Last updated on Feb 20, 2026

US-0144LTR free printable template

Show details

This form is a sample letter in Word format covering the subject matter of the title of the form.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

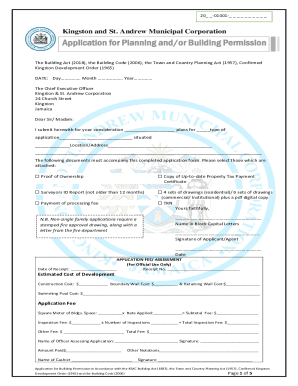

What is US-0144LTR

US-0144LTR is a document used for reporting certain tax information to the IRS.

pdfFiller scores top ratings on review platforms

ok cost me money so my daughter can go to school for scholarships

Needs to have more intuitive directions. Overall satisfied.

Easy to use, fantastic for all your fill in needs.

I'm amazed at how well it does with filling and editing. There are sooooo many features that I am still learning. Great product.

I really like working with this program I am do my trial version buy I will be purchasing this one its reliable.

Just getting started, but so far so good!

Who needs US-0144LTR?

Explore how professionals across industries use pdfFiller.

How to Complete the US-0144LTR Form

What is the US-0144LTR form?

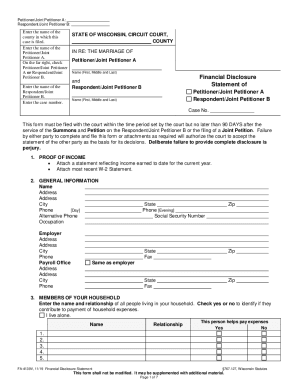

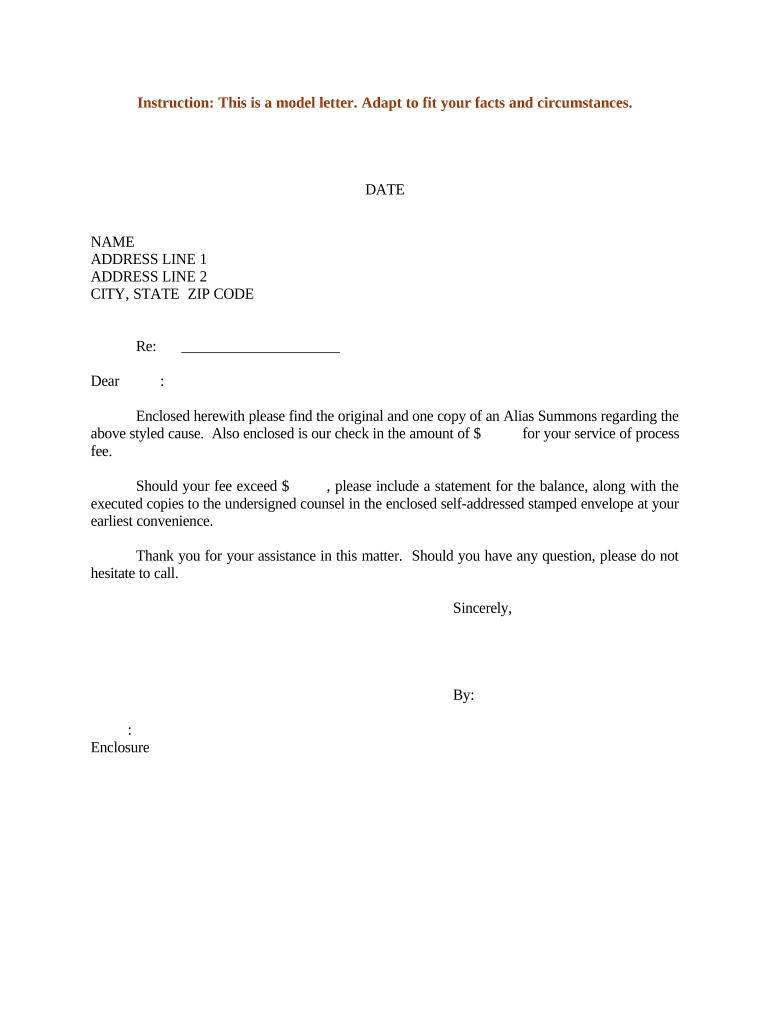

The US-0144LTR form is a legal document that facilitates communication between parties involved in a legal process. Its primary purpose is to ensure accurate service of process, which is crucial for upholding legal standards. Understanding this form and its requirements is essential for both individuals and legal professionals.

What are the key components of the US-0144LTR form?

-

Identify and enter the correct date of document submission to validate the process.

-

Accurately record the names of all parties involved, ensuring clarity and proper legal titles.

-

Follow guidelines for formatting address lines correctly, which helps avoid delivery issues.

-

Detail the subject line to specify the nature of the communication, assisting in immediate recognition.

-

Choose appropriate greetings based on the recipient to maintain formality in communication.

How do you fill out the US-0144LTR form step-by-step?

-

Enter the date accurately to prevent any legal complications due to improper submission timing.

-

Ensure you fill in the name with proper legal titles, which adds credibility and formality.

-

When adding address lines, avoid common pitfalls by double-checking formats to enhance clarity.

-

Draft an appropriate 'Re:' line to align with the formal expectations of legal correspondence.

-

Compose the body of the letter clearly, stating necessary information to avoid misunderstandings.

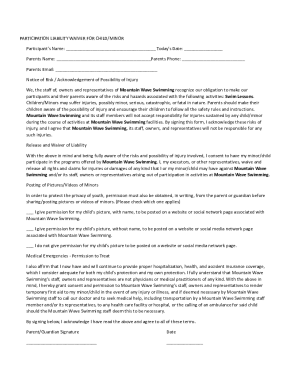

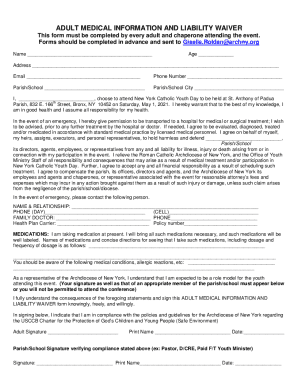

What standard content should you include in the US-0144LTR form?

-

Ensure all necessary documents are included to establish a complete and valid submission.

-

Clearly specify any payment amounts and conditions to avoid confusion over financial obligations.

-

Include essential elements of a formal signature to validate the document legally.

What common errors should you avoid?

-

Missing data can lead to legal repercussions; always verify complete entries prior to submission.

-

Understanding the proper format for dates and addresses is critical for clear communication.

-

Phrase requests and information clearly to prevent confusion and ensure the recipient understands intent.

What are best practices for managing the US-0144LTR form?

-

Using pdfFiller tools can streamline the process of editing and signing forms, making handling easier.

-

Keep digital copies for quick access and sharing, ensuring you never lose important documents.

-

Take advantage of cloud-based features for collaboration, helping maintain compliance and efficiency.

What additional considerations are there for filing the US-0144LTR form?

-

Timely filing is crucial; understand filing due dates to avoid costly delays and legal setbacks.

-

Follow specific instructions for sending or serving the form to ensure proper delivery.

-

Familiarize yourself with state-specific requirements for filing, as these can vary significantly.

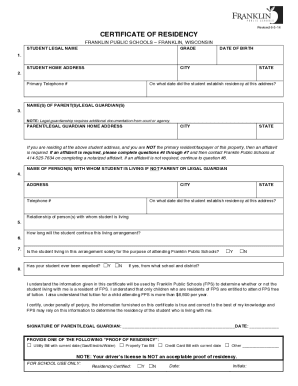

How to fill out the US-0144LTR

-

1.Open the PDF file of US-0144LTR in pdfFiller.

-

2.Start by entering your personal information including name, address, and taxpayer identification number (TIN) at the top of the form.

-

3.Move to the section that requires details about the income or deductions you are reporting; fill in the relevant fields accurately, ensuring all numbers are correct and formatted as required.

-

4.If applicable, provide any additional information requested in the designated areas, referring to any guidelines that may accompany the form.

-

5.Review all entries for completeness and accuracy, double-checking that no information is omitted or incorrectly filled.

-

6.Once satisfied, save your progress or print the completed form directly from pdfFiller before submitting it to the relevant IRS office.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.