Last updated on Feb 17, 2026

Get the free 497331741

Show details

A receipt is a written acknowledgment by the recipient of payment for goods, payment of a debt or receiving property from another. Business owners have private policies governing a purchaser's right

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is receipt of payment for

A receipt of payment for is a document acknowledging that payment has been received for goods or services rendered.

pdfFiller scores top ratings on review platforms

Great! But, I don't know how to print this off.

AWESOME AND PRETTY EASY TO USE ONCE YOU NAVIGATE THE SITE!!

It has been a big help in doing my business paperwork while on the move

It has helped me out with many documents. I can access my documents from anywhere.

A little confusing at the start but now working very well.

Some instructions were rather confusing but customer support helped me to find my forms and get them printed and deleted. Thank you for your assistance.

Who needs 497331741 template?

Explore how professionals across industries use pdfFiller.

How to fill out a receipt of payment for form form

Understanding the receipt of payment

A receipt of payment serves as proof of a transaction made between parties. This document is crucial for record-keeping, financial accountability, and legal protection. There are various types of receipts, including full and partial receipts, each serving different transactional needs.

-

Indicates that the payment has been completed in full and all services or goods have been delivered.

-

Documents payments that have been made but may not cover the entire amount owed, often used in installments.

-

Issuing a receipt can have legal implications, such as serving as evidence in disputes or audits.

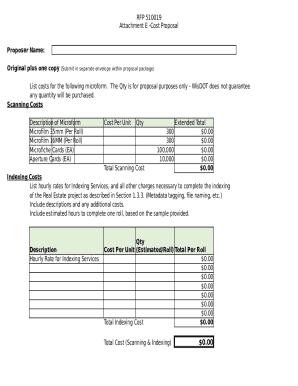

Essential components of a receipt of payment

A well-structured receipt must include vital information to ensure its validity. The fields should capture details like date of payment, names and addresses of both parties, amount paid, and the payment method. Omitting any of this information can lead to confusion and disputes down the line.

-

Indicates when the payment was made.

-

Identifies the payer and the payee for accountability.

-

Clearly shows the monetary amount exchanged during the transaction.

-

Details how the payment was made, such as cash, credit card, or bank transfer.

Step-by-step guide to creating your receipt

Creating a receipt has never been easier with pdfFiller. Utilize its tools to quickly and accurately draft a receipt of payment form. Follow these steps to ensure your receipt is well-prepared.

-

Start by logging into your pdfFiller account and navigate to the receipt template.

-

Ensure to input all required information such as names, date, and payment details.

-

Review the receipt, add your e-signature if necessary, and save it for your records.

Streamlining your document workflow

pdfFiller offers excellent collaboration features that enhance teamwork efficiency for document workflows. By utilizing cloud storage, teams can access documents from anywhere, allowing for seamless collaboration and real-time edits.

-

Share and edit documents with team members live.

-

Access documents securely from any device, making remote work effective.

-

Facilitates quicker decision-making and reduces delays in approval processes.

Regulatory compliance for receipts

In [region], it's essential to understand local regulations pertaining to receipts. These regulations can dictate how long you should retain receipts, as well as the information that must be included to comply with tax laws. Following best practices for organizing your receipts can also assist in audits or legal inquiries.

-

Be informed about the specific requirements for receipts in your area.

-

Organize receipts systematically for easier retrieval during audits.

-

Generally, receipts should be kept for at least 3 to 7 years.

Interactive tools for receipt management

pdfFiller provides innovative tools for managing your receipts more effectively. With customizable templates and auto-fill features, users can create tailored receipts quickly without repetitive data entry. E-signature options also provide an additional layer of professionalism.

-

User-friendly interface allows for easy personalization of receipt templates.

-

Saves time by populating repetitive fields like addresses or payment methods.

-

Facilitates quick signing, ensuring the receipt is valid and acknowledged by both parties.

Best practices when issuing receipts

Issuing receipts comes with certain best practices that can enhance professionalism and transparency. Recognizing when to issue a receipt is crucial as it can protect your business and reassure your clients about the transaction.

-

Always issue a receipt for any payment or transaction to maintain records.

-

Ensure that all receipts are clear, legible, and free of errors.

-

Inform clients about the importance of keeping receipts for their records.

Creating a custom receipt template

Creating a custom receipt template using pdfFiller is straightforward. Personalizing your receipts not only enhances brand identity but also makes them more recognizable to your customers.

-

Use the platform’s tools to customize components such as logos and layout.

-

Incorporate unique branding elements to enhance visibility and recognition.

-

Once complete, save templates for future use to streamline process.

How to fill out the 497331741 template

-

1.Open the pdfFiller website and sign in to your account.

-

2.Select 'Create New' and choose 'Upload Document' to add your receipt template.

-

3.Fill out the date of payment accurately at the top of the document.

-

4.Clearly indicate the name of the payer or company that made the payment.

-

5.Describe the goods or services for which the payment was made, including quantities and prices.

-

6.Include the total amount received and the method of payment (e.g., cash, credit card, check).

-

7.Add your business information or logo at the appropriate section, if applicable.

-

8.Ensure the receipt is signed by an authorized person, if required.

-

9.Review all entered information for accuracy and completeness.

-

10.Once verified, save the completed receipt and download it as a PDF or send it directly to the payer.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.