Get the free Notice of Default for Past Due Payments in connection with Contract for Deed template

Show details

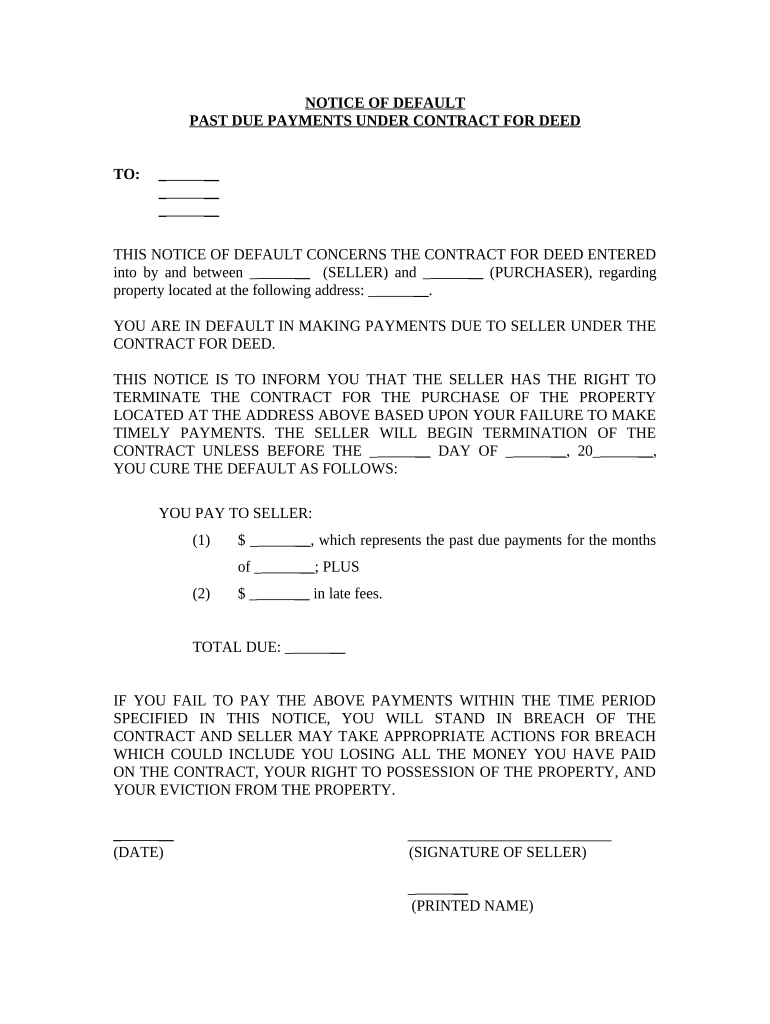

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

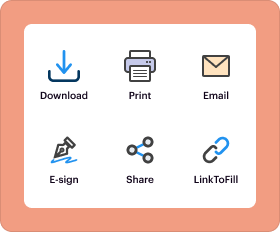

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of default for

A notice of default is a formal notification that a borrower has failed to meet the terms set forth in a loan agreement, typically regarding missed payments.

pdfFiller scores top ratings on review platforms

Great site very easy-to-use and convenient.

This has made the complicated job of trying to expedite a passport so much easier!

It works on documents that Microsoft Word does not.

Your courtesy and professionalism are marvelous. Thank you for allowing me this chance.

Lost an important form, because did not realize I needed to register first.

Easier to use than my usual pdf form filler.

Who needs notice of default for?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to Notice of Default

What is a Notice of Default?

A Notice of Default is a formal declaration by a lender indicating that a borrower has fallen behind on payments. Prompt attention to Notices of Default is crucial, as they can lead to serious consequences if ignored, including foreclosure or eviction.

-

Definition of a Notice of Default: A legal document that marks the beginning of the foreclosure process.

-

Importance of addressing Notices of Default promptly: Timely action can help avoid penalties such as increased fees or legal action.

-

Consequences of ignoring a Notice of Default: This may include foreclosure, damage to credit scores, and potential eviction.

How is the Notice of Default Document Structured?

Understanding the structure of a Notice of Default document can aid in its proper completion. Ensuring that all required contract information is included is vital for the enforceability of the document.

-

Overview of contract information: Includes necessary details regarding the loan agreement and payment terms.

-

Identification details of the Seller and Purchaser: Names, addresses, and involved parties must be clearly stated.

-

Property address inclusion requirements: The specific address of the property in question must be accurately noted.

How do you fill out your Notice of Default?

Completing your Notice of Default form accurately can determine your next steps. Enter relevant details and ensure all sections are thoroughly filled out to avoid delays.

-

Entering Seller and Purchaser information: Include accurate names and contact details to avoid miscommunication.

-

Completing the property address section: Clearly write the complete address, ensuring that it matches official records.

-

Filling in past due payments and late fees details: Document all amounts owed precisely to avoid disputes.

What are the critical deadlines and how to cure a default?

Understanding timelines for curing the default is essential. The failure to act within these timelines can severely limit your options.

-

Understanding the timeline for curing the default: Different states have varying regulations regarding this timeline.

-

Calculating total amount due: Include all missed payments and applicable late fees in your calculations.

-

Methods for submitting payments to Seller: Ensure payments are sent through accepted channels to maintain proper records.

What are the legal consequences of ignoring a Default Notice?

Ignoring a default notice can lead to severe legal repercussions. The lender may take legal action that culminates in losing your property.

-

Potential outcomes of failing to remedy the default: Ongoing non-payment could lead to foreclosure proceedings.

-

Legal rights of the Seller: They retain rights to pursue legal action for non-compliance.

-

Eviction process and customer rights: If a court rules in favor of the Seller, eviction may be pursued, with specific legal protocols to follow.

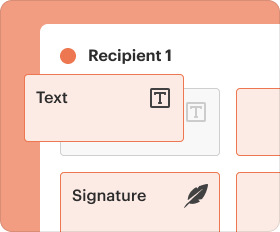

How does pdfFiller help with Notice of Default forms?

pdfFiller empowers users to seamlessly edit PDFs and facilitates the completion of various forms, including Notices of Default. With interactive tools, users can manage document creation efficiently.

-

Editing and filling out the Notice of Default form: Utilize user-friendly editing tools to complete necessary details.

-

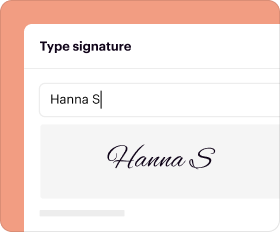

eSigning the document safely: Employ secure eSignature options to ensure document integrity.

-

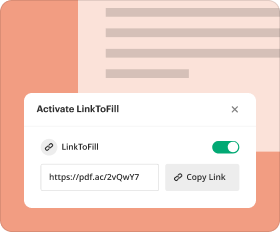

Collaborative document sharing: Share drafts with involved parties to gather input and updates easily.

What are cautionary insights on Default Notices?

Common pitfalls in addressing a Notice of Default can lead to worsening situations. It's important to be aware of these to effectively mitigate risks.

-

Common mistakes: These can include improper documentation and missed deadlines.

-

Tips for avoiding a default situation: Maintaining communication with lenders can prevent misunderstandings.

-

Resources for legal guidance: Seek legal aid or resources for tailored advice.

How to fill out the notice of default for

-

1.Open pdfFiller and upload the notice of default template or create a new document using the editor.

-

2.Begin by entering the date at the top of the document to indicate when the notice is being issued.

-

3.Fill in the name and address of the borrower in the appropriate fields, ensuring accuracy to avoid legal issues.

-

4.Add the lender’s name and contact information, as they are the party issuing the notice.

-

5.Clearly state the loan number associated with the property in default for easy identification.

-

6.Outline the specific reasons for the default, including details such as missed payment dates and amounts owed.

-

7.Include a statement regarding the consequences of failing to remedy the default, such as potential foreclosure.

-

8.Sign the document digitally or print it out for a physical signature to validate the notice.

-

9.Save the completed notice of default and choose whether to download it or send it directly to the necessary parties via pdfFiller.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.