Get the free Estate Planning Questionnaire and Worksheets template

Show details

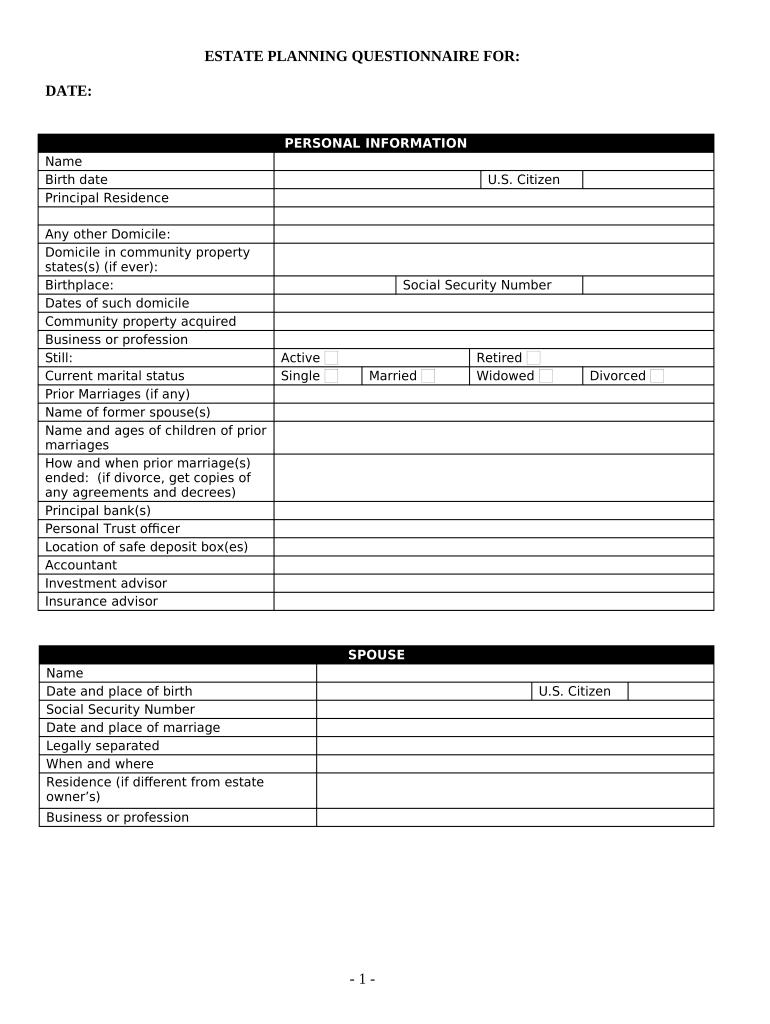

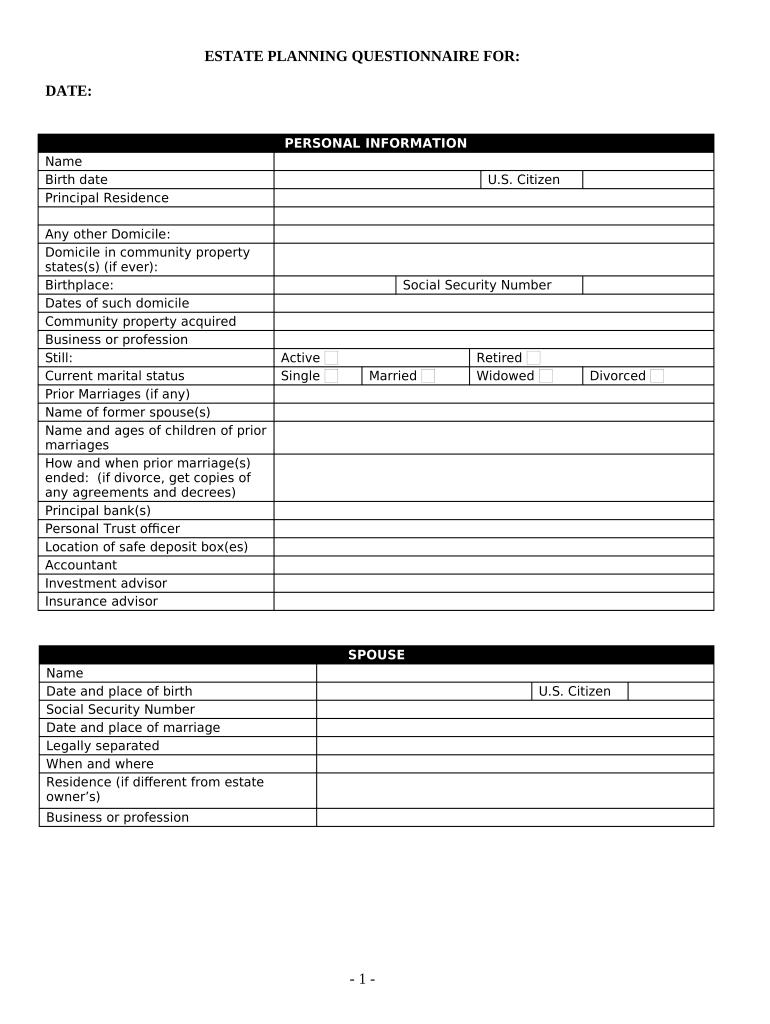

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is estate planning questionnaire and

An estate planning questionnaire is a tool used to gather information about an individual's assets, liabilities, and wishes regarding the distribution of their estate after death.

pdfFiller scores top ratings on review platforms

Great just do not need this service at this time

It works good even in the military helps a lot have told a bunch of people about it

Very useful tool. Now, I can do PDF files and manage them with a very comfortable interface.

Just signed up with PDFfiller and so far, I have learned a lot! Can't wait to learn the rest of the features to speed up my business and save time!

So far it's been great. Easy to navigate and a lot of useful functions.

Super easy to use. You should be able to change the folder in which you put downloads though..that is my only complaint.

Who needs estate planning questionnaire and?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to estate planning questionnaire and form form

How does estate planning work?

Estate planning is the process of arranging for the management and disposal of a person's estate during their life and after death. This involves the creation of wills, trusts, and other legal documents to ensure that your wishes are honored. The importance of estate planning cannot be overstated, as it helps prevent family disputes, reduces tax burdens, and provides peace of mind.

What is an estate planning questionnaire?

An estate planning questionnaire is a tool used to gather necessary information for creating an estate plan. It serves as a comprehensive form that helps individuals reflect on their assets, family dynamics, and final wishes. Using a questionnaire can streamline the estate planning process and ensure that important details are not overlooked.

Why use an estate planning questionnaire?

-

Enhances organization: Utilizing a questionnaire can help you organize your thoughts and documents, making the estate planning process smoother.

-

Identifies key components: It ensures you address all necessary components of your estate, including assets, beneficiaries, and fiduciaries.

-

Provides a helpful overview: The questionnaire offers a structured overview of your estate, allowing you to identify areas that require more attention.

How to gather personal information?

Filling out personal information fields on the estate planning questionnaire is crucial for documentation accuracy. Begin by including your full name and birth date. Additionally, note your principal residence and domicile, places of birth, and past residences. Accurate representation of your current marital status, alongside details about any prior marriages, is equally important.

Why document family structure and relationships?

-

Clarifies beneficiary designation: Documenting your family structure helps in clearly identifying beneficiaries, which can prevent future disputes.

-

Recognizes all forms of relationships: It allows you to accurately distinguish between biological, adopted, and step-children in your estate plan.

-

Fosters communication: Openly documenting familial relationships can promote family discussions about estate expectations and desires.

Who should be designated as beneficiaries and fiduciaries?

Designating beneficiaries and fiduciaries is a vital step in estate planning. Identify who will benefit from your will and assign roles such as executors, trustees, or guardians. When choosing fiduciaries, consider their reliability, willingness to serve, and understanding of your wishes to ensure smooth handling of your estate.

How to document gifts made during life?

-

Detail information: Record detailed information about gifts made during your lifetime, including the type and value of each gift.

-

Understand implications: It's important to recognize how these gifts may impact your overall estate planning strategy.

-

Consider tax implications: Be aware of tax implications related to significant gifts, especially if they exceed annual exclusion limits.

How to compile financial information and asset inventory?

Providing a detailed inventory of your financial assets is a cornerstone of effective estate planning. This includes detailing real estate holdings, types of properties, their values, and any associated mortgages. Listing investments such as stocks and bonds is equally imperative. Proper management and documentation of these assets contribute to a comprehensive estate plan.

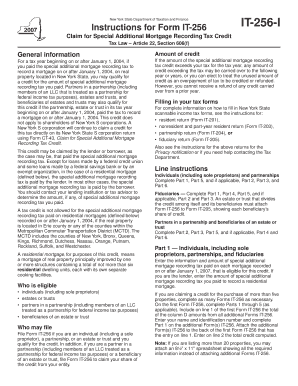

How to effectively use pdfFiller for estate planning?

pdfFiller enhances your estate planning experience by providing a seamless platform to fill out and edit your questionnaire. You can access the estate planning questionnaire online, securely fill out the information, and utilize the editing features to make necessary adjustments. Collaborating with family members or professional advisors is also simplified, ensuring that all voices are heard in your estate planning process.

What legal considerations should be kept in mind?

-

Understand local laws: Familiarize yourself with local legal requirements for estate planning, which may vary significantly by state.

-

Be aware of community property laws: If residing in a community property state, know how it impacts your estate planning.

-

Consult professionals: Consider consulting with attorneys and tax advisors to help navigate your estate planning, ensuring compliance with all legal factors.

What are the final steps to take?

Finalizing your estate plan involves reviewing all components and making necessary adjustments. Ensure that your documents are securely stored, accessible, and updated periodically. Regular reviews of your estate plan can reflect any changes in life circumstances, ensuring that your wishes remain current and accurately documented.

How to fill out the estate planning questionnaire and

-

1.Open the estate planning questionnaire on pdfFiller.

-

2.Begin by entering your personal details such as name, address, and contact information in the designated fields.

-

3.Provide information about your assets including real estate, bank accounts, investments, and other valuable possessions.

-

4.List any debts or liabilities that you currently have, as this will help in understanding your net worth.

-

5.Indicate your beneficiaries, specifying who will receive your assets and in what proportion.

-

6.Include your wishes regarding guardianship for any minor children, if applicable.

-

7.Consider adding any specific wishes regarding funeral arrangements or other personal requests.

-

8.Review all entries for accuracy and completeness, making sure nothing is overlooked.

-

9.Save the completed document on your device or submit it as instructed for further estate planning assistance.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.