding order is initiated through a legal process that may involve courts, employers, and employees. Familiarizing yourself with the steps can expedite this process.

-

A court must issue a wage withholding order, typically as part of a domestic relations case.

-

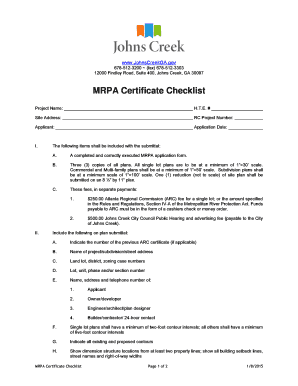

Relevant forms, such as the Domestic Relations Form 4A-341, are filled out and submitted for approval.

-

Employers receive the order, which provides clear instructions on the amounts to withhold and submit.

What does the withholding order form entail?

Completing the withholding order form accurately is essential for effective processing. Each field serves a distinct purpose and requires specific information.

-

Information about the paying parent, including full name and contact details.

-

Social security number and employer details to ensure proper identification.

-

Details of the amount to withhold monthly for tax obligations or child support.

-

Instructions for the employer on payment processing to avoid discrepancies.

How is the amount to withhold calculated?

Calculating the exact amount to withhold is crucial for compliance with judicial orders and state laws. The determination of appropriate withholding also varies based on individual financial circumstances.

-

Employers should assess each employee's financial obligations to calculate the correct withholding amount.

-

Utilizing tools or calculators available through pdfFiller can help streamline these calculations.

-

Consider any variations in income, as changes may require adjustments to the withholding amount.

How do you file and submit the withholding order?

Once the wage withholding order form is completed, it must be submitted correctly to the appropriate judicial district to ensure processing without delays. Understanding the filing requirements will help avoid issues.

-

The wage withholding order should be filed with the designated court, ensuring it matches local jurisdiction guidelines.

-

All necessary attachments and supporting documents must accompany the form to prevent processing delays.

-

Submit the forms promptly to adhere to the deadlines set forth by the court.

What are the employer's obligations regarding withholding?

Employers have clear responsibilities when it comes to withholding and remitting payments. Ensuring compliance with the order can help avoid legal repercussions.

-

Employers must accurately withhold and remit the correct amounts according to the order.

-

Reports detailing withheld amounts must be submitted within the specified timeframe.

-

Neglecting to comply with these requirements may result in legal consequences for the employer.

What interactive tools aid in managing wage withholding?

Utilizing interactive tools can enhance the management of wage withholding processes. pdfFiller offers various features that support document creation and compliance.

-

pdfFiller provides editing tools to modify forms quickly and accurately.

-

Features for real-time collaboration enable teams to work together effectively.

-

Electronic signature options facilitate smooth and legally binding transactions.

What common pitfalls should be avoided when handling wage withholding?

Understanding common mistakes is crucial for effective management of wage withholding processes. Avoidable errors can have serious consequences.

-

Incorrectly filling out forms may lead to processing delays or disputes.

-

Failing to comply with deadlines can result in unnecessary penalties.

-

Not fully understanding the obligations can lead to costly mistakes for employers.

How to fill out the new mexico withholding template

-

1.Access the new mexico withholding form on pdfFiller.

-

2.Begin by entering your name and address in the designated fields.

-

3.Fill out your Social Security number accurately to ensure correct identification.

-

4.Indicate your filing status (Single, Married, Head of Household) as this affects your withholding rate.

-

5.Provide your total annual income estimate to help determine the appropriate withholding amount.

-

6.If you have other deductions or credits, include that information on the form.

-

7.Review all entered information for accuracy before proceeding to the next step.

-

8.Submit the form electronically via pdfFiller or print it for submission to the New Mexico Taxation and Revenue Department.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.