Last updated on Feb 20, 2026

Get the free Sample Letter for Letter Requesting Extension to File Business Tax s template

Show details

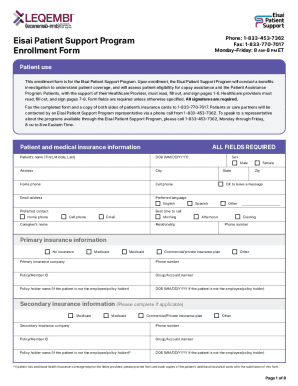

Sample Letter for Letter Requesting Extension to File Business Tax Forms

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sample letter for letter

A sample letter for letter is a template used to create a personalized letter responding to or requesting specific information from a recipient.

pdfFiller scores top ratings on review platforms

Able to create high quality complex forms with ease.

I found this program on the internet when I needed something to fill a need. I used it and still have some questions as to how and what I can do with it.

It's a godsend in terms of doing contracts and forms of various kinds in my day to day business, I don't know what I'd do without it.

I like everything in one place that's easy to use.

my experience so far has be very good like to learn more about PDFfille

I have only used it twice and so far it has been easy. I would like to learn more about your services.

Who needs sample letter for letter?

Explore how professionals across industries use pdfFiller.

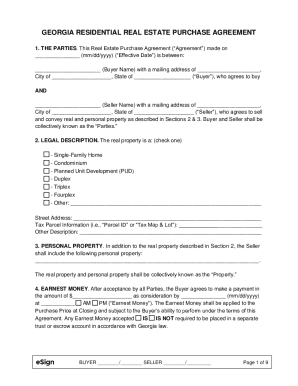

How to Write a Sample Letter for Letter Form Form

What is the purpose of the letter?

Writing a letter requesting an extension for filing business tax forms serves to formally inform the IRS of your need for more time. Common reasons include unforeseen circumstances such as illness, or the necessity for additional documentation. It is critical to adhere to IRS deadlines, which underscores the importance of this communication.

What are the essential components of the letter?

A well-structured letter should include several key components to ensure clarity and professionalism. Each section plays a crucial role in how your request is perceived by the IRS.

-

Include your complete address in the top left corner, formatted correctly to ensure proper delivery.

-

Position the date just below the return address; it shows the timing of your request.

-

Address the IRS correctly by using their official address to ensure your letter reaches the right department.

-

A subject line should clearly state the letter's purpose, making it easy for the reader to understand.

-

Begin with a formal salutation, such as 'Dear [IRS Department Name or Specific Recipient]'.

How to draft the letter step by step?

Drafting a formal request letter involves several critical steps to ensure it achieves its purpose. Start with a clear introduction to your request and provide necessary details in a structured manner.

-

Clearly state your intent to request an extension for submitting your business tax forms.

-

Include details about your business and specify the tax forms for which you are requesting the extension.

-

Mention any documents you are sending along with the request that support your case.

-

Professionally close your letter by inviting any follow-up communication, and include a note about any enclosures.

What format considerations matter for the letter?

Format is essential for professionalism in business letters. Using the correct layout enhances readability and demonstrates attention to detail.

-

This format has no indentation; all lines start at the left margin.

-

This format includes indents for the paragraphs and requires careful density control for homogeneity.

-

Standard fonts like Times New Roman or Arial at size 12 are recommended for clarity.

Why is reviewing and editing your letter crucial?

Proofreading is essential to eliminate errors and ensure your letter conveys the intended message accurately. Small mistakes can undermine your request's professionalism.

-

Check for grammatical errors, spelling mistakes, and ensure the letter flows logically.

-

Utilize tools like pdfFiller’s editing capabilities to refine the document before submission.

-

Ask colleagues or professional advisors to review your letter for additional perspectives.

How do you submit your letter to the IRS?

After drafting your letter, knowing how to submit it correctly is vital for ensuring it reaches the IRS. Incorrect submission can delay your request.

-

You can either mail your letter or choose to e-file, depending on your preference.

-

Use tracking services provided by your mailing service to confirm receipt of your letter.

-

Ensure your letter is sent well before the deadline to avoid late penalties.

How can pdfFiller enhance your document management?

Utilizing pdfFiller’s features streamlines the process of drafting your letter. Features such as document editing and e-signatures can significantly enhance your workflow.

-

Easily make adjustments to your draft with pdfFiller’s editing tools, ensuring accurate content.

-

Swiftly sign your document, eliminating the need for printing and scanning.

-

Work harmoniously with team members or advisors in real-time to refine your letter.

How to fill out the sample letter for letter

-

1.Open pdfFiller and select 'Create New Document'.

-

2.Upload the sample letter template you wish to use.

-

3.Click on the text fields to enter the recipient's name and address.

-

4.Input your name, address, and other relevant information in the designated areas.

-

5.Edit the body of the letter to customize the message according to your needs.

-

6.Utilize the formatting tools to adjust fonts and alignments if necessary.

-

7.Proofread the letter for any spelling or grammatical errors.

-

8.Once satisfied, click on 'Save' to store your document or 'Send' to email it directly to the recipient.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.