Last updated on Feb 20, 2026

Get the free Agreement to Compromise Debt by Returning Secured Property template

Show details

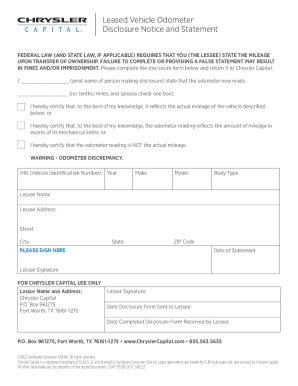

In this agreement, debtor returns certain leased property in return for the creditor/lessor writing off the lease payments owed.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is agreement to compromise debt

An agreement to compromise debt is a legal document allowing a borrower to settle a debt for less than the total amount owed.

pdfFiller scores top ratings on review platforms

great

I am pleased to use the 30-day free trial.

the shopping experience was good.

i am so dumb when it comes to technology, but this just made is extremely simple and easy to navigate

muito bom

So far, I have been very satisfied with PDF Filler!

Who needs agreement to compromise debt?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Agreement to Compromise Debt Form

This guide aims to assist individuals and teams in understanding how to fill out an agreement to compromise debt form. By following our straightforward instructions, you will be able to navigate the complexities of debt settlement agreements effectively.

What is an agreement to compromise debt?

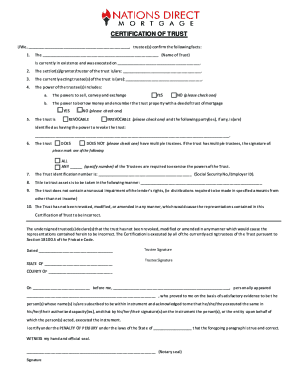

An agreement to compromise debt is a formal arrangement between a debtor and a creditor to reduce the overall amount owed. It’s essential for both parties to clearly outline their responsibilities to avoid future disputes. The document serves as a legally binding contract that can protect both sides' interests.

-

A legally binding document that settles a debt for less than the full amount owed.

-

Formalizing the agreement ensures both parties understand their rights and obligations.

-

Includes definitions of terms related to both the debtor's and creditor's obligations.

What are the key elements of the agreement?

Each agreement must contain specific elements to be valid and enforceable. Identifying the parties involved clearly helps prevent ambiguity in responsibilities.

-

Clearly state who the debtor and creditor are, including full names and contact information.

-

Detail what the debtor is expected to complete, such as payment schedules.

-

Specify the purpose of the debt and any pertinent financial information.

-

Outline the conditions that must be met for the agreement to be enforceable.

How do you fill out an agreement to compromise debt form?

Filling out the form can be straightforward with the correct approach. Following a structured, step-by-step guide minimizes errors.

-

Follow the sections carefully, ensuring all fields are properly filled.

-

Avoid leaving fields blank or inputting incorrect information, which can nullify the agreement.

-

Utilize pdfFiller’s interactive tools to complete the form efficiently.

What are the legality and compliance considerations?

Different states have unique laws impacting debt agreements. Understanding these regulations helps ensure the agreement is legally enforceable.

-

Research laws relevant to debt compromises applicable in your region.

-

Know what makes your agreement enforceable and avoid common pitfalls.

-

Some regions require notarization for such agreements to be binding.

What is the role of former shareholders in the agreement?

Former shareholders can have a critical role in debt agreements, particularly if a company is involved. Understanding their responsibilities ensures further clarity in obligations.

-

Their involvement may affect debt liability and settlement terms.

-

Former shareholders may need to disclose specific financial information.

-

Failure to adhere to terms could lead to legal repercussions.

Can you provide a sample agreement template and practical examples?

Utilizing a template can expedite the filling process. Here's an illustrative example followed by relevant customizations.

-

An example demonstrates how a completed form should appear.

-

Learn how to adapt the template to fit your specific situation.

-

Real-world scenarios highlight situations where these agreements are crucial.

What post-agreement actions should you consider?

After signing the agreement, both parties should manage expectations coherently for smooth execution. This includes understanding how to enforce the terms and address any disputes that may arise.

-

Post-signing responsibilities including payment schedules.

-

Maintain open lines of communication to facilitate dispute resolution.

-

Contemplate strategies for addressing disagreements in a timely manner.

How to fill out the agreement to compromise debt

-

1.Access pdfFiller and log in to your account.

-

2.Search for 'agreement to compromise debt' in the template library.

-

3.Select the appropriate template and open it for editing.

-

4.Fill in your personal details, including your name and address, in the designated fields.

-

5.Enter the creditor's name and contact information accurately.

-

6.Specify the original debt amount and the proposed settlement amount clearly.

-

7.Include the due date for the settlement payment to avoid confusion.

-

8.Review all entered information for accuracy and completeness.

-

9.If applicable, state how the remaining balance will be managed.

-

10.Sign the document in the signature field and date it appropriately.

-

11.Save your changes and download the completed document for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.