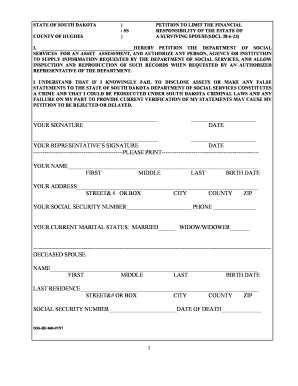

Get the free South Carolina Installments Fixed Rate Promissory Note Secured by Residential Real E...

Show details

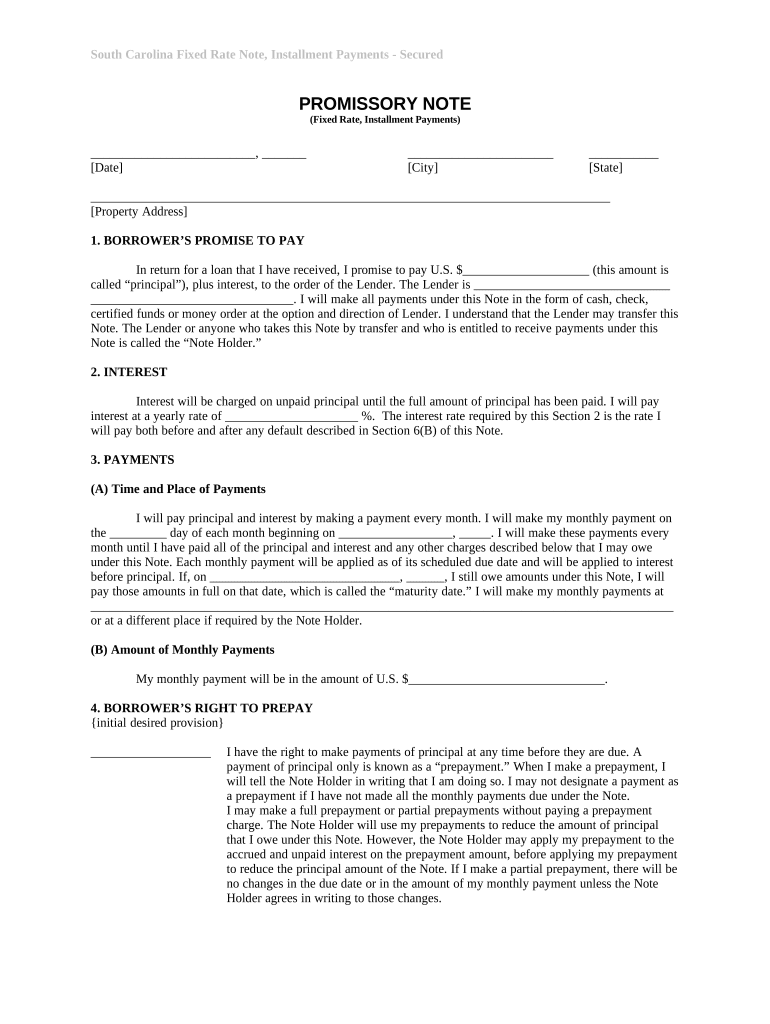

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is south carolina installments fixed

South Carolina installments fixed refers to a legal document or agreement that outlines specific terms for installment payments in the state of South Carolina.

pdfFiller scores top ratings on review platforms

Overall a great product

Overall very easy to use, tools are easy to manage and it's great at converting PDF to Word.

It is a little expensive but other than that, no issues.

A Great Time Saving Tool

This software is a great time-saving tool in that it allows me to fill in, search, and edit forms and send them electronically within minutes. That way, I don't have to manually hand write information the form, then scan them (or mail them) and wait for recipients to respond. The software basically digitizes the workflow process, which saves me a lot of time.

The software is limited to specific industries and the forms and features that these industries use. Therefore, not all forms and features are fully applicable to our company so we can't take advantage of them.

Great tool

PDF filling out can be tricky so I always use PDF filler No printer or scanning needed

Nada no complaints all is what it is meant to be

Excellent

Ease of use. Very efficient use of my time. Streamlines workflow.

Some challenge getting used to the location of screens/options.

PDFs

PDF filler is the best form filler software I have ever used.

All PDF software has really helped me protect my work for alterations,and copyright violations.I can also fill out forms with ease,and print them out

it was great,there were no flaws,or issues using the software.

Happy User

we have accidentally deleted some forms and we couldn't find it, but our overall experience is great

easy to create a fillable forms and let our clients to fill

need to pay upgrade to get certain function, like just directly download the filled form from my clients

Who needs south carolina installments fixed?

Explore how professionals across industries use pdfFiller.

Complete Guide to South Carolina Fixed Rate Installment Payments

How to fill out a south carolina installments fixed form form

To fill out a South Carolina installments fixed form form, begin by clearly entering the borrower's and lender's information, followed by specifying the loan amount and interest rates. Then, establish a payment schedule and detailed terms for how repayments will be structured. Ensure that all sections are completed accurately to avoid potential disputes.

What are the South Carolina fixed rate note installment payments?

The South Carolina fixed rate note installment payments refer to a loan structure where the borrower agrees to repay the principal plus interest in equal installments over a predetermined period. This format provides predictability in budgeting for borrowers while securing lenders by defining the repayment terms.

-

Fixed Rate Note: A contract that specifies the interest rate remains the same throughout the loan term, helping borrowers plan their payments effectively.

-

Secured Promissory Note: A legal document that outlines the borrower's promise to repay the loan, often backed by collateral.

-

Key components include principal amount borrowed, the agreed interest rate, and specific payment terms that dictate how often payments are due.

How do draft my fixed rate note?

Drafting a Fixed Rate Note involves several steps to ensure all vital information is captured correctly. It starts with entering the borrower's information including their name, address, and the date of signing. Following this, the lender's information must be accurately entered to formalize the agreement.

-

Be clear when entering borrower information to avoid confusion in identity.

-

Detail the loan amount and specify the agreed-upon interest rates to solidify expectations.

-

Review the document for any missing information before finalizing.

What should know about creating a payment schedule?

Establishing a payment schedule is crucial for managing your loan efficiently. Setting monthly payment frequencies creates a structure and commitment that helps borrowers stay accountable. Identifying the exact due date of payments ensures that both parties agree on when installment payments are to be made.

-

Determine the frequency of payments and their due dates to cultivate a budgeting strategy.

-

Discuss factors like interest rates and loan amounts when proposing payment amounts.

-

Communicate regularly with the lender to confirm that payment arrangements are understood.

Why is understanding interest calculations important?

Understanding interest calculations is vital, as unpaid principal amounts incur interest, leading to higher overall costs if not managed properly. Familiarity with how interest rates are calculated can significantly impact payment plans, offering borrowers insights into how their payments are broken down.

-

Calculate interest accurately to avoid overpayment and financial distress.

-

Recognize the definition of default and its serious implications, which may include penalties and other legal actions.

How can manage my payment plan agreement effectively?

Effective management of a payment plan agreement involves consistent tracking of payment schedules. The implementation of strategies to remain current with payments, such as setting reminders, can prevent defaults or late fees. Keeping detailed records of payment history is equally important for transparency between the borrower and lender.

-

Utilize the features available on platforms like pdfFiller for document management and ease of access.

-

Maintain communication with the lender to address any issues or payment concerns.

Who benefits from using a South Carolina fixed rate note?

Individuals considering personal loans or structured payment plans can greatly benefit from using a South Carolina Fixed Rate Note. This is also advantageous for organizations wanting to formally establish debt repayment terms, ensuring clarity and legal protections for all involved parties.

-

Individuals needing clarity in loan agreements for personal use can specialize payment terms to fit their financial circumstances.

-

Organizations looking to maintain formal agreements can find these notes essential to uphold business integrity.

What are the advantages of having a well-structured payment plan?

Having a well-structured payment plan can minimize conflicts and misunderstandings between borrowers and lenders. Furthermore, a legally binding document can enhance security, ensuring that both parties are aware of their commitments and expectations.

-

Clear agreements promote better relationships and reduce disputes.

-

Improved financial planning and forecasting can be achieved through organized installment agreements.

What challenges might arise in drafting a payment plan agreement?

Drafting a payment plan agreement can present challenges, including common pitfalls that can lead to ambiguity or disputes. Familiarity with legal considerations and regulations specific to South Carolina can help avoid these pitfalls and ensure compliance with state laws.

-

Being aware of local regulations will bolster the validity of your agreements.

-

Utilize available resources in South Carolina for assistance and template development.

How to fill out the south carolina installments fixed

-

1.Access the PDF file for the South Carolina installments fixed form on pdfFiller.

-

2.Begin by entering your full name in the designated field at the top of the document.

-

3.Provide your current address, including city, state, and ZIP code, below your name.

-

4.Then, enter the name and contact information of the recipient or business you are entering into the installment agreement with.

-

5.Next, clearly outline the total amount due and specify the number of installment payments to be made.

-

6.Fill in the amount for each installment payment, making sure to include any interest or additional fees if applicable.

-

7.If required, input the payment due dates for each installment, ensuring they are reachable and realistic for your budget.

-

8.After completing all fields, review the document thoroughly for accuracy.

-

9.Once verified, save the document and go to the option to share or submit it as required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.