Last updated on Feb 20, 2026

Get the free Health Insurance Claim for Workers' Compensation template

Show details

This is one of the official workers' compensation forms for the the state of South Carolina

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

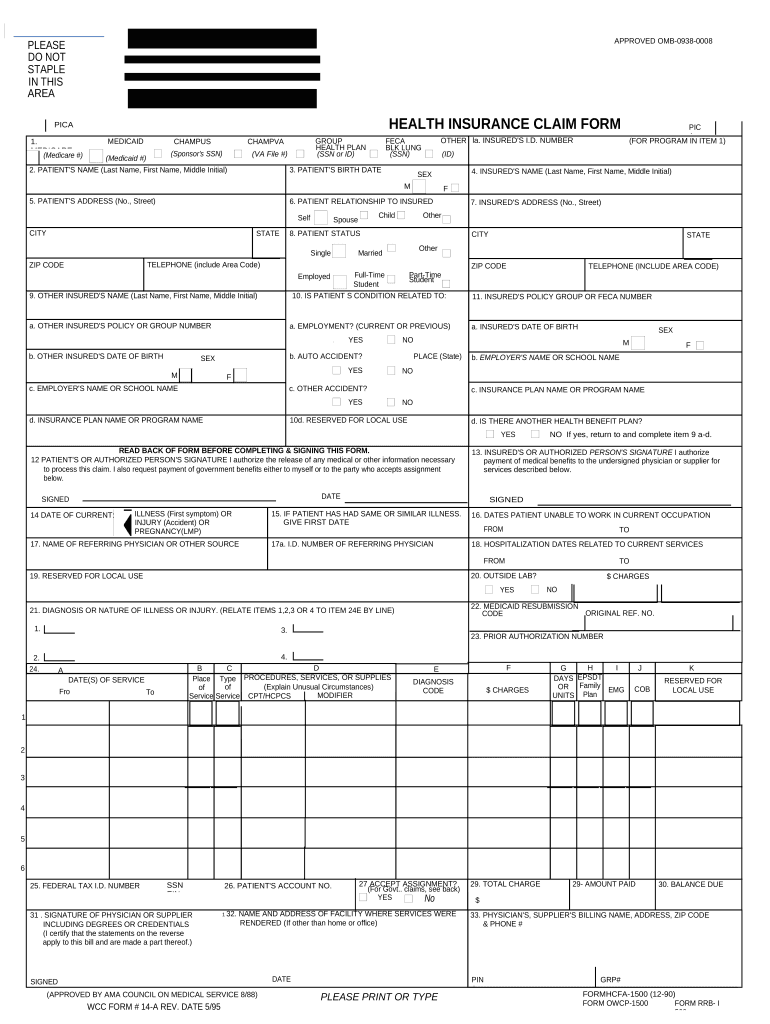

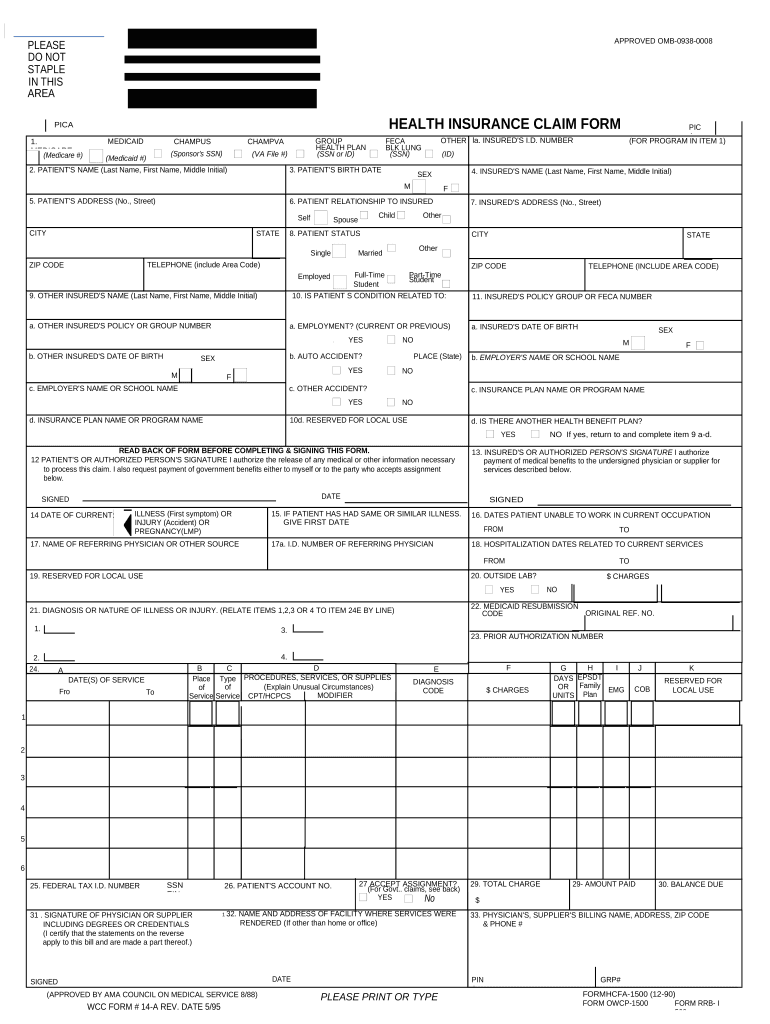

What is health insurance claim form

A health insurance claim form is a document used by policyholders to request reimbursement for medical expenses covered by their health insurance plan.

pdfFiller scores top ratings on review platforms

This program is very easy to follow, yet I would still like to know more. And I need to know how to use is on my other office compute

I love that I can get support when I need it through chat.

Is good but would be nice to be able to move a text box once its created and has text

Nice applications, sometimes doesn't move real smoothe from one blank to the next if you do not need to fill in for that one it seems to get stuck and has a lag, but over all, nice program.

It is an easy to use program.. Unfortunately, I do not have an ongoing use for it.. I only needed a one time form...

Great so far. Confused a bit as to the # of documents that I can store versus folders.

Who needs health insurance claim for?

Explore how professionals across industries use pdfFiller.

Filling Out the Health Insurance Claim Form on pdfFiller

What is a health insurance claim form?

The health insurance claim form is a document that you need to file with your health insurance provider to receive reimbursement for medical expenses. Understanding this form is crucial as accurate submission can significantly reduce delays in processing your claims. Familiarizing yourself with common terminology, such as copay, deductible, and coinsurance, can also aid in accurately completing the form.

How do navigate the health insurance claim form fields?

Navigating the health insurance claim form requires attention to detail and understanding of several key fields. Each section has specific requirements, including patient information, insured information, and claim details. For example, ensuring correct entries in the patient's information section, including name, birth date, and address, is imperative for a successful claim.

-

This section includes basic details such as the patient’s full name, birth date, and address.

-

Fill out the information of the insured, including their relationship to the patient and the insurance ID number.

-

Provide information on the medical condition, confirming if it relates to employment and any other insurance plans.

How can complete the form step by step?

Completing the health insurance claim form involves several steps. Each section will need specific data from the patient and the insured, so it's important to gather all necessary information beforehand.

Section 1: Patient Information

-

Ensure the name matches official records.

-

Accurate details help to verify identity.

-

Clarify how the patient is related to the person holding insurance.

Section 2: Insured's Information

-

These should correspond with the insurance records to prevent claims denial.

-

This is crucial for the insurance company to process claim requests correctly.

Section 3: Claim Details

-

This can influence coverage and claims processing.

-

Multiple insurance plans must be disclosed to determine primary coverage.

-

A clear description helps in validating the claim.

Section 4: Signatures

-

Make sure to sign in the designated area to validate the claim.

-

Informed consent is needed for the release of information.

-

A missing signature can lead to immediate claim rejection.

What common mistakes should avoid when filing the claim?

Common errors such as typos in personal information, missing signatures, or incorrect claim details often lead to claim rejections. Taking the time to double-check information before submission can prevent unnecessary delays. Always keep copies of submitted claims for your records, as they can be useful for follow-ups.

-

Ensure that all sections are filled out completely.

-

Reviewing your form thoroughly can save time.

-

This aids in tracking and managing future inquiries.

How can check and manage my claim status?

After submitting your claim, you can track its status using the tools provided by your insurance company. If you encounter issues, always reach out for assistance. Moreover, pdfFiller offers document management features that allow you to update and retrieve documentation effectively, making the entire process smoother.

-

Utilize online claim status tools or customer service hotlines.

-

Consider contacting your insurance provider directly.

-

Efficiently organize and manage your forms with pdfFiller.

What are the benefits of integrating pdfFiller's solutions into your document workflow?

PdfFiller streamlines the process of filling out forms and managing documents, ultimately saving you time and enhancing productivity. The editing and eSigning features simplify the process of document management from any location. With cloud-based solutions, you can seamlessly collaborate with others on the same document, ensuring a smooth workflow.

-

Facilitates quick edits and secure signatures, making form completion easier.

-

Access your documents anytime, anywhere, enhancing flexibility.

-

Integrated tools improve efficiency and reduce the likelihood of errors.

How to fill out the health insurance claim for

-

1.Download the health insurance claim form from the insurance provider's website or access it through pdfFiller.

-

2.Open the form in pdfFiller and review the required fields.

-

3.Fill in personal information including name, address, and date of birth as the patient.

-

4.Provide details of the insurance policy, including the policy number and group number if applicable.

-

5.List the details of the medical services received, including dates, providers' names, and service codes.

-

6.Attach any required documentation such as invoices, receipts, and explanation of benefits from the insurer.

-

7.Review the filled form for accuracy and completeness before submitting.

-

8.Submit the claim electronically through pdfFiller or print and mail it to the insurance company as directed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.