Last updated on Feb 17, 2026

Get the free Personal Guaranty - General template

Show details

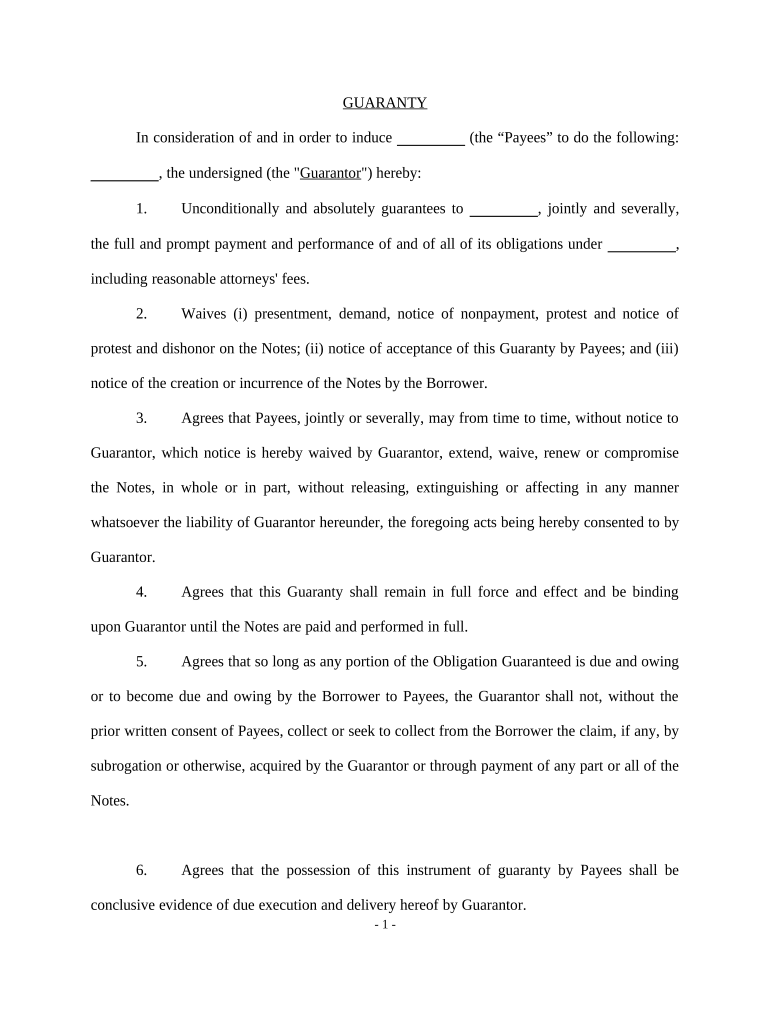

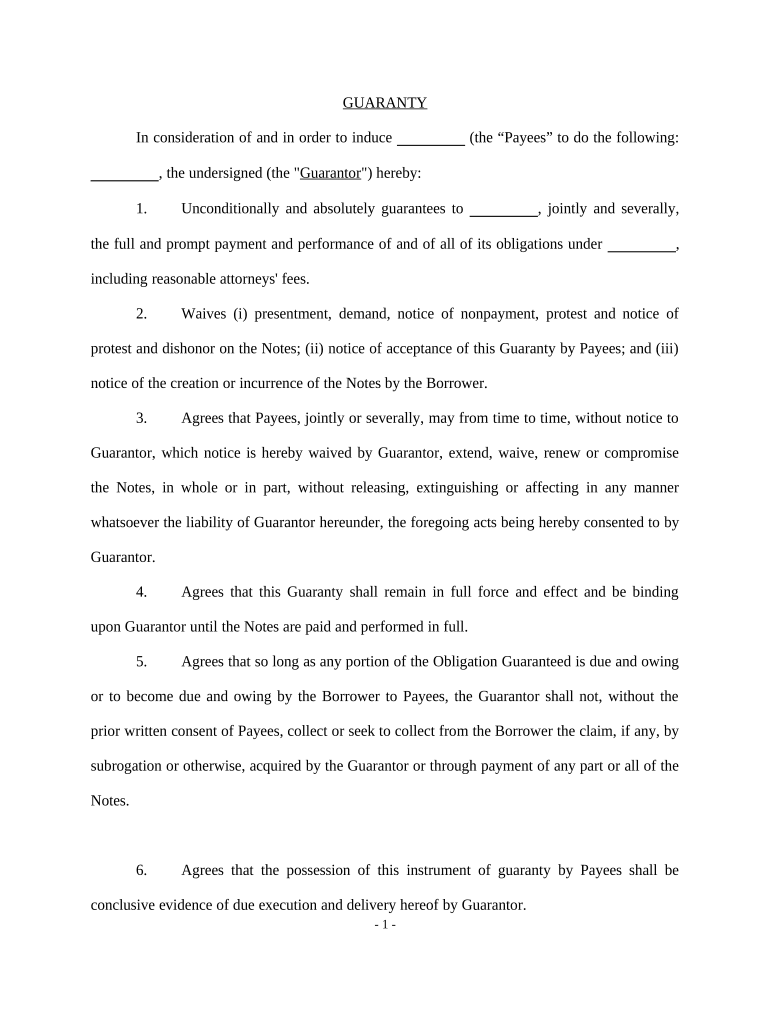

This form is a Guaranty. The form provides that the guarantor assures the full and prompt payment of all obligations incurred by the payor.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is personal guaranty - general

A personal guaranty - general is a legal document in which an individual agrees to be responsible for the debt or obligation of another party if that party fails to meet their financial commitments.

pdfFiller scores top ratings on review platforms

So far this seems like a very cool however i don't know if it has a feature i am looking for.

been great, no issues

It's been good so far. Thank you

Nice so far!!!

it was what i was looking for a one time

I would like unsubscribe this transaction

Edit and create PDFs easily

If you work daily with PDF documents, this is a must for you

It has a lot of PDF Tools in one on the cheapest plan

Maybe they can unify the first and mid tier plans. They don't add a lot to the mid tier plan to increase the price. It just don't worth it

Who needs personal guaranty - general?

Explore how professionals across industries use pdfFiller.

How to fill out a personal guaranty - general form form

What is a personal guaranty?

A personal guaranty is a legal commitment made by an individual (the guarantor) to repay another person's debt in case of default. This form is crucial in various financial agreements, especially when businesses seek loans or credit. The importance of a personal guaranty in financial transactions cannot be overstated, as it provides lenders with an added layer of security.

-

A personal guaranty legally binds an individual to fulfill someone else's obligation if that person fails to do so.

-

By signing a personal guaranty, the guarantor increases the likelihood of obtaining financing, particularly for new businesses.

What are the key components of a personal guaranty form?

A well-structured personal guaranty form includes several core components that dictate the obligations of the guarantor. Each of these elements is essential for understanding the terms and conditions of the guaranty.

-

Clearly identify the guarantor and the recipients of the guaranty to prevent legal misunderstandings.

-

Detail the specific financial obligations that the guarantor is responsible for, including payment amounts and deadlines.

-

Include waivers of notice which can affect the guarantor’s rights concerning defaults.

-

Clarify the responsibilities that may be assigned to successors and assigns, ensuring obligations are transferable.

How do you fill out a personal guaranty form using pdfFiller?

Filling out a personal guaranty form can be simplified using pdfFiller's user-friendly platform. Follow this step-by-step guide to ensure accuracy and compliance with legal standards.

-

Access pdfFiller and upload your form. Fill out the required fields methodically, ensuring all information is accurate.

-

Make use of available editing tools and tips to enhance accuracy, including automatic field validators.

-

Utilize pdfFiller features to eSign the document easily, making the process secure and efficient.

-

Store and manage your personal guaranty forms securely in the cloud, ensuring easy access and organization.

What common mistakes to avoid when completing a personal guaranty?

Completing a personal guaranty form can seem straightforward, but there are several pitfalls that users should be aware of in order to avoid issues.

-

Always ensure that all required fields are filled in; missing information can lead to legal complications.

-

Take the time to understand the exact obligations being accepted before signing to avoid unforeseen liabilities.

-

Don't neglect to review any waivers of notice, as they impact your rights significantly.

-

Always double-check that signatures and dates are confirmed; failures in this area can invalidate the document.

What are the legal considerations and compliance issues?

Understanding the legal framework surrounding personal guaranties is essential. Different regions may have varying laws that affect how personal guaranties are enforced.

-

Learn about the specific legal requirements in your region that govern personal guaranties to ensure compliance.

-

Familiarize yourself with the necessary compliance measures in your jurisdiction to avoid potential legal pitfalls.

-

Engage with legal counsel before signing to navigate complex legal obligations and ensure your rights are protected.

Where can you find support and resources for personal guaranty users?

If you require assistance or additional resources regarding personal guaranties, pdfFiller provides excellent support for users.

-

Reach out to pdfFiller customer support for any issues concerning your personal guaranty form.

-

Explore comprehensive guides and FAQs on personal guaranties to aid in the filling process.

-

Find relevant contact information for legal consultations for personalized advice regarding your personal guaranty.

What are the liability and release terms?

When entering into a personal guaranty, it is crucial to understand liability and the terms regarding the release of those obligations.

-

Personal guarantors are fully responsible for the debt obligations outlined in the agreement.

-

Learn the conditions under which a guarantor can seek release from obligations and the procedural steps involved.

-

Not fulfilling the obligations may lead to serious financial and legal repercussions for the guarantor.

How to fill out the personal guaranty - general

-

1.Begin by downloading the personal guaranty - general template from pdfFiller.

-

2.Open the PDF document in pdfFiller's editor interface.

-

3.Locate the section for the guarantor's personal details and fill in your full name, address, and contact information.

-

4.In the next section, provide the details of the party whose obligations you are guaranteeing, including the business name and address.

-

5.Specify the amount or obligation you are guaranteeing; this can include a loan amount, lease, or service contract.

-

6.Review the terms of the guaranty to ensure you understand your responsibilities if the primary party defaults.

-

7.Sign and date the document in the designated areas, ensuring your signature matches your printed name.

-

8.Lastly, save the completed document and either print it for physical submission or share it digitally as required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.