Last updated on Feb 20, 2026

Get the free Irrevocable Trust Agreement for Benefit of Trustor's Children and Grandchildren temp...

Show details

A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the grantor departs

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is irrevocable trust agreement for

An irrevocable trust agreement is a legal document that establishes a trust that cannot be modified or terminated without the consent of the beneficiaries.

pdfFiller scores top ratings on review platforms

Very efficient and of good quality, which it had more of a variety of font sizes and style of writing, but overall great experience

PDFfiller is very easy to use and the auto-save feature works reliably. One thing that I didn't like was that I had to sign up for a plan to be able to save my pdf. Had I not chosen to sign up, I believe my work would have not been saved. What compelled me to sign up was that I didn't want to lose the work that I was doing. Overall, I think PDFfiller is a great tool and worth the money; however, some users may not like the mandatory payment in order to see their documents again.

Could be more user friendly finding documents. However, filling is easy. Slightly pricey.

Je suis très satisfaite du fonctionnement de PDFfille

PDFfiller has been a great tool for me, one of the best things is it saves all of my work

great program, fast and easy to use and learn

Who needs irrevocable trust agreement for?

Explore how professionals across industries use pdfFiller.

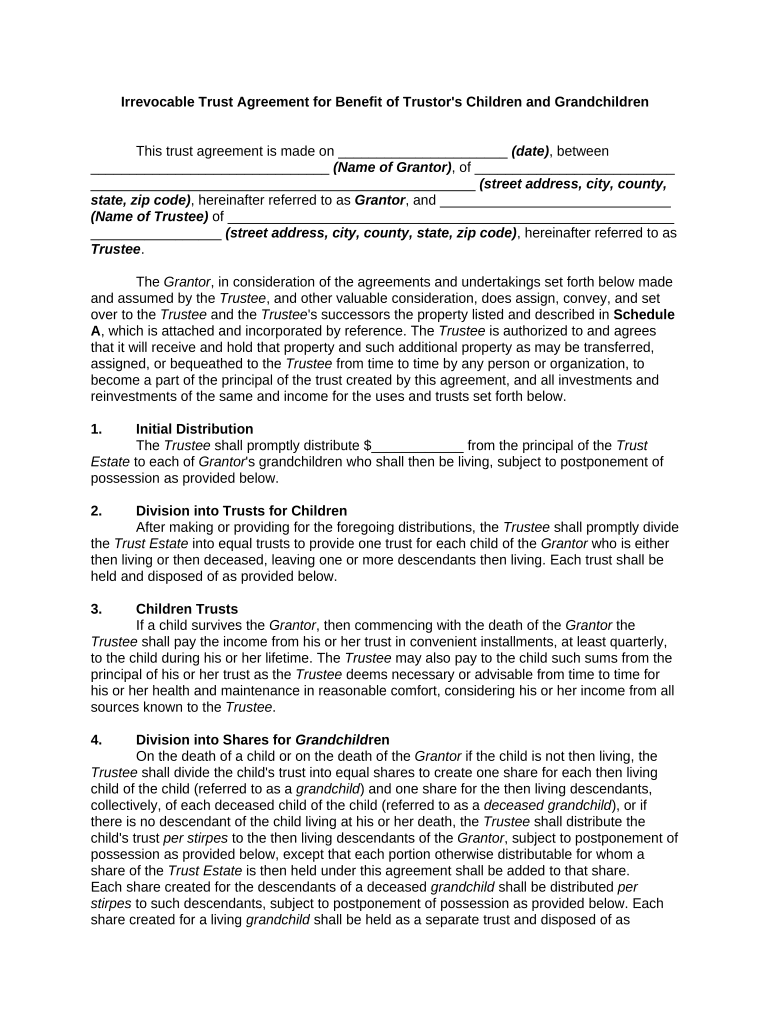

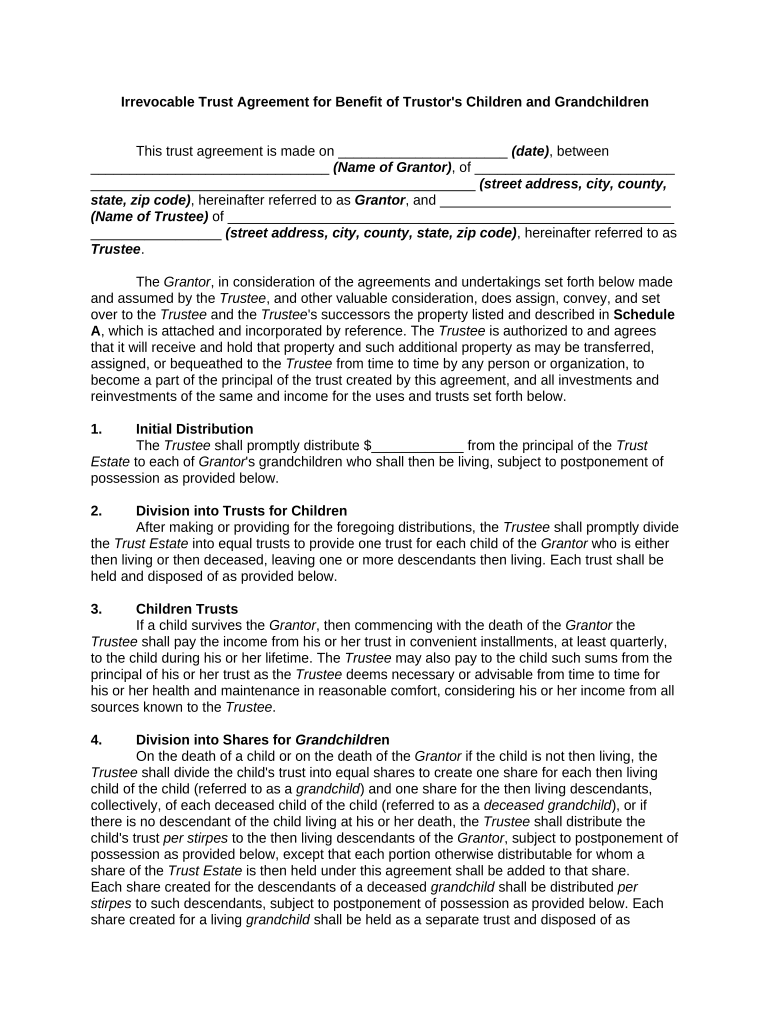

Understanding Irrevocable Trust Agreements

What is an irrevocable trust agreement?

An irrevocable trust agreement is a legal document that establishes a trust that cannot be modified or terminated by the grantor without the consent of the beneficiaries. This type of trust is often used for estate planning and asset protection because it removes ownership of the assets from the grantor, thus providing advantages like tax reduction and safeguarding assets from creditors.

-

An irrevocable trust is defined as a trust that, once established, cannot be altered or dissolved by the grantor, ensuring long-term protection of assets.

-

Unlike a revocable trust, where the grantor retains control and can amend it at any time, an irrevocable trust is permanently fixed, which offers certain legal and tax benefits but limits flexibility.

What are the components of the irrevocable trust?

An irrevocable trust consists of several critical components that ensure its proper functioning and compliance with legal requirements. Understanding these components is essential for both grantors and beneficiaries to navigate the trust effectively.

-

The grantor is the individual who creates the trust and transfers assets into it. The trustee is responsible for managing the trust according to its terms, while trust beneficiaries are individuals or entities who receive the benefits from the trust.

-

Schedule A lists all the assets included in the irrevocable trust, providing clarity on what properties are subject to the trust's terms and facilitating smoother asset management.

How to write an irrevocable trust agreement?

Creating an irrevocable trust agreement requires careful planning and attention to detail. The following steps outline the key phases involved in writing a comprehensive trust document.

-

Prepare a detailed list of all involved parties, including the grantor, trustee, and beneficiaries, along with their relevant details.

-

Clearly state the grantor's intentions regarding the trust, outlining its purpose and the specific terms that govern asset distribution.

-

Incorporate legal jargon and provisions that comply with state laws to protect the trust’s validity and the rights of all parties involved.

What does a sample irrevocable trust agreement template include?

Using a sample template can greatly simplify the drafting process for an irrevocable trust agreement. While templates vary, they generally encompass key sections that guide the creation of a personalized trust.

-

Most templates start with an introduction that outlines the purpose of the trust and basic terms.

-

Templates often provide not only structure but also example clauses that can be adapted to specific needs.

-

Emphasize modifying placeholders to reflect personal situations and intent, ensuring compliance with applicable laws.

What is the process for initial distribution of trust assets?

The initial distribution of trust assets is a critical step that occurs after the irrevocable trust is established. Understanding this process ensures beneficiaries know what to expect.

-

Trust provisions may specify how assets are to be distributed to minor grandchildren, emphasizing educational funds or other support until they reach maturity.

-

It’s important to communicate how and when beneficiaries will gain access to their inherited assets, which might be postponed until certain conditions are met.

How to divide the trust for children?

When multiple children are involved, dividing an irrevocable trust can ensure equitable treatment while considering individual needs.

-

Establishing separate trusts allows customization of terms and distributions tailored to each child's situation and needs.

-

Contingency clauses can outline what happens to a child’s share if they are not alive at the time of distribution, ensuring benefits are passed to their descendants.

How does income distribution work post grantor's death?

Understanding how income distributions occur is vital for both the trustee and beneficiaries. This process must align with the trust’s terms.

-

Income from trust assets may be distributed to each child at predetermined intervals, often quarterly, as long as the terms of the trust allow.

-

Consider explaining how payments are calculated and any fluctuations based on trust asset performance and expenses.

Who needs an irrevocable trust?

An irrevocable trust can be beneficial for various individuals depending on their financial and personal circumstances. Recognizing these situations can help determine its necessity.

-

Common scenarios include high-net-worth individuals looking to minimize estate taxes or families seeking to protect assets from creditors.

-

Individuals involved in estate planning or who have specific wishes for their descendants often find that creating an irrevocable trust aligns with their goals.

How do irrevocable trusts compare to revocable living trusts?

When deciding on a trust type for estate planning, it's crucial to understand the differences between irrevocable trusts and revocable living trusts.

-

Revocable trusts allow for more flexibility in control and changes, while irrevocable trusts offer significant tax advantages and asset protection.

-

For example, someone wanting to maintain control over their assets may prefer a revocable trust, while those focused on tax benefits might opt for an irrevocable trust.

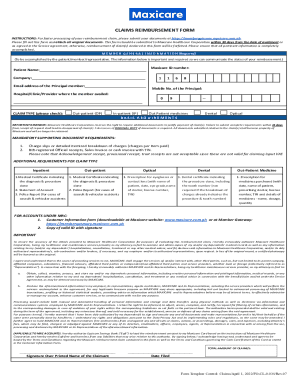

How to fill out the irrevocable trust agreement for

-

1.Begin by accessing the pdfFiller platform and selecting the irrevocable trust agreement template.

-

2.Enter the title of the trust as it will appear in legal documents.

-

3.Input the names and addresses of the grantor (the person creating the trust) and the trustee (the person managing the trust).

-

4.List the beneficiaries, including their names and contact information, specifying their respective shares of the trust.

-

5.Clearly delineate the assets involved in the trust, detailing each item's value and description.

-

6.Indicate how and when the assets should be distributed to the beneficiaries.

-

7.Review all entries for accuracy and completeness to prevent any legal complications later.

-

8.Sign and date the agreement in designated areas and consider having it witnessed or notarized according to local laws.

-

9.Submit the completed form through pdfFiller or print it for physical signing and filing.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.