Last updated on Feb 20, 2026

Get the free rate employees edit

Show details

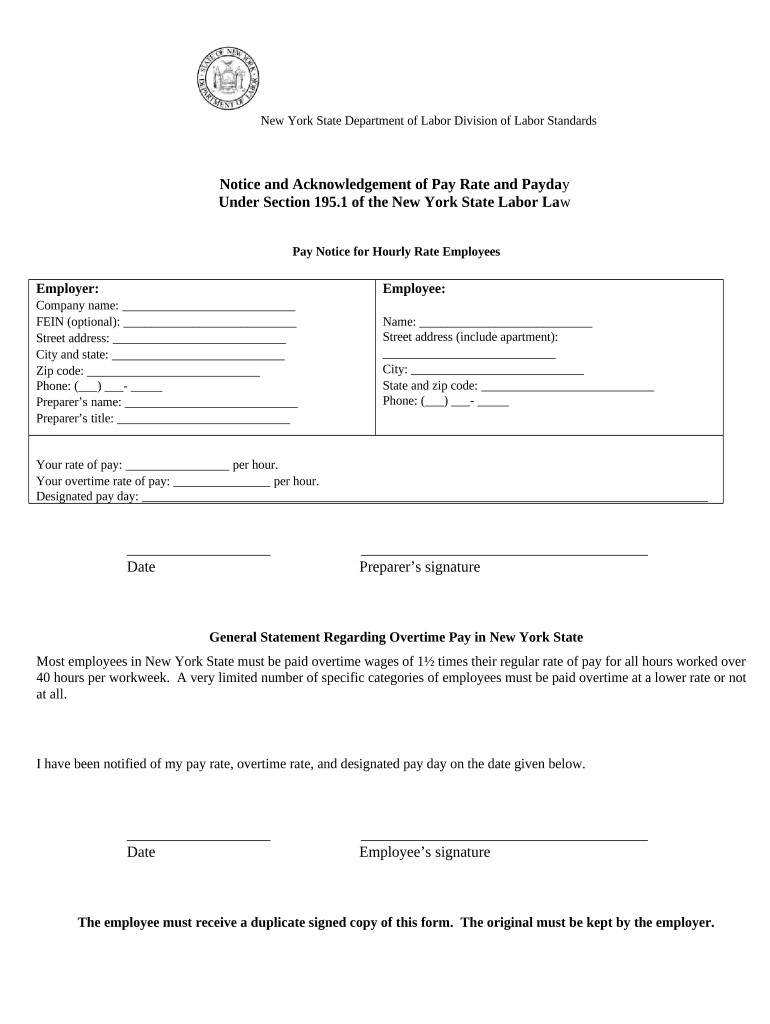

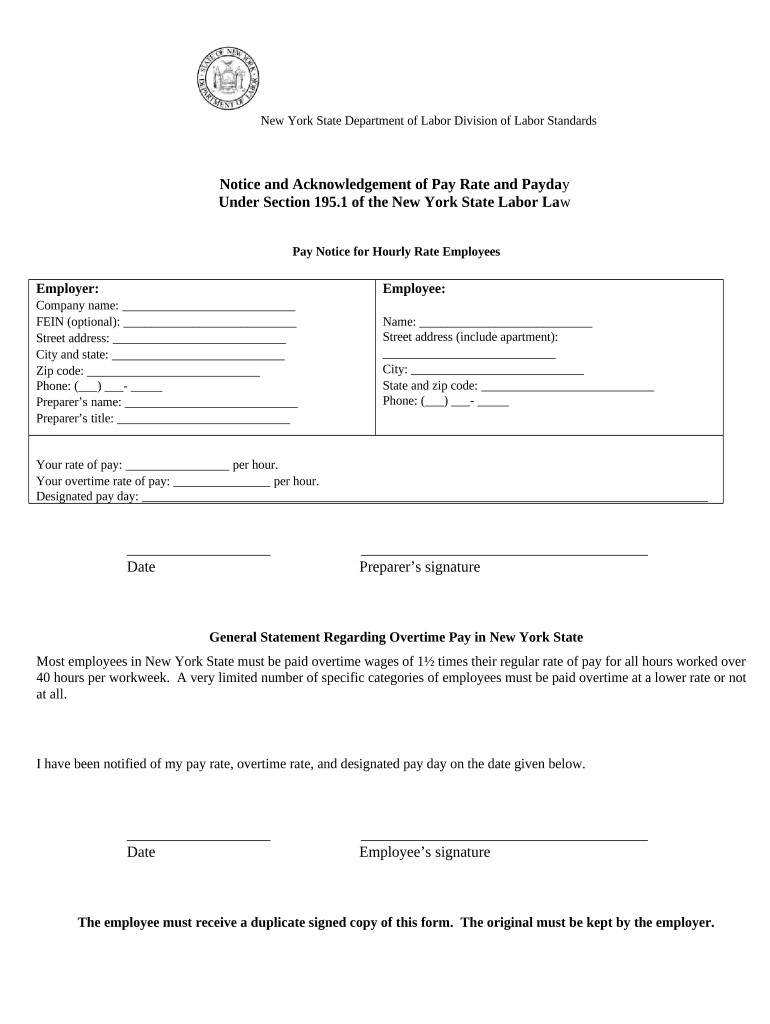

This is an official New York State form required under Section 195.1 of the New York State Labor Law.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is pay notice for hourly

A pay notice for hourly is a document that outlines hourly wages, payment schedules, and any deductions applicable to an employee's pay.

pdfFiller scores top ratings on review platforms

easy to make forms and complete and print

easonably easy to use, lots of helpful tools

Had problems with page not working at first. But now all is ok.

I enjoy the ability to convert PDF files back into MS Word. Very Often I will start in MS Word and send the document to an employer who then sends me a final version in PDF which is OK until such time as there is a need amend it. As I don't travel with a copier, printer or scanner this creates problems.

I can feel absolutely in control of what I would like to do with the document to complete the task and make it best suitable to my requirement.

I couldn't function without it. Very helpful product.

Who needs rate employees edit template?

Explore how professionals across industries use pdfFiller.

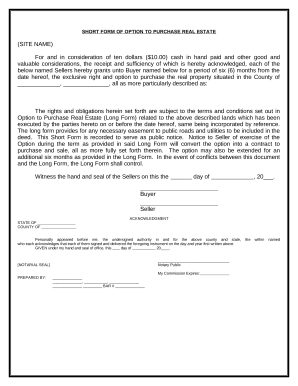

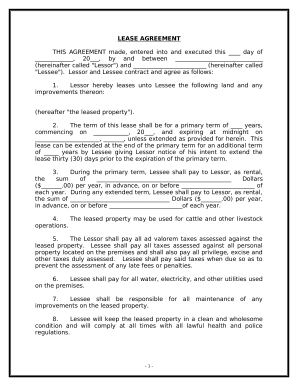

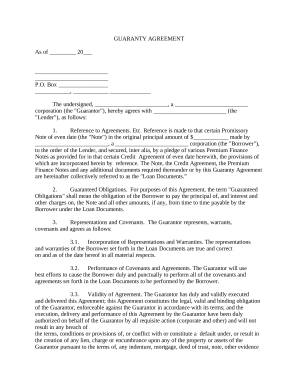

Pay Notice for Hourly Form Guide

Filling out a pay notice for hourly form is crucial for compliance with New York State labor laws. This guide will offer step-by-step instructions for properly completing the form, ensuring both employers and employees understand their rights and obligations.

What is a Pay Notice and Its Importance?

A pay notice is a legal document that informs employees, particularly hourly rate employees, about the terms and conditions of their compensation. Under Section 195.1 of the New York State Labor Law, employers are required to provide these notices to ensure transparency in employee compensation.

-

The document serves as official communication detailing pay rates and pay schedule, helping prevent misunderstandings.

-

This section mandates that employers provide all employees with a written notice of their pay rates, thereby fostering legal compliance.

-

Failure to comply can lead to significant penalties and affect employee morale, making adherence critical.

Who qualifies as an Hourly Rate Employee?

Hourly rate employees are generally those who are compensated based on the number of hours worked rather than a fixed salary. Understanding who qualifies impacts the information that needs to be included in the pay notice.

Key components of the pay notice for hourly rate employees

-

This should be explicitly stated, ensuring transparency in compensation.

-

Employers must communicate the pay rate for hours worked over the standard 40-hour workweek.

-

The pay notice must also specify regular pay periods, allowing employees to plan financially.

How can employers ensure compliance with New York State laws?

Employers should regularly review their processes to guarantee they provide accurate pay notices in accordance with state laws. Regular employee training and system audits can also serve as useful compliance mechanisms.

What essential fields are included in the Pay Notice Form?

-

Must include company name, address, and contact details.

-

Must include employee name and address for identification.

-

Includes hourly rate, overtime rate, and pay schedule.

What are the Overtime Pay Regulations in New York State?

Overtime pay regulations require that eligible hourly employees receive a rate of 1.5 times their regular pay after working 40 hours in a week. Employers need to clearly communicate these policies in the pay notice.

-

Employees should be aware of their right to receive overtime for qualifying work hours.

-

Not all employees are eligible; it varies based on their job functions and salary thresholds.

-

Employers should clarify overtime expectations in employee orientation and in the pay notice itself.

How can employers create and distribute the Pay Notice?

Creating a pay notice involves filling out the relevant sections accurately. Once complete, employers should ensure they distribute these notices effectively, either in person or electronically.

-

Employers should double-check all entries for accuracy before distributing.

-

Using email or secure document-sharing services ensures timely delivery.

-

It's crucial to maintain records for compliance purposes in case of audits.

How can pdfFiller assist in managing Pay Notices?

pdfFiller offers a user-friendly platform for efficiently managing pay notices. It allows for easy editing, signing, and document management entirely online.

-

With pdfFiller, employers can modify templates to fit their specific needs.

-

Streamline approvals and collaboration among team members directly within the platform.

-

Enjoy peace of mind with secure storage and easy access to completed pay notices.

What are the Legal Consequences of Non-Compliance?

Failing to provide a pay notice can result in substantial penalties for employers under New York State laws. Employees may also have grounds for legal recourse if they feel their rights have been violated.

-

Fines or sanctions may apply for each instance of non-compliance.

-

Employees can report non-compliance and take legal action to protect their rights.

-

Staying informed about changes in laws is essential for ongoing compliance.

What are some Case Studies and Examples?

Examining case studies helps clarify the importance of correctly using the pay notice. Employers can learn from hypothetical scenarios that illustrate both best practices and common mistakes.

-

Demonstrates how failing to provide a pay notice can lead to misunderstandings regarding compensation.

-

Examples of companies that have effectively implemented pay notices and improved employee morale.

-

Identifying these mistakes can help others avoid similar pitfalls.

How to fill out the rate employees edit template

-

1.Open the pay notice form on pdfFiller.

-

2.Fill in the employee's full name at the top of the form.

-

3.Enter the employee's job title in the designated field.

-

4.Input the hourly pay rate clearly, ensuring it's formatted as currency.

-

5.Indicate the pay period dates to specify the range of work hours.

-

6.List the total hours worked in the corresponding section.

-

7.If there are deductions, itemize them in the appropriate section with clear explanations.

-

8.Review all filled information for accuracy and compliance with company policies.

-

9.Save the document, ensuring it's titled appropriately for reference.

-

10.Print or share the completed pay notice electronically with the employee for their records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.