Last updated on Feb 20, 2026

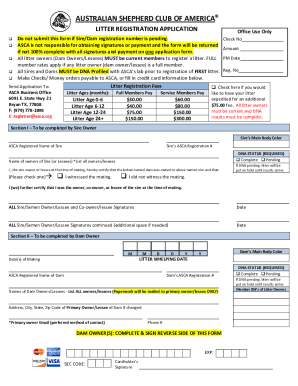

Get the free Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficultie...

Show details

When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter to credit card

A letter to a credit card company is a formal communication tool used to address issues, make requests, or provide important information regarding a credit card account.

pdfFiller scores top ratings on review platforms

easy to use and works as intended

love it!

Somewhat hard to navigate

EASY TO WORK WITH

Integrates easily with cloud platforms such as Google Drive/ O365 and has easy to use options for securely creating online fillable forms.

Easy to use

Who needs letter to credit card?

Explore how professionals across industries use pdfFiller.

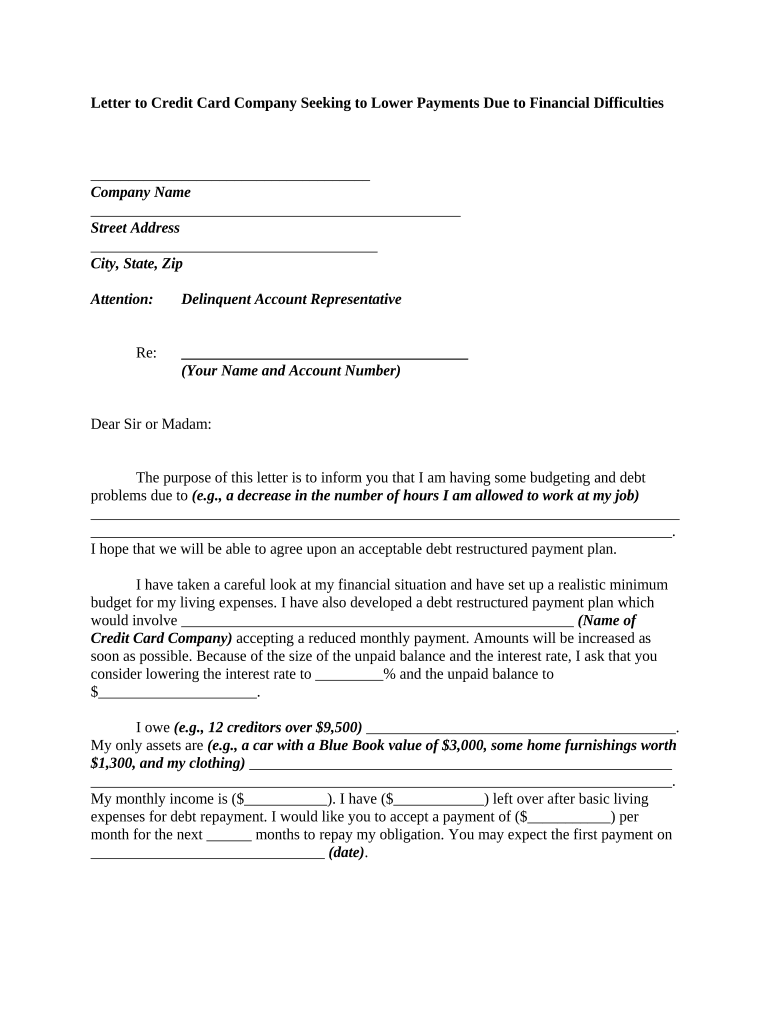

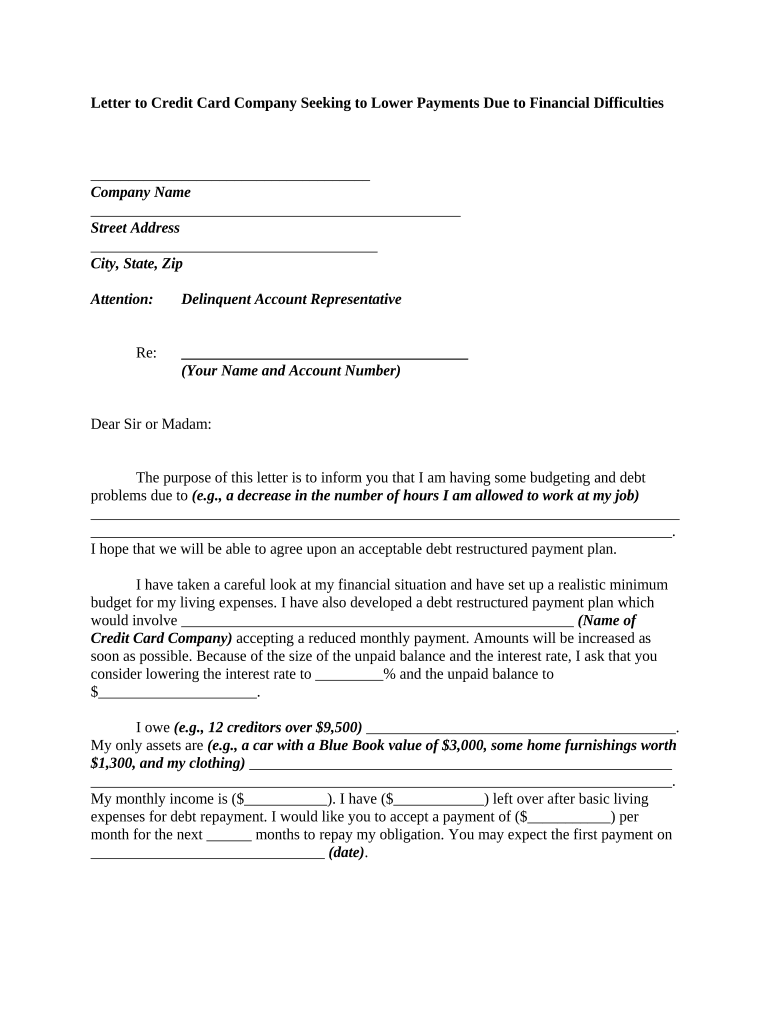

How to Write a Letter to Your Credit Card Company to Request Payment Revisions

How do draft an effective letter to my credit card company?

Writing a letter to your credit card company to request payment revisions can feel daunting. However, with a clear understanding of its purpose and structure, you can create a compelling case for financial adjustments. This guide will provide step-by-step insights into making a persuasive request.

When drafting your letter, consider your financial situation and be clear about the changes you need. These adjustments, sometimes referred to as debt negotiation strategies, could include lowering monthly payments or even negotiating a temporary payment pause.

What is the purpose of a credit card modification request?

A letter to a credit card company is a formal way to request changes in payment terms due to financial hardship. Recognizing the importance of addressing these concerns is crucial, as it helps to maintain a positive relationship with your creditor.

-

The letter should clearly articulate the request and the reasons behind it, giving the lender a comprehensive view of the situation.

-

Addressing the request with professionalism and clarity can significantly influence the response from the credit card company.

-

Common reasons might include unexpected medical expenses, job loss, or other financial hardships that necessitate revising payment terms.

What should include in my letter for a positive response?

Key components are vital for maximizing your chances of a favorable reply. Each element should be crafted thoughtfully to reflect urgency and necessity in a professional tone.

-

Include your full name, address, phone number, and email to facilitate easy communication.

-

Be sure to specify your account number and any relevant card details to avoid confusion.

-

Describe your current financial hardship honestly and concisely but without excessive detail.

-

Suggest realistic terms for revised payments, such as reduced amounts or extended deadlines, based on your ability to pay.

-

End your letter on a positive note, showing willingness to work together to find a solution.

How can effectively structure the content of my letter?

Understanding how to format the letter professionally is essential for making a positive impression. This includes using standard business letter format.

-

Use a standard font and size with appropriate spacing, ensuring clarity and readability.

-

Start with a strong opening statement that conveys your intention regarding the payment modification.

-

Provide facts, such as income changes or unexpected expenses, to support your request.

-

Include specific figures or terms, demonstrating realistic expectations.

-

Review for clarity and correctness, then send via certified mail or email, allowing for confirmation of receipt.

What are my rights and responsibilities when negotiating?

As a consumer, you have specific rights concerning credit card negotiations. Understanding these is paramount for successful discussions.

-

You have the right to negotiate and request terms that are fair and just, especially in times of distress.

-

Credit card companies must adhere to federal and state laws regarding lending and collections.

-

If your request is denied, remain calm, and consider alternative strategies or seek further advice to explore your next steps.

How can use pdfFiller to assist in preparing my letter?

Using digital tools, like pdfFiller, can enhance the letter creation and management process. This platform offers templates and editing tools to streamline the drafting experience.

-

pdfFiller offers templates that you can modify to suit your specific situation, making the letter creation process easier.

-

Using pdfFiller, you can eSign your letter effortlessly, expediting submission and eliminating the need for printing.

-

Invite others to review or assist in drafting the letter, facilitating better outcomes through collaborative efforts.

What mistakes should avoid when writing my letter?

Preventing common pitfalls can significantly improve the chance of a positive outcome. Being tactful and realistic is important when drafting your request.

-

Strive to keep your tone professional and reasoned, steering clear of overly emotional appeals.

-

Propose payment terms that you can genuinely adhere to without compromising your financial stability.

-

Before sending, review the letter for grammatical errors or vague statements that could confuse the reader.

How to fill out the letter to credit card

-

1.Open pdfFiller and select the 'Create' option to begin a new document.

-

2.Choose the 'Import PDF' option and upload the template for the letter to a credit card company.

-

3.Fill in your personal details, such as your name, address, and contact information at the top of the letter.

-

4.Add the date of writing the letter underneath your details.

-

5.Enter the recipient's information, including the credit card company's name, address, and any specific department if applicable.

-

6.Begin the letter with a formal greeting, such as 'Dear Customer Service,' or 'To Whom It May Concern,' depending on your audience.

-

7.Clearly state the purpose of your letter in the opening paragraph, whether it’s a request, complaint, or inquiry.

-

8.Provide further details and any relevant account information in the following paragraphs, ensuring to remain concise and to the point.

-

9.Close the letter with a polite conclusion, such as 'Thank you for your attention to this matter.'

-

10.Sign the letter, either digitally if your software supports it or by printing and signing manually when completed.

-

11.Save your document and choose the option to email or print the letter as needed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.