Get the free pdffiller

Show details

Records are an essential element in claiming deductions on your taxes. Record keeping is important to help you track your business activities so you know where you stand at all times. Records also

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

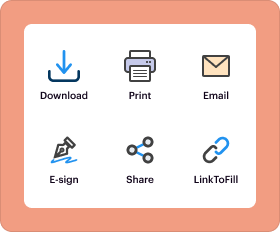

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is checklist - key record

A checklist - key record is a structured document used to ensure all necessary items or tasks are accounted for and completed.

pdfFiller scores top ratings on review platforms

luv this program, makes everything easy!

Overall good experience. Sometimes have difficultly moving text box in my iPad. Very useful though. Thank you!

It's easy to use, eliminating the need to printout, fill in and scan forms. It makes my life easier.

Customer service is helpful and quickly resolved my problem.

I love the site, I don't like all of the pop ups though! I constantly have to click out of the pop ups when opening a new form. That is my only complaint! But, all in all, I love this site and it helps me be more efficient.

Very Quick, saves me a lot of time. I regularly get pdf's that need to be completed and sent back. Now I can upload, fill out and return in a fraction of the time. Since the data is typed, I never get a question about what I wrote.

I can't believe how easy it is to fax with PDFiller! Awesome!

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Key Record Keeping Checklist - pdfFiller

A key record keeping checklist helps ensure that all critical documents are organized and accessible, which is vital for maintaining compliance and transparency in business operations. In this guide, we’ll explore how to create and manage a key record keeping checklist using pdfFiller.

What is a key record keeping checklist?

A key record keeping checklist defines the essential records that businesses must maintain to comply with regulations and manage finances effectively. Record keeping is integral for tax compliance and ensures transparency in operations.

-

Maintaining accurate records prevents possible legal issues and financial discrepancies.

-

Organized records can help maximize deductions and improve financial decision-making.

-

Having a checklist clarifies what documents are required for various processes, saving time.

How do select my record keeping method?

Evaluating various travel and entertainment record-keeping methods is crucial. Choosing a method that allows easy access to documents ensures you can retrieve the necessary information quickly for travel deductions.

-

Digital methods are often more efficient, allowing for easier backup and sharing.

-

Consider chronological or category-based approaches for organizing records.

-

Ensure you keep records of dates, participants, purposes, and expenses for meetings.

Why is documenting business mileage important?

Tracking business mileage is essential for securing tax deductions and accurate reporting. Proper documentation helps justify business expenses and can significantly impact your bottom line.

-

Record your car's odometer at the start and end of each journey.

-

Maintain logs of trips including date, start and end locations, and purpose.

-

Utilize pdfFiller to manage and organize your mileage records efficiently.

What are effective receipt management strategies?

Receipt management is crucial for documenting expenses accurately. Creating an organized storage system makes it easier to find crucial documents during audits or reviews.

-

Establish a dedicated space, either physical or digital, to store receipts.

-

Group supporting documents into categories such as invoices and checks for easier access.

-

Use chronological or account-based methods, or leverage pdfFiller's templates for organized filing.

What are my tax record keeping duties?

Understanding your federal and state record-keeping requirements is vital for compliance. Being aware of the necessary resources for tax compliance can save both time and money.

-

Follow the guidelines provided in IRS publications to ensure compliance.

-

Create reminders for critical deadlines related to your record keeping.

-

Tax compliance resources, like IRS Publication 583, guide individuals on maintaining proper records.

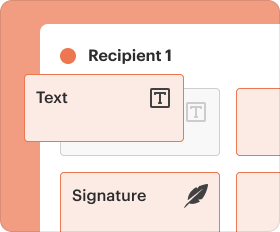

How can create a custom checklist with pdfFiller?

Creating a personalized checklist with pdfFiller is straightforward. Follow the step-by-step guide to design a template that fits your specific needs and integrates electronic signatures for a quick validation process.

-

Use pdfFiller’s user-friendly tools to design a checklist template that aligns with your requirements.

-

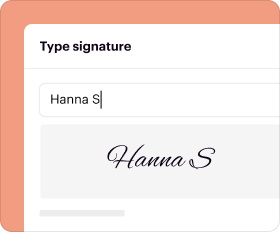

Incorporate digital signatures to streamline the approval process.

-

Utilize pdfFiller’s collaboration tools to gather input from team members effectively.

What are best practices for ongoing record management?

Regular updates and maintenance of your record-keeping system are essential. It’s important to periodically review and adjust your checklist to meet evolving business needs.

-

Conduct reviews to ensure that your checklist remains relevant to your workflows.

-

Maintain records to reflect recent changes in regulations or business structure.

-

Implement best practices with pdfFiller to ensure effective record management.

How can technology help with efficient record keeping?

Technology plays a crucial role in simplifying record keeping. Tools like pdfFiller enhance the accuracy and accessibility of records, making it easier to manage documentation.

-

Digital record keeping allows for instant access from anywhere.

-

Automated systems reduce human error in documentation.

-

Stay updated with trends to leverage new technologies for best practices in record management.

How to fill out the pdffiller template

-

1.Open the checklist - key record PDF file in pdfFiller.

-

2.Start by reviewing the checklist items listed at the top of the document.

-

3.Use the provided input fields to check off each item as it is completed.

-

4.If additional information is required, fill in the relevant sections with the corresponding details.

-

5.For any items that do not apply, ensure they are clearly marked as 'Not Applicable' to avoid confusion.

-

6.Once all items have been addressed, review the completed checklist for accuracy.

-

7.Save your progress frequently to avoid data loss.

-

8.Finalize the document by signing if required, either digitally or by printing to sign manually.

-

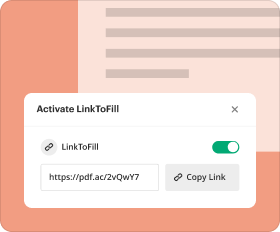

9.Download the filled-out checklist - key record or share it directly through pdfFiller with the relevant stakeholders.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.