Get the free Salary Verification for Potential Lease template

Show details

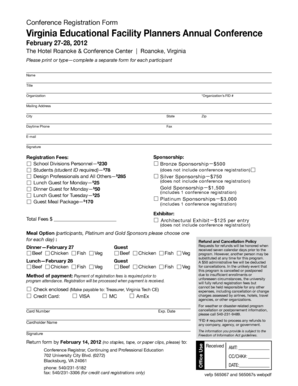

This Salary Verification form for Potential Lease is a form to be sent to a potential tenant's employer, in order for the Landlord to verify the lease applicant's income as reported on an application

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is salary verification form for

A salary verification form is used to confirm an individual's income and employment status for various purposes such as loan applications or rental agreements.

pdfFiller scores top ratings on review platforms

It provided me what I needed

Good

I am learning to navigate and have used this product twice. I am pleased thus far.

Please remember commun users like me, that we live in south american countries, without too much incomes. Stay with a free option

I have none

No comments

Who needs salary verification for potential?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide on Salary Verification Form for Lease or Loan

How to fill out a salary verification form?

Filling out a salary verification form involves gathering necessary information about your employment status and income. Ensure to provide accurate details to avoid potential delays in lease or loan approvals. Utilize tools like pdfFiller to streamline the process, making it easier to submit your form.

Understanding the salary verification form

A salary verification form is a document used primarily by lenders or lessors to confirm a borrower's income and employment. This verification is essential for making informed decisions about loan approvals or lease agreements. Generally, the form becomes necessary when potential lessees or borrowers apply for financing or rental agreements.

-

It provides financial institutions the necessary proof that a borrower is employed and earns sufficient income to meet repayment terms.

-

This form protects lessors and lenders by ensuring applicants can afford rent or loan repayments.

-

It's typically required during the application process for loans, leases, or any financial agreements where income verification is critical.

Essential components of the salary verification form

Understanding the essential components of a salary verification form is crucial for accurate completion. Each section plays a pivotal role in verifying the applicant’s income and employment status, ensuring the information flows smoothly between the employer, lender, and the applicant.

-

This section identifies the employer responsible for providing the verification.

-

Here, identify the entity that will receive the completed verification for decision-making.

-

Clearly state the name of the applicant and ensure it aligns with their official documentation.

-

Include the date of hiring, current job title, and salary information to give lenders a complete income picture.

-

This section ensures that the employer has consented to release personal employment details to the lender.

Filling out the salary verification form: step-by-step instructions

Completing a salary verification form accurately is essential to prevent processing delays. Follow these step-by-step instructions to ensure all necessary details are filled correctly.

-

Make sure to provide accurate employer information, such as business name and contact information.

-

When detailing the applicant's information, ensure accuracy in job title, employment start date, and salary to prevent discrepancies.

-

This involves confirming that the name matches government-issued identification to avoid delays.

-

Make sure the authorization signatures are clear and any consent forms included to verify information are properly signed.

Best practices for submitting the salary verification form

Submitting the salary verification form promptly is crucial to maintain the pace of your loan or lease application. Follow these practices to make submission easier and more efficient.

-

Take advantage of pdfFiller’s platform for easy-to-use editing and form completion.

-

Always verify the correct address for submission and consider using certified mail for tracking purposes.

-

After submission, remind employers gently to expedite the process and alleviate any concerns from lenders awaiting verification.

Common mistakes to avoid on the salary verification form

Awareness of common pitfalls can save time and ensure a smooth verification process. Here are key mistakes to avoid when filling out the salary verification form.

-

Ensure all required fields are filled out to avoid unnecessary delays in processing.

-

Double-check all information to ensure it is current and matches the applicant’s official records.

-

Always secure proper consent from all parties involved to avoid legal issues or rejection of the application.

How pdfFiller enhances the form completion experience

pdfFiller simplifies the process of managing documents, including salary verification forms. With its range of features, users enjoy an enhanced experience that caters to their documentation needs.

-

Users can modify existing PDFs, adding or removing fields as necessary for their specific needs.

-

With integrated eSignature options, users can sign and send documents without printing them out.

-

Teams can work together in real-time, ensuring all necessary documentation is managed efficiently and shared across platforms.

Navigating compliance with salary verification forms

Compliance is critical when dealing with salary verification forms, as regional and industry-specific regulations govern their use. Understanding these rules ensures you remain within legal boundaries throughout the verification process.

-

Different regions have unique regulations regarding income verification; familiarize yourself with local laws to ensure compliance.

-

Real estate, automotive, and other industries may have specific guidelines regarding the use of salary verification forms.

-

Staying informed about changes in legislation helps maintain compliance, mitigating risks of data breaches or legal issues.

How to fill out the salary verification for potential

-

1.Open the salary verification form on pdfFiller platform.

-

2.Begin by entering your personal information such as your name, address, and contact details in the designated fields.

-

3.Fill in the employment details including your employer's name, address, and phone number.

-

4.Specify your job title alongside your employment start date.

-

5.Next, provide your current salary information, stating both base salary and any additional compensations, if applicable.

-

6.If required, include any bonuses or commissions you regularly receive.

-

7.Review all entered information for accuracy to ensure completeness.

-

8.Once satisfied, save your filled-out form to your device or use the platform's options to send it directly to the requesting party.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.