Get the free Oregon Department of Revenue Tax Compliance Certification template

Show details

Oregon Department of Revenue Tax Compliance Certification

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is oregon department of revenue

The Oregon Department of Revenue is the state agency responsible for collecting taxes, administering tax laws, and distributing funds to local governments in Oregon.

pdfFiller scores top ratings on review platforms

I REALLY LIKE THIS PROGRAM THE ONLY…

I REALLY LIKE THIS PROGRAM THE ONLY THING I WISH IT HAD MORE TOOLS LIKE MAKING CIRCLES TO CIRCLE MY TIMES ON MY CALENDAR.

really like pdfFiller

really like pdfFiller

Has helped me tremendously

FREE USING PDFFILLER 100%

I LIKE PDFFILER BECAUSE THEIR GIVING ME FREE USING 100% THANKS A LOT GUYS!!!

Polite, understanding and helpful!

Dee at Pdfiller was brilliant, was incredibly polite and understanding and helped me with my issue straight away!

Easy to use

Easy to use, upload and download. Just what I'm after.

Very flexible

Very flexible

Who needs oregon department of revenue?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Oregon Department of Revenue Tax Compliance Certification Form

What is the Tax Compliance Certification Form?

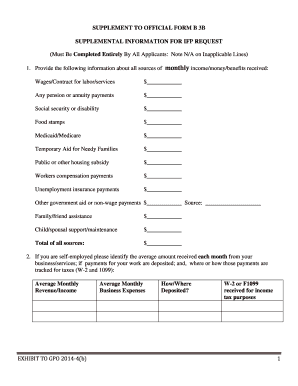

The Oregon Department of Revenue Tax Compliance Certification Form is a crucial document that certifies compliance with tax obligations in Oregon. This form is essential for individuals and businesses wishing to demonstrate their standing with tax regulations. Accurate completion is vital to avoid penalties and ensure that all necessary tax requirements are met.

Who needs to complete this form?

-

Individuals filing state taxes must complete the form to show compliance.

-

Business entities need this certification for various licensing and contract purposes.

-

The form is typically required when applying for permits, loans, or contracts that require proof of tax compliance.

Key components of the Tax Compliance Certification Form

-

Applicants must accurately fill out their name, address, and Social Security Number.

-

Businesses must provide details such as their Business Name, Employer Identification Number (EIN), and Type of Business.

-

This section facilitates the Department's access to tax records and should be filled out carefully.

How do you prepare to fill out the form?

-

Gather all required documents and information before starting to ensure a smooth filling process.

-

Be diligent in selecting the right options and fields appropriate to your tax situation.

-

Utilize pdfFiller's interactive tools to simplify data entry and avoid mistakes.

What are the step-by-step instructions for completing the form?

-

Provide accurate information about the applicant to avoid discrepancies.

-

Ensure that the EIN and BIN are correctly entered and verified.

-

Carefully complete the authorization to allow the Oregon Department of Revenue to retrieve your tax information.

What is the submission process?

-

The completed form should be sent to the specified physical address provided by the Oregon Department of Revenue.

-

You can also submit the form online using pdfFiller, making the process faster and more efficient.

-

Be aware of submission deadlines to avoid late penalties or documentation delays.

What are common mistakes to avoid?

-

Common mistakes include missing signatures, wrong EINs, and incomplete address information.

-

Inaccuracies can lead to rejection of the form or further investigation by the tax authority.

-

Always double-check your entries before submission using pdfFiller tools for greater accuracy.

What are the post-submission actions?

-

After submission, you will receive confirmation of receipt from the Oregon Department of Revenue.

-

You can check the status of your form using the tools provided by the Department.

-

If additional information is requested, respond promptly to avoid delays.

What resources are available for additional assistance?

-

For help, refer to the Oregon Department of Revenue’s official contacts.

-

pdfFiller offers resources and support to assist you in the form-filling process.

-

Visit the official Oregon Department of Revenue website for the latest updates on tax compliance.

How to fill out the oregon department of revenue

-

1.Obtain the relevant forms from the Oregon Department of Revenue website or pdfFiller.

-

2.Open the selected form in pdfFiller.

-

3.Fill in your personal information, including your name, address, and Social Security number, as required by the form.

-

4.Complete the tax-related sections, ensuring to report all income and deductions accurately.

-

5.Review the form for any errors or omissions, as this can affect your tax situation.

-

6.If applicable, fill in information regarding any credits or additional taxes owed.

-

7.Save your progress regularly to avoid losing any data you've entered.

-

8.Once completed, submit the form electronically through pdfFiller or download and print it for mailing, following the submission instructions provided in the form.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.