Get the Rhode Island Tax Free Exchange Package template

Show details

The Tax-Free Exchange Package contains essential forms to successfully complete a tax-free exchange of like-kind property.

This package contains the following forms:

(1) Exchange Agreement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

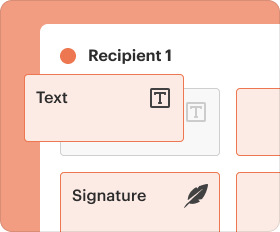

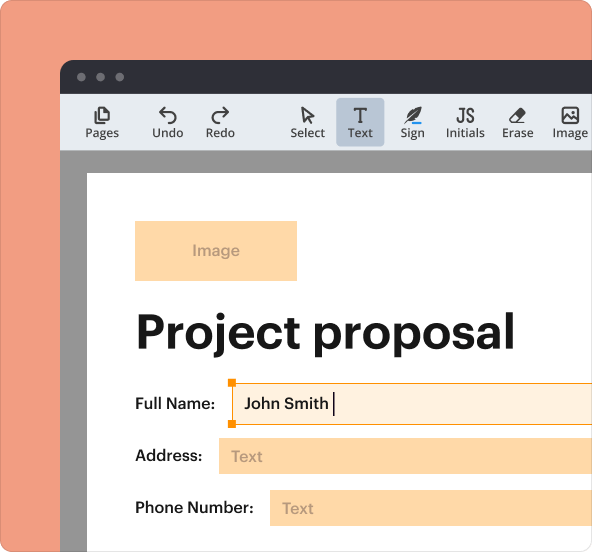

All-in-one solution

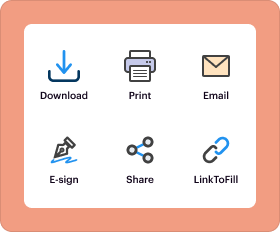

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

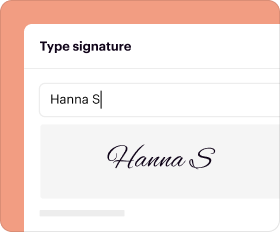

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is rhode island tax exchange

Rhode Island Tax Exchange is a document utilized for exchanging tax-related information and managing tax obligations within the state of Rhode Island.

pdfFiller scores top ratings on review platforms

need additional instructions for processing multiple of the same form.

I just started using this product but love it so far.

It comes in handy when a printer is not accessible and having to convert files.

Some bugs,like disappearing input after saving, but mostly good.

It has made my small business operate easily...no worries about running out of forms or not having the form...i love this software

I have been using this site for 10 minutes, I really cannot give a good assessment. I do believe that a users manual should be more accessible from the home page so you can review the user guide while using the form filler.

Who needs rhode island tax exchange?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Rhode Island Tax Exchange Form

In this guide, we will cover how to complete the Rhode Island tax exchange form efficiently and correctly, ensuring compliance with state laws.

What is a tax-free exchange in Rhode Island?

A tax-free exchange, often referred to as a 1031 exchange, allows property owners to defer capital gains taxes when exchanging similar types of property. This method is particularly relevant in real estate transactions as it can significantly increase the potential for investment growth.

Utilizing the Rhode Island tax exchange form provides numerous benefits, including tax deferral and increased leveraging capability for future property investments.

-

The primary appealing aspect is that you can defer paying taxes on the profit from your property sale.

-

It allows investors to reinvest the full amount of their capital without having to immediately pay taxes.

Key legal considerations in Rhode Island include state-specific regulations and restrictions related to tax exchanges. It’s crucial to be aware of these nuances to avoid any legal repercussions.

What essential forms are included in the tax exchange package?

The Rhode Island tax exchange package consists of several important documents that facilitate the exchange process.

-

This is the primary document outlining the terms of the exchange.

-

This document is used to amend the original agreement if necessary.

-

A declaration confirming certain reporting requirements have been met.

What are the detailed descriptions of each form?

Understanding the purpose of each form is essential for a successful tax exchange.

-

This form lays out all details about the exchange, including timelines, conditions, and responsibilities.

-

This is crucial for making amendments and ensuring all parties adhere to the updated terms.

-

This confirms that there won't be any taxable income from the exchange, which is a key factor in tax reporting.

-

Additional paperwork such as Personal Planning Information and Document Inventory Worksheets help maintain organized records throughout the process.

How do you complete the Rhode Island tax exchange form?

Completing the Rhode Island tax exchange form requires careful attention to detail and compliance with state regulations.

-

Gather necessary information such as property details, party information, and financial specifics.

-

Ensure accurate and compliant information is filled out, avoiding common mistakes that can lead to delays.

-

Choose recommended filing methods suitable for your situation, and adhere to timelines to avoid penalties.

What are best practices for legal document storage and management?

Best practices for storing completed tax exchange documents include ensuring they are securely stored and easily accessible.

-

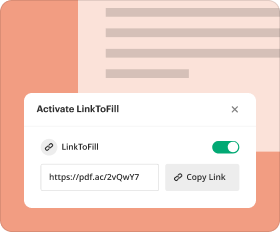

Using a secure platform like pdfFiller allows for efficient document management, sharing, and retrieval.

-

Regularly back up documents to prevent loss and ensure you have access to all necessary papers during the exchange process.

How can you navigate common challenges in the tax exchange process?

Challenges such as incomplete forms or miscommunication with involved parties can hinder the tax exchange process.

-

Understand typical errors, like omitting key information, to prevent delays.

-

Seek advice from legal counsel or tax advisors to help streamline the process.

-

Utilize pdfFiller’s interactive tools to assist with form completion and ensure accuracy.

What are important disclaimers and legal notices?

It is crucial to read and understand all disclaimers related to the use of the Tax-Free Exchange Package.

-

Be aware of all legal disclaimers concerning tax advice and document handling.

-

Understand pdfFiller's role in document management and ensure compliance with all outlined terms.

How to fill out the rhode island tax exchange

-

1.Open the PDF file for the Rhode Island Tax Exchange form.

-

2.Begin filling out your personal information in the designated sections, including your name, address, and Social Security number.

-

3.Continue to the income section and enter your total income for the relevant tax year, ensuring accuracy.

-

4.If applicable, provide details about any deductions or credits you intend to claim on your taxes.

-

5.Review any additional questions related to your tax situation, marking the appropriate boxes.

-

6.Once all necessary fields are filled, double-check your information to avoid errors.

-

7.Sign and date the form in the specified area to validate your submission.

-

8.Finally, save the completed form and follow the submission instructions provided, either electronically or by mail.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.