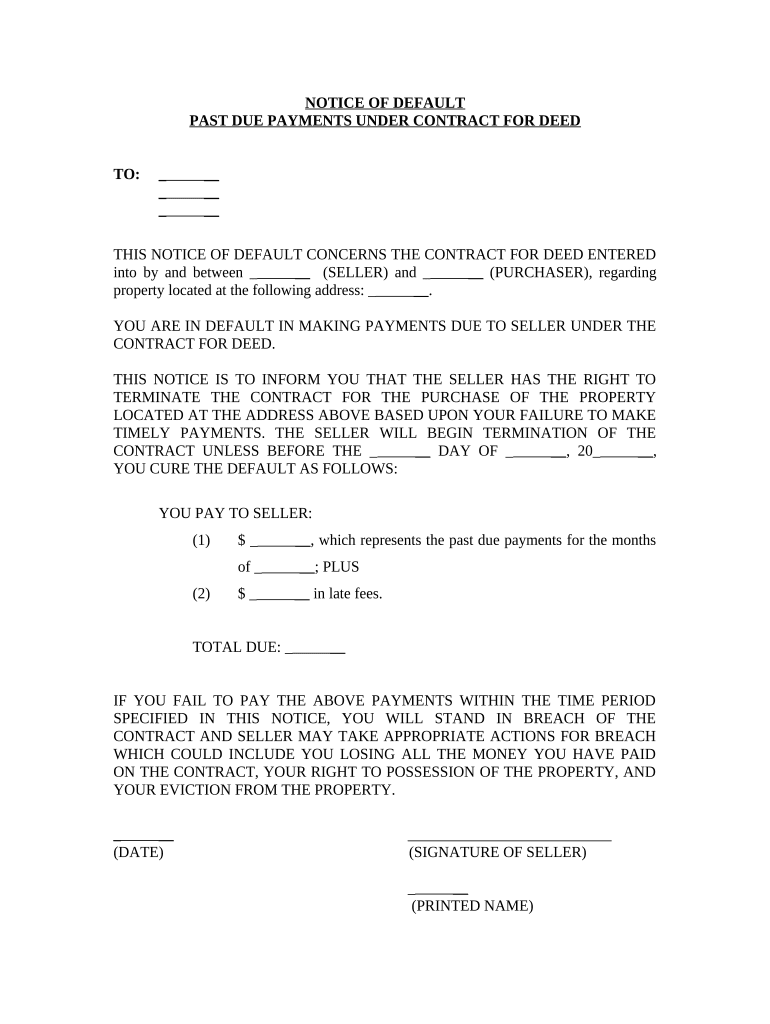

Get the free Notice of Default for Past Due Payments in connection with Contract for Deed template

Show details

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of default for

A notice of default is a formal declaration that a borrower has failed to meet the terms of a loan agreement, typically involving mortgage payments.

pdfFiller scores top ratings on review platforms

It's fine. My issue has been user error I'm sure! I'm figuring it out though!

It was easy and quick. THank you.

I'm new at using Pdf filler. I am interested in learning wjhat it can do for me on a personal basis and professional, simple office useage

fun

Very fast

Works pretty good. Could use some better documentation

Who needs notice of default for?

Explore how professionals across industries use pdfFiller.

Landing Page for Notice of Default Form

How should you understand a notice of default?

A Notice of Default (NOD) is an official notification that a borrower has failed to make required payments on a loan as outlined in the contract for deed. Understanding this crucial document is essential for anyone involved in real estate transactions, especially for both buyers and sellers. Timely payment is vital to avoid serious consequences.

-

A legal indication of the borrower's failure to fulfill loan payment obligations.

-

Failure to meet payment deadlines can lead to the initiation of foreclosure proceedings.

-

Receiving an NOD can impact your credit score significantly and may affect future borrowing capabilities.

What are the components of the notice of default?

Each Notice of Default comprises several key components that must be clearly stated to ensure both parties fully understand their responsibilities and rights.

-

Clearly listed names and addresses to avoid ambiguities.

-

Includes the property address and relevant legal descriptions.

-

Any outstanding balances, additional fees, and strict timelines for rectifying the situation.

How do you complete the notice of default form?

Filling out the Notice of Default form accurately is essential for its legal validity. With tools like pdfFiller, the entire process is simplified.

-

Utilize templates and guided prompts to ensure completeness and accuracy.

-

Double-check all information and maintain a clear writing style for readability.

-

Make sure to track changes and use electronic signature features for security.

What are the legal implications of receiving a notice of default?

Receiving a notice of default can have severe legal ramifications, especially regarding the borrower's rights and obligations.

-

Defaulting on payment can be seen as a breach, potentially leading to foreclosure.

-

Failure to resolve the issue might result in legal actions such as eviction.

-

Borrowers may have the right to contest the NOD or negotiate payment plans.

What cautionary guidelines should you follow after receiving a notice of default?

Immediate action is crucial after receiving a notice of default to avoid further complications.

-

Contact your lender to discuss the issue and explore options.

-

Legal professionals can provide guidance and help navigate your options.

-

Keep records of all communications and payments to support your case.

When can defaults be removed?

Understanding when and how defaults can be removed is crucial for anyone who receives a notice of default.

-

Address the payment or issue cited in the NOD to seek its removal.

-

Consider timely communication with your lender and making payments.

-

Act swiftly and maintain records of all interactions for reference.

How can interactive tools assist in managing your notice of default?

Leveraging interactive tools, particularly those offered by pdfFiller, can streamline the management of your notice of default.

-

Easily fill out, store, and manage your Notice of Default forms in one location.

-

Maintain all relevant documents and communications to safeguard your rights.

-

Easily share documents and receive feedback, saving time and confusion.

How do you finalize your notice of default document?

The finalization of your Notice of Default document is the last step before submission, and it needs careful attention.

-

Proofread the document to catch any errors before signing.

-

Utilize electronic signatures for a quick and legally binding process.

-

Use pdfFiller's cloud storage to access your documents anywhere.

How to fill out the notice of default for

-

1.Open pdfFiller and log in to your account.

-

2.Select the option to create a new document and search for 'Notice of Default'.

-

3.Choose a template that fits your needs and open it.

-

4.Fill in the borrower's full name and address at the top of the form.

-

5.Enter the lender's information next, including name and address.

-

6.Specify the loan details, including the loan number and date of default occurrence.

-

7.Indicate the total amount due and any additional fees or charges.

-

8.Review all entered information for accuracy and completeness.

-

9.Add any required signatures, including the lender's representative if necessary.

-

10.Save the completed document and choose to download or send it directly from pdfFiller.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.