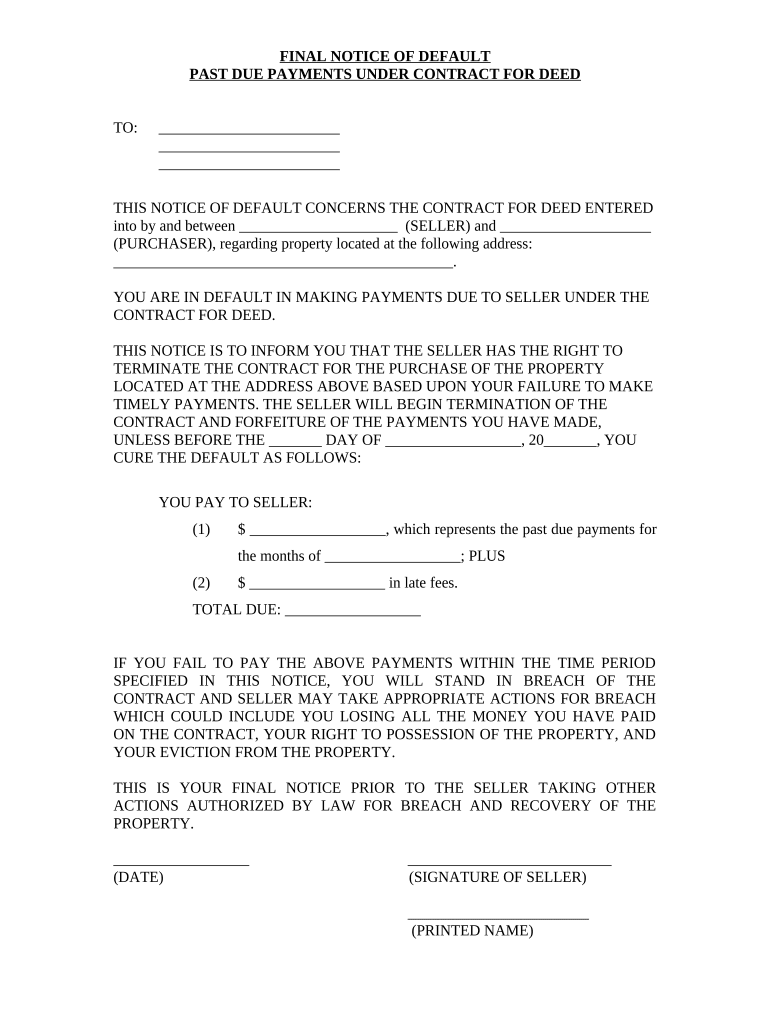

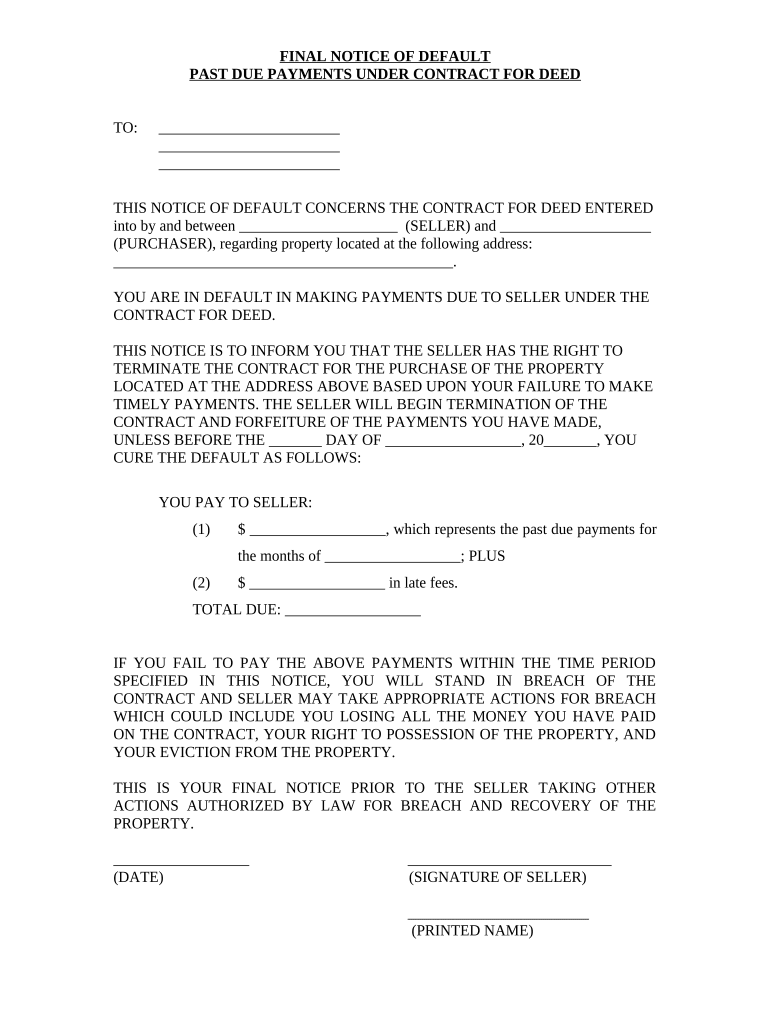

Get the free Final Notice of Default for Past Due Payments in connection with Contract for Deed t...

Show details

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is final notice of default

A final notice of default is a formal document notifying a borrower that they have failed to meet their mortgage obligations and are at risk of foreclosure.

pdfFiller scores top ratings on review platforms

easy and simple for editting

modification editing saving changes and signing the file is done in an easy and simple way

PDFfiller is super amazing . it eases things.

It is magical. Yes I suggest you to use this product

very easy to use when im not computer smart. been a very good experience using this website to edit my files.

I just started to use it now but so far so good.

Ease of use

Who needs final notice of default?

Explore how professionals across industries use pdfFiller.

Final Notice of Default Form: A Comprehensive Guide

How to fill out a final notice of default form

Filling out a final notice of default form accurately is crucial for managing defaults in real estate transactions. In this guide, we will explore everything you need to know to successfully fill out and respond to a final notice of default.

Understanding the final notice of default

The final notice of default serves as an important legal document in real estate transactions. It is a notification sent to a borrower who has defaulted on a loan, signifying that they are in breach of the terms agreed upon in their contract. Its importance cannot be overstated, as it underlines the potential consequences for both the seller and buyer.

-

Definition of a Final Notice of Default: This document explicitly states that the borrower has failed to meet payment obligations.

-

Importance of the notice: It alerts the borrower to rectify the situation to avoid foreclosure.

-

Legal implications: Ignoring this notice can result in severe legal consequences, including foreclosure proceedings.

What is a notice of default?

A notice of default indicates that a borrower has failed to meet the mortgage payment requirements stipulated in their agreement. Understanding this is essential as it can stem from various reasons, including missed payments or communication lapses between parties.

-

Explanation of default in contracts: Defaults can occur when payments are not made on time or if other contractual terms are violated.

-

Common reasons for receiving a notice: These often include financial hardships, miscommunication, or simple oversight.

-

Consequences of ignoring a notice of default: Failure to respond can lead to foreclosure or loss of property.

-

Importance of timely response: Quick communication with the seller or lender can prevent escalation.

Step-by-step guide on how to fill out the notice

Completing a final notice of default form requires careful attention to detail. Make sure to follow these steps for accuracy and compliance.

-

Filling in seller's and purchaser's details: Clearly state the names and contact information.

-

Property address inclusion: Ensure the complete property address is specified.

-

Calculating past due payments: Include precise amounts owed with any associated fees.

-

Filling out payment cure details: Clearly state the required actions to remedy the default.

-

Including signature and date fields: Ensure all parties sign and date the document to validate it.

Details of the default

Understanding what constitutes a default is critical. A default in payment can arise from various events, most commonly late or missed payments.

-

Explanation of what constitutes a default in payment: Default is determined when the borrower fails to meet their contractual obligations.

-

Clarification on payment due dates: Knowing the specific payment schedule can help avoid future defaults.

-

Documentation required: Keep records of all payment history to prove compliance and communication.

What happens when you receive a default notice?

Receiving a default notice can be intimidating, but it's crucial to know the potential outcomes and actions to take.

-

Potential outcomes of ignoring the notice: Consequences can include legal action, property loss, or foreclosure.

-

Possible legal actions from the seller: They may initiate foreclosure proceedings if the default is not cured.

-

Long-term consequences for the purchaser: Ignoring a notice can lead to eviction and a bad credit report.

Caution and reminders

Receiving a notice of default requires immediate action. Delaying can lead to dire consequences.

-

Urgency of acting: Prompt action can prevent further legal and financial implications.

-

Tips on avoiding penalties: Maintaining timely payments and good communication with the seller is essential.

-

Importance of keeping documentation organized: Having records readily available can assist in resolving disputes.

Next steps and options for the purchaser

If you're facing a default notice, knowing your options is key to avoiding foreclosure and maintaining your property.

-

Steps to take to cure the default: Explore options for payment arrangements or settlement offers.

-

Alternatives to payment: Consider negotiation for different payment terms if financial circumstances have changed.

-

Exploring legal options: Consulting with an attorney can help identify potential defenses or strategies.

Utilizing pdfFiller to manage your notice of default

Easy document management with tools like pdfFiller can streamline the process of handling notices of default.

-

Benefits of using pdfFiller: It allows for easy edits and collaborations on forms.

-

How to use interactive tools: Engage with forms in real-time and adjust as needed.

-

eSigning securely: Collaborate with all parties efficiently and securely sign documents online.

Compliance notes for [Region] and related regulations

Understanding local regulations around notices of default is crucial to remain compliant and informed.

-

Local regulations: Each region may have unique requirements for issuing and responding to notices.

-

Best practices: Ensure compliance with legal notices to avoid unnecessary litigation.

-

Updates on changes: Stay informed on any regulatory updates that may affect transactions.

How to fill out the final notice of default

-

1.Start by opening the PDF template for the final notice of default in pdfFiller.

-

2.Fill in the borrower's details, including full name and address, in the designated fields.

-

3.Enter the lender's information, including the name and address of the lending institution.

-

4.Indicate the loan number associated with the mortgage in the specified section.

-

5.Include the date that the default occurred, providing accurate details of missed payments.

-

6.Clearly state the amount owed, breaking down principal, interest, and any additional fees.

-

7.Provide a deadline for the borrower to correct the default, typically 30 days from the notice date.

-

8.Review the document for accuracy, ensuring all fields are correctly filled out.

-

9.Save the completed document and print it for notarization if necessary.

-

10.Finally, send the final notice of default to the borrower via certified mail for legal documentation.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.