Get the free Guidelines for Lease vs. Purchase of Ination Technology template

Show details

The rate of technology change is increasing, with an emphasis on client/server

technology, faster system development, and shorter life cycles. This has led to spiraling information technology (IT)

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is guidelines for lease vs

Guidelines for lease vs are a set of instructions outlining the differences and considerations between various types of lease agreements.

pdfFiller scores top ratings on review platforms

na

very pleasant

Fast and reliable

Great experience! Lots of helpful tools!

Everything i need in one place. I love it! I especially like that i can fill out these forms from my desktop.

Their customer service is great! And they didn't hesitate to refund my money and give me another option that would meet my needs!

Who needs guidelines for lease vs?

Explore how professionals across industries use pdfFiller.

Guidelines for Lease vs Purchase of Information Technology

When considering the best strategy for acquiring information technology, understanding the guidelines for lease vs purchase is essential. This decision not only impacts budget allocations but also reflects the operational needs of your organization. In this guide, we will explore various aspects, including the advantages and disadvantages of each option, financial considerations, and management practices.

What are the advantages of leasing technology solutions?

Leasing technology offers significant benefits that can help organizations manage their budgets more effectively and ensure they remain competitive. Here are some key advantages:

-

Leasing helps smooth budget spikes, making financial planning and allocation more manageable.

-

Leasing facilitates rapid deployment of technology solutions, ensuring organizations can stay current with the latest innovations.

-

Leasing supports standardization across organizations, simplifying training and support.

-

It provides a structured approach to disposing of outdated equipment, reducing potential environmental issues.

What are the disadvantages of leasing technology solutions?

While leasing can be advantageous, it does come with challenges that organizations must consider. The following points outline key disadvantages:

-

Without in-house IT asset management, organizations may overlook critical components of the leased technology.

-

Signing long-term contracts with specific vendors can pose financial risks if technology needs change.

-

Effective contract negotiation and management are essential to avoid potential pitfalls.

-

Ensuring strict adherence to contract terms can be difficult, particularly in a rapidly changing technology landscape.

-

A robust architectural plan is necessary for successfully integrating leased technology into existing systems.

How do financial considerations impact leasing vs purchasing?

Understanding financial implications is crucial when deciding between leasing and purchasing. Here are key considerations:

-

Determine costs related to your current procurement methods to compare against leasing and purchasing options.

-

Break down acquisition costs alongside ongoing asset management expenses to visualize total expenditure.

-

Calculate IT support costs associated with both leasing and purchasing to evaluate long-term financial impacts.

-

Consider disposal costs as part of total expenditure to gain a more accurate financial picture.

-

Using accumulated data can aid in determining which option is more economical for your organization.

What are the pros and cons of outright purchase of technology?

Outright purchase of technology comes with its own set of advantages and disadvantages. Let’s examine these aspects:

-

Purchases are typically made using general revenue or dedicated funds, providing flexibility.

-

It is important to understand how capital budgets classify expenditure to ensure appropriate allocation.

-

Outright purchases can lead to significant long-term value when compared to leasing solutions.

What is lease-purchase and capital leasing?

Lease-purchase agreements allow organizations to spread out payments, easing the financial burden of large IT acquisitions. Key points include:

-

Lease-purchase agreements typically involve structured payments over time.

-

At the end of the payment period, ownership of the leased equipment transfers to the purchaser.

-

This approach eases the financial burden and encourages investment in necessary technologies.

How to manage technology over time?

Effective management of technology throughout its lifecycle involves addressing key issues, such as:

-

Rapid technological advancements can complicate decision-making regarding upgrades and replacements.

-

Ongoing IT management is crucial from acquisition through lifecycle to ensure systems remain effective.

-

Assessing how to dispose of equipment after use is essential to ensure compliance and environmental responsibility.

What compliance and legal considerations need to be navigated?

Navigating compliance and legal matters is critical when leasing or purchasing technology. Steps include:

-

Stay informed about local regulations that impact leasing and purchasing practices.

-

Ensure that compliance requirements are integrated into lease and purchase processes.

-

Being aware of potential legal pitfalls in technology contracts helps mitigate risks.

How can pdfFiller assist in lease and purchase decisions?

pdfFiller provides valuable tools and resources to aid in making informed lease vs. purchase decisions. Features include:

-

Access interactive tools designed to analyze lease vs. purchase options effectively.

-

Edit, sign, and manage related documentation seamlessly using pdfFiller.

-

Collaborate with team members effortlessly through cloud-based functionalities.

In summary, understanding the guidelines for lease vs purchase involves evaluating the advantages, disadvantages, and financial considerations of each option. Utilizing tools like pdfFiller can streamline the process, ensuring a more efficient decision-making experience.

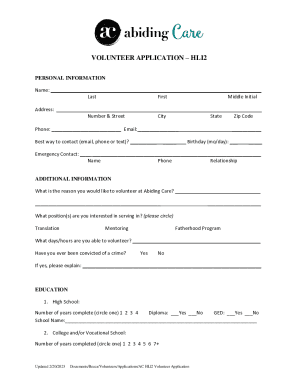

How to fill out the guidelines for lease vs

-

1.Open the guidelines for lease vs document on pdfFiller.

-

2.Review the sections to understand lease types, terms, and conditions.

-

3.Select the appropriate lease template based on your needs.

-

4.Fill in the required fields, such as tenant and landlord information, property details, and lease duration.

-

5.Provide any specific lease terms and conditions relevant to your agreement.

-

6.Ensure to include signatures and dates for both parties in the designated areas.

-

7.Review the filled document for accuracy and completeness, making sure all sections are properly filled.

-

8.Save your completed lease vs guidelines document and distribute it to involved parties.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.