Get the free Living Trust for Husband and Wife with Minor and or Adult Children template

Show details

This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is living trust for husband

A living trust for husband is a legal document that allows a husband to retain control over assets while designating beneficiaries, facilitating smoother asset distribution upon death.

pdfFiller scores top ratings on review platforms

NOT User friendly

Needed to file 1099's for client including some past years. Pdf filler made it easy!

great app, easy to catch on

This was just new to me so it has taken me a lot of time to navigate around to do what I needed to do. I'm sure with some use and training it will be very easy to use. I have accomplished filling in the form but I'm trying to see how to get the new file name to appear as a download on my computer, so this is what I'm working on now.

Good

just getting into it.

Who needs living trust for husband?

Explore how professionals across industries use pdfFiller.

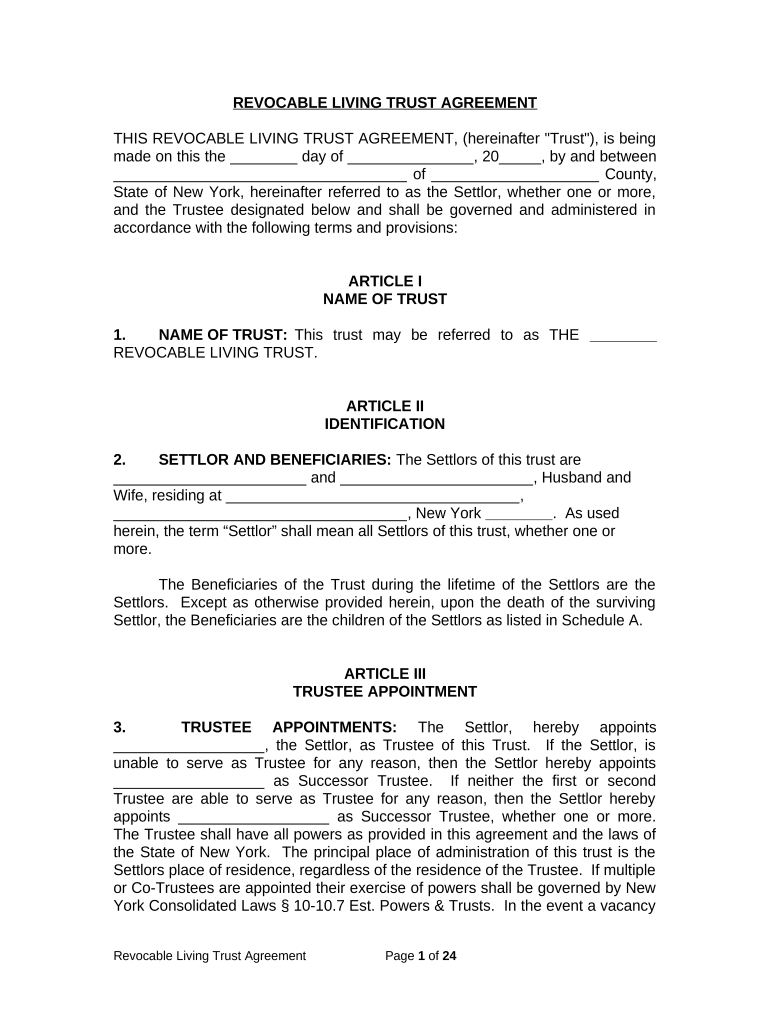

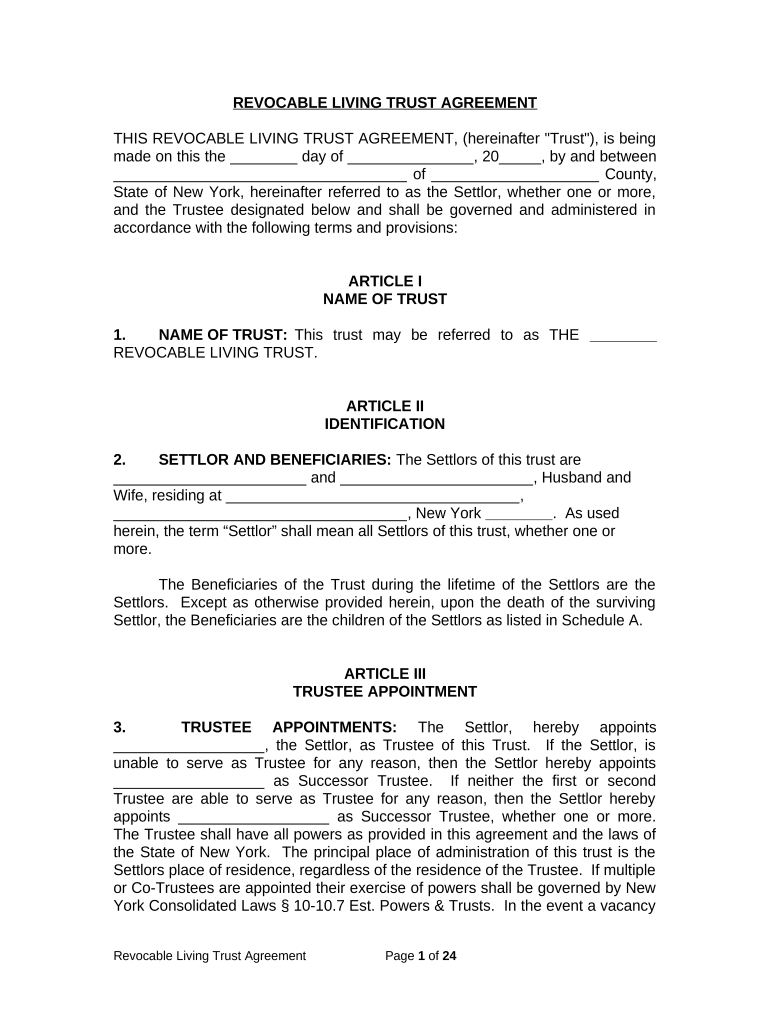

Comprehensive Guide to Filling Out a Living Trust for Husband Form on pdfFiller

How does a revocable living trust work?

A revocable living trust is a legal document that allows individuals to manage their assets during their lifetime and stipulates how those assets will be distributed upon their death. This type of trust is called 'revocable' because it can be altered or canceled by the grantor (the person who establishes the trust) at any time before their death. It's an essential tool in estate planning, providing benefits such as avoiding probate costs and increasing privacy regarding one's estate.

What are the advantages and disadvantages of a revocable living trust?

Using a revocable living trust presents several benefits as well as potential drawbacks that should be considered. On one hand, it enables smooth transition of assets without the need for probate, allows for flexibility, and can be tailored to meet individual needs. On the contrary, one of the disadvantages is that the trust may not provide asset protection from creditors and may involve ongoing management.

-

A revocable living trust avoids probate costs and delays, offers privacy since the trust does not go through public probate, and allows for ease of asset management.

-

While revocable trusts are flexible, they do not protect assets from creditors and may require more complex record-keeping.

What key components make up the revocable living trust agreement?

The revocable living trust agreement consists of essential components that outline how the trust operates. The primary parties involved include the settlor, who creates the trust, and the beneficiaries, who will benefit from the assets held in the trust. It's crucial to appoint a trustee, who will manage the assets in accordance with the trust's directives, and clarity regarding the responsibilities of the trustee is vital for effective trust administration.

-

Settlors create the trust and determine its terms, while beneficiaries are designated to receive trust assets.

-

The trustee manages the trust during the settlor's lifetime and is responsible for adhering to the trust's terms.

How can you complete the living trust form step-by-step?

Completing the living trust for husband form requires careful preparation and attention to detail. Start by gathering all necessary information, including asset details and the names of the parties involved. Fill out the form accurately, ensuring that you respond to each section thoughtfully. To avoid common pitfalls, double-check the entries for potential errors or omissions before finalizing the form.

-

Compile a list of assets and their values, as well as personal information about the husband and other relevant parties.

-

Follow the form’s structure, ensuring all required fields are completed correctly to avoid delays.

-

Be wary of incomplete information, forgotten signatures, or incorrectly spelled names.

How can pdfFiller assist you in managing trust documents?

pdfFiller provides a seamless platform for managing your revocable living trust documents. You can easily access and edit your trust document using their tools, enabling quick modifications whenever necessary. The platform also supports eSigning and collaboration, making it convenient to work with your spouse or other involved parties while securely storing and sharing your living trust document.

-

Utilize pdfFiller's online features to make real-time changes to your trust document.

-

Invite team members or family members to collaborate and sign the trust agreement digitally.

-

Store your living trust safely in the cloud for easy retrieval when needed.

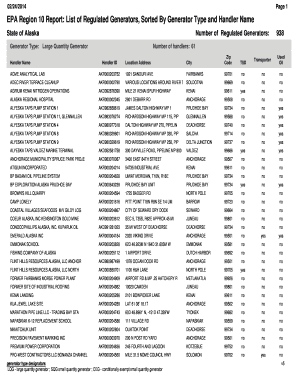

What are the legal compliance requirements in New York for revocable living trusts?

Navigating legal compliance when creating a revocable living trust in New York is crucial to ensure the trust is valid. Familiarize yourself with state laws that govern revocable trusts, as requirements may vary. It’s advisable to periodically review and update the trust document to reflect any changes in personal circumstances or legal statutes.

-

Consult local regulations to comprehend the requirements your living trust must meet in New York.

-

Proper compliance guarantees the trust's effectiveness and protects the interests of all parties.

-

Schedule regular check-ins to update the trust as laws change or personal situations evolve.

How to fill out the living trust for husband

-

1.Start by gathering all necessary documents related to your assets, including property deeds, bank statements, and investment accounts.

-

2.Open the PDF file of the living trust form on pdfFiller.

-

3.Begin by filling in your personal information in the designated sections, including your name and contact information.

-

4.Provide the name of your spouse and specify that they are the primary beneficiary.

-

5.List all assets that will be included in the trust, ensuring you include detailed descriptions like property addresses and account numbers.

-

6.Designate a trustee; this can be yourself, your spouse, or another trusted individual.

-

7.Review all entries for accuracy and completeness before moving on.

-

8.Sign and date the document in the presence of a notary public as required.

-

9.Save your completed document and print copies for your records and for your spouse.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.