Last updated on Feb 20, 2026

Get the free 497328230

Show details

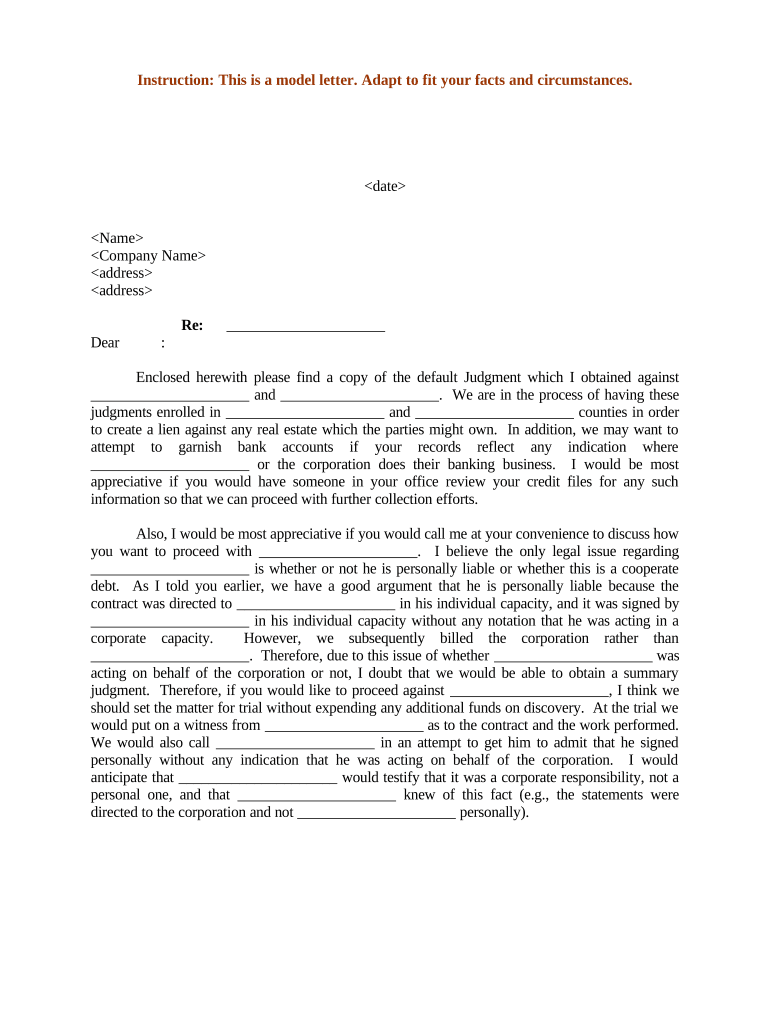

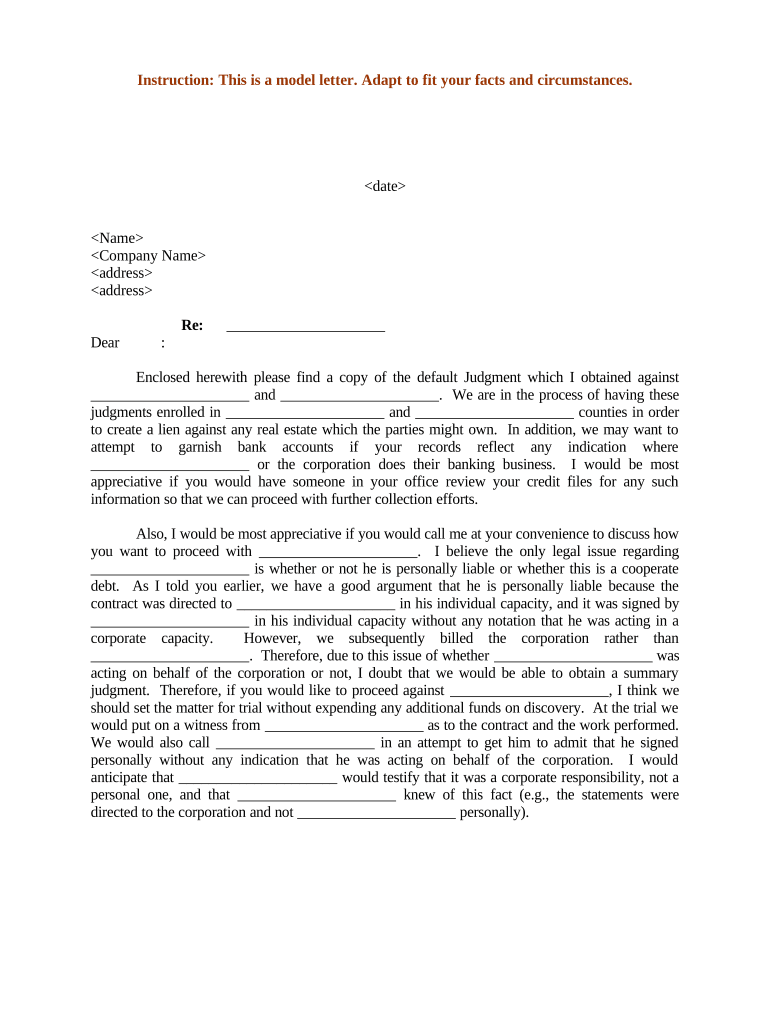

This form is a sample letter in Word format covering the subject matter of the title of the form.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sample letter for collection

A sample letter for collection is a template used to request payment for overdue debts in a professional manner.

pdfFiller scores top ratings on review platforms

IT IS VERY FRIENDLY AND EASY TO USE. i LIKE IT

It works great. Only thing is how can I use another claim for the same clients with different dates?

Quickly created my document and now I have the appropriate paperwork for my business. Well worth the time and investment.

Makes working on the road and being away so convenient - personally and business.

IT IS REALLY FRIENDLY TO USE THE PROGRAM AND EASY

Love Pdffiller due to the great convenience of creating templates and using them anytime, from anywhere.

Who needs 497328230 template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Crafting a Sample Collection Letter using pdfFiller

Filling out a sample letter for collection form form can seem daunting, but with the right guidance, you can create a powerful, effective communication tool for your debt recovery efforts. This guide will walk you through the essential components and considerations for drafting your collection letter.

What is the importance and purpose of collection letters?

A collection letter serves a crucial role in the debt recovery process by formally notifying individuals or businesses of outstanding debts. It not only reminds debtors of their obligations but also provides a record of communication. The legal implications of sending a collection letter are significant, as it can affect your ability to pursue further legal action if necessary. Effective communication in these letters can enhance recovery efforts.

-

They are formal documents requesting payment from debtors, providing a clear reminder of unpaid amounts.

-

Sending a collection letter involves specific regulations that must be adhered to, especially under the Fair Debt Collection Practices Act.

-

Well-crafted letters can significantly improve the chances of receiving the owed amounts by establishing professionalism.

What are the key components of an effective collection letter?

An effective collection letter includes crucial components to convey clarity and urgency regarding the payment. Start with a clear introduction that states the purpose of the letter and identifies the debt in question. Including details of any judgment and the necessary call to action is essential for an impactful communication.

-

State the letter’s purpose and clearly identify the debt owed.

-

Include important information regarding any legal actions taken, so the debtor understands the seriousness of the situation.

-

Encourage the recipient to communicate their banking information or mention any potential assets.

-

Encourage a response to discuss the debt further and establish a dialogue.

How can you optimize your collection letter with strategic communication?

The tone and clarity of your wording can significantly influence the effectiveness of your collection letter. A professional tone combined with clear, concise language asserts authority, while personalized elements help to engage the recipient, making them feel valued.

-

A respectful yet firm tone ensures the recipient feels compelled to respond positively.

-

Incorporating appropriate legal terminology can enhance professionalism and seriousness.

-

Adding personal touches, such as the debtor's name, fosters a connection and increases response rates.

How can you adapt a model collection letter?

Customizing a collection letter based on specific situations can make it more effective. Providing a template allows users to adjust content to fit their unique circumstances, whether dealing with personal or corporate debts.

-

Start with a structured template that can be filled with personalized information.

-

Adapt the tone and content based on whether the debt is personal or corporate.

-

Give concrete examples of how to modify the template for different cases.

What are best practices for sending your collection letter?

The method of delivery can impact the effectiveness of your collection letter. Best practices include choosing the right method, be it mail or email, and outlining a timeline for follow-ups to ensure the debtor knows the importance of a timely response.

-

Consider both physical mail and email, along with their respective benefits and drawbacks.

-

Establish a clear timeline for follow-ups post-sending to maintain communication.

-

Keep meticulous records of all communications to facilitate follow-ups and legal processes if necessary.

How can interactive tools on pdfFiller assist in letter creation?

pdfFiller provides extensive features that streamline the process of drafting collection letters. Users can edit templates intuitively, utilize eSignature capabilities, and collaborate with team members effectively to ensure the letter meets all necessary specifications.

-

Easily manipulate models to fit individual needs, saving time and enhancing productivity.

-

Digital signatures expedite the agreement process, making it more efficient to finalize deals.

-

Teams can work together on documents to better manage letter creation and ensure conformity.

What potential legal issues should you navigate in collection letters?

Understanding the legal landscape of collection letters is essential. Common pitfalls can include violating the Fair Debt Collection Practices Act, which establishes strict guidelines for creditor communication. It is also crucial to remain aware of personal liability issues that may arise from non-compliance.

-

Be cautious of language that could be perceived as threatening, which can lead to legal consequences.

-

Understand the ramifications that may arise from communications to individuals who are not the debtors.

-

Seek professional guidance to ensure adherence to legal standards throughout the process.

How can you analyze responses to collection letters for continuous improvement?

Tracking responses to your collection letters allows for an understanding of what elements work best. Regularly revising templates based on feedback will ensure that your communication evolves effectively over time.

-

Implement a system to log responses to identify which elements trigger good results.

-

Use feedback to continually refine and improve the effectiveness of your letters.

-

Stay alert to trends in responses and adapt your strategies accordingly to maximize recovery.

How to fill out the 497328230 template

-

1.Open pdfFiller and upload the sample letter for collection template.

-

2.Fill in your name and contact information at the top of the letter.

-

3.Enter the recipient's name and address, ensuring correct formatting.

-

4.Include the date when the letter is being sent.

-

5.Clearly state the amount owed and the due date in a prominent section.

-

6.Provide a brief explanation of the services or products for which payment is due.

-

7.Incorporate any previous communication details related to the debt for context.

-

8.Add a polite but firm request for payment, specifying acceptable payment methods.

-

9.Include a due date for the payment along with any consequences for non-payment.

-

10.Conclude with your signature and printed name, then save the document.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.