Last updated on Feb 20, 2026

Get the free Angel Investment Term Sheet template

Show details

An angel investor or angel (also known as a business angel or informal investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is angel investment term sheet

An angel investment term sheet is a non-binding document that outlines the terms and conditions under which an angel investor intends to invest in a startup or early-stage company.

pdfFiller scores top ratings on review platforms

yes, but as a teacher, I find that this subscription fee will be too high for me to want to maintain. Any reduced rates for educators?

Thank you for allowing me to sign into a different machine. Please let this be a trusted machine as well.

Some things i needed to fill out individually which was very time consuming

a few little quirky things, but otherwise good

Somewhat easy to use with little guidance needed.

so far, so good. Still learning. pretty easy to use.

Who needs angel investment term sheet?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Angel Investment Term Sheet Creation

How does an angel investment term sheet function?

An angel investment term sheet functions as a preliminary agreement between a startup seeking funding and an angel investor considering the investment. Essentially, it outlines the essential terms and conditions of the investment and serves as a roadmap for the final, formal agreement. Understanding this document is crucial for both parties involved in the investment process.

-

A term sheet lays out key financial and contractual terms, including the amount to be invested and the equity stake offered.

-

The term sheet is vital as it sets the negotiation stage and forms the foundation for the investor’s future agreements.

-

The main participants typically include the company seeking funds, the angel investor providing capital, and possibly a lead investor facilitating the deal.

What are the key components of an angel investment term sheet?

Understanding the components of an angel investment term sheet is vital for both entrepreneurs and investors. This familiarity helps negotiate favorable terms and fosters a smoother investment process.

-

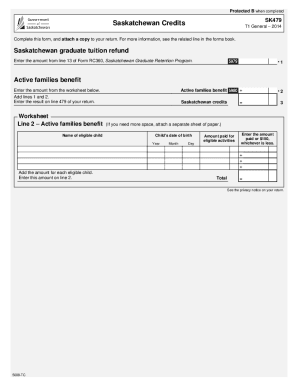

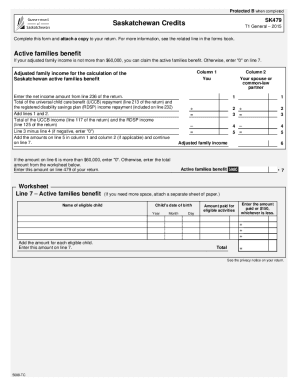

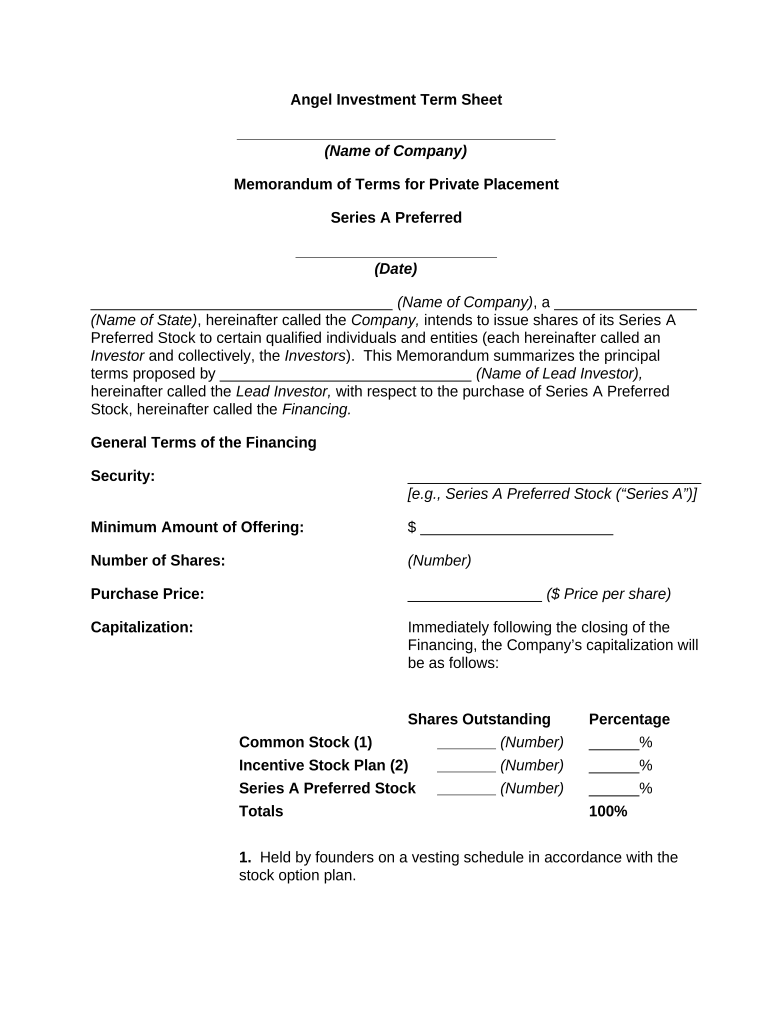

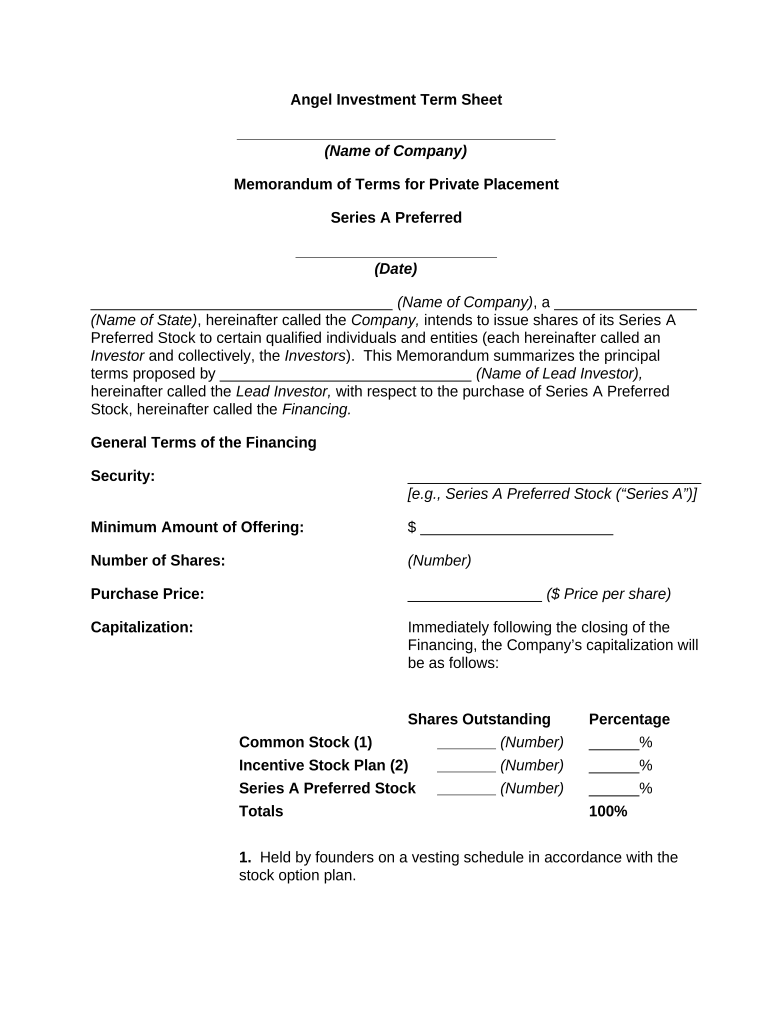

The term sheet begins with the company's name and the date, establishing the document's relevance.

-

It details the type of securities being offered, often in the form of Series A Preferred Stock, which provides certain privileges to investors.

-

The offering terms specify the minimum amount of investment required, the number of shares available, and the purchase price per share.

-

This outlines how the company’s valuation and ownership will change after the investment is completed.

-

Investors are granted specific rights, privileges, and preferences which may include voting rights and liquidation preferences.

How are offer terms broken down in an angel investment term sheet?

Understanding the offer terms in an angel investment term sheet is critical for both parties involved. A well-structured breakdown can simplify negotiation and pave the way for mutual agreement.

-

Dividends represent the earnings allocated to preferred stockholders, typically paid before common stockholders.

-

Liquidation preferences determine the order of asset distribution if the company is sold or liquidated, ensuring investors recoup their investments first.

-

A vesting schedule specifies when founders and employees gain full ownership of their shares, incentivizing commitment.

-

These plans provide options for employees to purchase shares at a fixed price, boosting their stake in the company.

How do you fill out the angel investment term sheet?

Filling out an angel investment term sheet requires precision and attention to detail to ensure all relevant information is accurately presented. A step-by-step approach is beneficial for both investors and entrepreneurs.

-

Investors should carefully follow the blank term sheet, filling out their details, including investment amount and desired terms.

-

The company’s information must be complete, including its legal structure and ownership.

-

Detail the financial terms, including the pricing of shares and the nature of the investment.

-

Clearly articulate the rights and preferences that will apply to the investors.

-

Utilize pdfFiller’s editing features to finalize and eSign the term sheet for quick approval.

What are the legal compliance and best practices for term sheets?

Legal compliance is crucial when dealing with angel investment term sheets. Ensuring that all provisions meet regulatory expectations is fundamental to avoid pitfalls down the line.

-

Term sheets must comply with laws governing securities and investments, including disclosure requirements.

-

Each region may have specific laws affecting the creation and execution of term sheets and investments.

-

Reviewing term sheets collaboratively with legal counsel and ensuring clarity in terms can significantly improve outcomes.

How can you navigate common challenges in angel investments?

Navigating challenges in angel investments requires a comprehensive understanding of the ecosystem. Being proactive in identifying potential red flags can safeguard interests.

-

Investors should be aware of any unusual terms or conditions that could signal problems within the startup.

-

Effective negotiation pertains to revising terms to create a mutually beneficial agreement.

-

Familiarizing oneself with investment terminology can alleviate misunderstandings and promote clarity.

How can pdfFiller assist in managing term sheets?

pdfFiller offers a robust platform for managing angel investment term sheets with features that enhance efficiency. This technology simplifies editing and storing term sheets.

-

Users can modify term sheets directly within the platform, allowing for personalization and accuracy.

-

The platform provides electronic signing capabilities, facilitating faster approvals and reducing delays.

-

pdfFiller supports collaboration among teams, making it easier for stakeholders to work simultaneously on documents.

How to fill out the angel investment term sheet

-

1.Open your PDF file containing the angel investment term sheet template in pdfFiller.

-

2.Review the document to understand required sections like the investment amount, valuation, and equity stake.

-

3.Begin by entering the name of the startup and the address in the designated fields.

-

4.Fill in the investor's name and contact information clearly.

-

5.Specify the amount of investment being offered by the angel investor.

-

6.Outline the valuation of the company in the appropriate section, ensuring that it aligns with the amount agreed upon.

-

7.Detail the equity ownership percentage that the investor will hold post-investment.

-

8.Include any special terms that apply, such as preferred shares or rights to future funding.

-

9.Review the terms for accuracy and completeness, ensuring all details are correct and reflect the agreement reached between the parties.

-

10.Once satisfied, save the document, and if applicable, share it with relevant parties for review before finalization.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.