US-01329BG free printable template

Show details

Bartering are agreements for the exchange of personal and real property are subject to the general rules of law applicable to contracts, and particularly to the rules applicable to sales of personal

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-01329BG

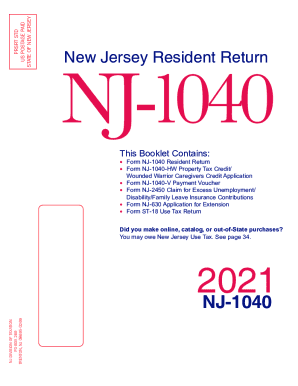

US-01329BG is a federal form used for reporting specific tax information to the Internal Revenue Service (IRS).

pdfFiller scores top ratings on review platforms

User Friendly Site!

I was thrilled to find a site that would allow me to modify PDF files. Furthermore, being able to save and share the files, once I modified them was extremely helpful. Overall, I found the whole site to be very user friendly.

A little trouble navigating at first

A little trouble navigating at first. Caught on OK

Awesome software to use

Awesome software to use, I just wish it wasn't so expense even for a light user!

Great way of editing PDF documents

Great way of editing PDF documents, quick easy

A little difficult to scroll

A little difficult to scroll, but easy to navigate and lots of tools.

It really does work

It really does work. Wish it would allow me to add pages from other PDFs, and move pages around. But it works!

Who needs US-01329BG?

Explore how professionals across industries use pdfFiller.

How to fill out the US-01329BG

-

1.Open pdfFiller and upload the US-01329BG form from your device or select it from your documents.

-

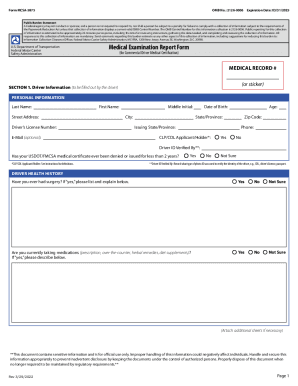

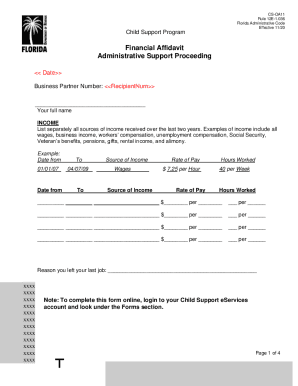

2.Begin filling out the form by entering the required personal information, including your name, address, and taxpayer identification number.

-

3.Proceed to the income section of the form. Carefully input all applicable income amounts and write detailed descriptions as necessary.

-

4.If applicable, fill in any deductions or credits that can be claimed, ensuring that you have the necessary documentation to support these claims.

-

5.Review the form for completeness and accuracy, making sure that all fields are filled out according to IRS guidelines.

-

6.Utilize pdfFiller’s tools to add digital signatures if required and to preview the finished form.

-

7.Once the form is completed and reviewed, save a copy of the filled US-01329BG for your records and follow instructions to submit it to the IRS.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.