Last updated on Feb 17, 2026

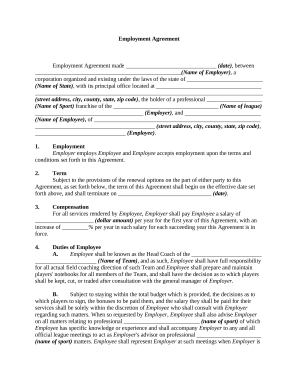

Get the free Tennessee Installments Fixed Rate Promissory Note Secured by Personal Property template

Show details

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is tennessee installments fixed rate

The Tennessee Installments Fixed Rate is a financial agreement that allows borrowers to repay a loan in fixed, regular installments over a specified period.

pdfFiller scores top ratings on review platforms

Eliminating so much wasted paper

Very good! Would highly recommend to any fast paced office

We have cut out paper usage in half since we started using this product! And by refusing our waste we also reduced our shredding fees

I haven't found anything to dislike yet. So far it's been a very positive experience and no complaints.

Reasonable but not fantastic

Pretty decent, I'm not sure it's the best PDF software available, but it's not bad and can complete most tasks you'd ask of it.

The software works for the most part well and allows the signing and creation of forms, handy for mild administrative use.

Support seems limited to live chat only, which is a bit of pain if something goes wrong. It could also do with a mobile app which I don't believe there is currently.

Great Service for the value

Great Service for the value. It has been extremely helpful for our small business. I only need the service for a short time during the year - our needs are perfectly met.Customer service has been exemplary - chats are responsive, gracious and perfect remedy for all my questions. Thank you pdfiller!

Great editing options and easy access…

Great editing options and easy access to sharing files and printing as well.

10 good

....................................................................................................

Worked well during trial, decent pricing.

worked well and the free trial was great. Definitely considering for future use and purchase!

Who needs tennessee installments fixed rate?

Explore how professionals across industries use pdfFiller.

Tennessee fixed rate installment note: A comprehensive guide

How does a Tennessee fixed rate note work?

A Tennessee fixed rate installment note is a crucial document for borrowers and lenders in Tennessee, providing clarity on repayment terms and legal obligations. This form outlines the borrower's promise to repay a specific amount borrowed over time at a fixed interest rate, ensuring that payments remain constant throughout the life of the loan.

What are the essential components of a fixed rate note?

-

The total amount borrowed, which remains unchanged unless modified through refinancing.

-

The fixed percentage charged on the principal amount, determining the total repayment amount.

-

The timeline and frequency of payments, typically monthly, specifying due dates and payment amounts.

Understanding these components helps borrowers recognize their financial commitments and ensure timely payments.

What essential information should you know about the form?

-

Fill in the date of the agreement, along with city and state where the document is executed, ensuring legitimacy.

-

Include the accurate address of the borrower, as it establishes legal residency and jurisdiction.

-

Always read the contract thoroughly before signing to understand obligations and avoid surprises.

What mandatory components should be in the promissory note?

-

The borrower's commitment to repay as stated, highlighting the seriousness of this legal obligation.

-

Detail the repercussions, such as late fees or potential foreclosure, emphasizing the need for timely payments.

-

Clarify terms like 'Note Holder' and 'Lender' to ensure all parties understand their roles.

How do interest rates affect your loan?

-

Typically calculated monthly on the unpaid principal, which may lead to higher costs if payments are delayed.

-

Fixed rates ensure stability, whereas variable rates can change, potentially increasing total repayment amounts depending on market conditions.

-

Tennessee law requires lenders to disclose annual interest rate specifics clearly, enabling better loan comparisons.

What is the payment structure and schedule like?

-

Clarify the exact amount due every month, making budgeting easier for borrowers.

-

Understand what happens once the loan matures, including any final payments required.

-

Document all payment methods accepted by your lender, ensuring a seamless transaction process.

How to fill out the Tennessee installments fixed rate form?

Filling out the Tennessee installments fixed rate form accurately is pivotal for a hassle-free loan experience. Start with a clear, step-by-step approach to avoid errors.

-

Review your information for correctness, especially address and financial details, as mistakes can lead to delays.

-

Be wary of potential pitfalls, like missing signatures or incomplete sections.

-

Utilize pdfFiller’s editing and signing tools to simplify the process and ensure all fields are filled.

How can pdfFiller support your document management?

-

Access your documents from any device with an internet connection, offering ultimate flexibility.

-

Share documents easily, making it simple for teams to work on loan processes together.

-

Sign documents securely, ensuring compliance with legal standards from anywhere.

What are the compliance considerations in Tennessee?

-

Compliance with Tennessee installment loan regulations is essential to avoid legal issues.

-

Certain disclosures must be provided by lenders, which helps borrowers make informed decisions.

-

Ensure that your promissory note complies with all state regulations, safeguarding against future disputes.

What recommendations exist for future borrowers?

-

Consider your financial situation and whether a fixed rate loan best suits your long-term goals.

-

Look into other financial products that might provide better terms or benefits.

-

Utilize advisory services or online resources to enhance your understanding of the loan landscape.

How to fill out the tennessee installments fixed rate

-

1.Open the PDF document for the Tennessee Installments Fixed Rate on pdfFiller.

-

2.Begin by filling in your personal information, including your full name, address, and contact details in the designated fields.

-

3.Provide the loan amount you wish to apply for, ensuring it matches your financial needs.

-

4.Input the desired repayment term, specifying the number of months for your installment plan.

-

5.Select the fixed interest rate option, and carefully review the rates offered to choose the most suitable one.

-

6.Fill in any additional required information, such as employment details or income verification information.

-

7.Review all entered information for accuracy before proceeding.

-

8.Once confirmed, sign and date the document at the bottom where indicated.

-

9.Finally, save your filled document and submit it as per the instructions provided or your lender's requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.