Last updated on Feb 20, 2026

Get the free pdffiller

Show details

A form is where the Seller has agreed to accept a promissory note as payment of the earnest money.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is earnest money promissory note

An earnest money promissory note is a written promise to pay a specified amount of money as earnest money, typically associated with a real estate transaction.

pdfFiller scores top ratings on review platforms

Easy to use this powerful tool to edit…

Easy to use this powerful tool to edit the PDF online.

It did what I needed and it was a 1x…

It did what I needed and it was a 1x need, so thanks.

user friendly

user friendly

Efficient and easy to use.

Efficient and easy to use.

nice tool touse

nice tool touse

My experience has been ease-of-use. The only reason for 4 stars is I can't find a way to make it my default pdf program. Thanks

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

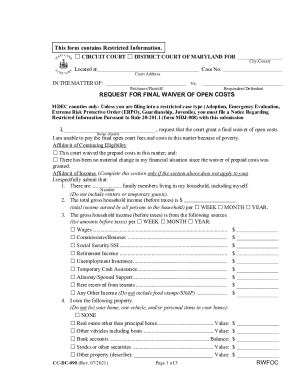

How to fill out an earnest money promissory note form

What is an earnest money promissory note?

An earnest money promissory note is a financial agreement used in real estate transactions that provides assurance of the buyer's intent to purchase a property. It acts as a binding commitment, indicating that the buyer is serious about the purchase and willing to place a deposit, known as earnest money, to signify their sincerity.

This note serves the dual purpose of outlining the amount of earnest money provided and acting as a promissory note, which details the terms under which the buyer commits to the transaction. Understanding this financial document is crucial for all parties involved in the real estate process.

Why use an earnest money promissory note in real estate?

-

It provides peace of mind to sellers that the buyer is committed to proceeding with the transaction.

-

Defines the amount of money at stake, alongside terms that govern its use, ensuring both parties are on the same page.

-

Can be altered as needed, allowing for flexibility in negotiations during the home buying process.

What are the key components of the promissory note?

-

Protects both parties by marking when the agreement was made.

-

Identifies all parties involved clearly to avoid confusion.

-

Specifies how much money is being put down and any interest rates applicable.

-

Outlines any conditions for when and how the money can be refunded, which is critical if the deal falls through.

-

Legally binds all parties involved, making their commitment enforceable in court.

How can you fill out the earnest money promissory note?

Filling out the form requires careful attention to detail as each field must be accurately completed to avoid potential disputes.

-

Start by entering the date, then the parties' names and their respective addresses.

-

Clearly state the earnest money amount and interest rates if applicable.

-

Detail the repayment options and ensure all parties sign the document.

Be sure to double-check for common mistakes, like missing signatures or incorrect amounts, to ensure the document is binding.

How to edit and customize your earnest money promissory note?

Utilizing pdfFiller’s tools, users can modify the template efficiently. This includes adjusting text, adding additional clauses, and making sure the document reflects the required terms accurately.

-

pdfFiller allows multiple users to work on the document simultaneously, streamlining the signing process.

-

Documents can be saved and exported easily, ensuring all versions are securely stored for future reference.

Why is signing the note important?

Signing the earnest money promissory note is crucial, as this legally formalizes the agreement between both parties. The use of electronic signatures is increasingly popular and aligns with state laws regarding eSigning, making the process faster and more efficient.

-

Using eSigning features on platforms like pdfFiller ensures compliance with legal requirements in most jurisdictions.

-

The digital signing process saves time and reduces reliance on physical documentation.

How to manage your agreement effectively?

Managing your earnest money promissory note effectively includes securely storing documents and tracking any changes.

-

Use pdfFiller to keep all related documents in one cloud-based location to enhance accessibility.

-

Utilizing reminder features can help ensure that all payment deadlines are met.

Additionally, staying updated with alterations or amendments will help maintain an accurate understanding of obligations.

How to fill out the pdffiller template

-

1.Begin by downloading the earnest money promissory note template from pdfFiller.

-

2.Open the downloaded PDF document in pdfFiller's editor.

-

3.Fill in the date at the top of the document to indicate when the note is being created.

-

4.Enter the buyer's full name and address in the designated fields to identify the person making the promise.

-

5.Provide the seller's full name and address to ensure proper identification of the property seller.

-

6.Specify the amount of earnest money being pledged in the section labeled ‘Amount’ and ensure it is clearly written.

-

7.Include any relevant terms regarding the payment schedule or conditions for the earnest money.

-

8.Review all entered information carefully for accuracy to avoid future disputes.

-

9.Sign the document at the bottom, ensuring that the signature matches the name of the buyer.

-

10.Save the completed document and send it to the relevant parties involved in the transaction.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.