Last updated on Feb 17, 2026

Get the free Checklist - Leasing vs. Purchasing template

Show details

Every lease decision is unique so it's important to study the lease agreement carefully. When deciding to obtain equipment, you need to determine whether it is better to lease or purchase the equipment.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is checklist - leasing vs

A checklist comparing leasing options and terms to guide decision-making.

pdfFiller scores top ratings on review platforms

I was completely satisfied with my support today!

Im just trying it and i am getting a hold of it

Good experience, saves money for scanning

Thank you so much for this program!! It is easy to use and an incredible help to us!!!

The fillable form was easy to navigate and clear instructions were provided.

I really enjoy using PDFfiller, it is simple to use. Customer Service was great in assisting me on anything I did not know how to use. They responded very quickly.

Who needs checklist - leasing vs?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Checklist - Leasing vs Purchasing

If you're contemplating whether to lease or purchase equipment, property, or vehicles, using a checklist can streamline the decision-making process significantly. This comprehensive guide will help clarify the factors you need to evaluate in order to make the best choice for your situation.

Understanding financial implications of leasing vs. purchasing

Make informed decisions by examining cash flow requirements unique to your situation. Leasing typically demands lower upfront costs compared to purchasing, but it may also lead to higher-long term expenses.

-

Identify initial cash outlay required for leasing versus purchasing; leasing often offers more flexible payment options.

-

Consider how loans can lock you into long-term financial obligations compared to more flexible leasing agreements.

Evaluating maintenance costs

Understanding maintenance costs is crucial. Often, leases cover maintenance, which can simplify budgeting and reduce surprise expenses.

-

Examine whether your lease includes maintenance services; having these covered can significantly reduce your responsibilities.

-

Calculate your anticipated maintenance costs when items are purchased, as these can add to your total cost of ownership.

Insurance considerations in leasing and purchasing

Insurance implications also vary between leasing and purchasing. Assess what insurance provisions are included in your agreements.

-

Understand whether your lease covers insurance costs, which may make leasing an attractive option to lower your financial risks.

-

Estimate the potential insurance burdens related to ownership; basing your choices on comprehensive risk assessments is key.

Analyzing seasonal business cash flow

Seasonality can strongly influence your budgeting. Evaluate which option aligns with your cash flow cycles and seasonal business variations.

-

Consider whether the more predictable payments from leasing fit better with your cash flow patterns versus the lump sum of a purchase.

-

Take into account how seasonal business needs might impact your choice between leasing and purchasing.

Key financial metrics to compare

When evaluating leasing versus purchasing, key financial metrics provide clarity. Metrics like down payments and contract lengths help gauge the total financial commitment.

-

Assess the initial payments necessary for both leases and loans; generally, leases require a lower initial payment.

-

Identify the duration of lease agreements or loan terms, which usually impacts your long-term costs.

Understanding payment structures

Monthly payment structures vary significantly. It’s essential to break down payment obligations clearly, including the implications of balloon payments.

-

Break down the recurring payment amounts for leases and loans to understand your monthly cash outflows better.

-

Discuss the potential balloon payments at the end of a loan period and their impact on financial planning.

Assessing extended warranty options

Extended warranties can extend the life of purchased items, yet they come with added costs. Assess them carefully when deciding between leasing and purchasing.

-

Explain the costs associated with extended warranties when items are purchased; they can raise your total expenditure significantly.

-

Compare warranty costs against security provided through leasing, which may mitigate some risks of equipment failure.

Total cost of ownership analysis

Total cost of ownership includes more than just purchasing price. Consider all factors, including maintenance and warranties, for a complete analysis.

-

Discern the total cost for leasing versus purchasing across the item’s lifespan; this comprehensive view aids better decision-making.

-

Be sure to factor in maintenance, potential warranties, and payment structures when calculating total expenses from both options.

How pdfFiller enhances document management

Managing leasing and purchasing agreements is simplified with pdfFiller’s robust tools. From document creation to collaboration, the process is seamless and efficient.

-

Explore pdfFiller’s online platform that supports document creation and management in a user-friendly environment.

-

Utilize powerful tools for editing, signing, and collaborating on leasing and purchasing agreements to streamline your workflow.

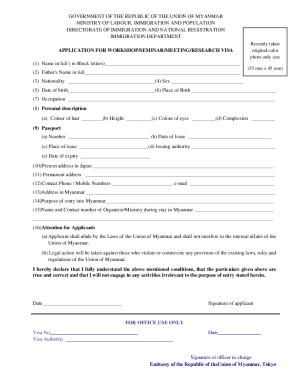

How to fill out the checklist - leasing vs

-

1.Open the 'checklist - leasing vs' document in pdfFiller.

-

2.Review the sections provided, which typically cover various leasing aspects like terms, fees, and legal obligations.

-

3.Begin filling out your personal information, including your name and contact details at the top of the checklist.

-

4.As you read through each item, check off the boxes that align with your situation or preferences for leasing.

-

5.If there are sections requiring specific information or comparisons, make detailed notes in the provided fields for clarity.

-

6.Double-check your responses for accuracy and completeness before proceeding.

-

7.Save your completed checklist by clicking the 'Save' or 'Download' button to keep a copy for your records.

-

8.Consider sharing the completed checklist with any advisors or parties involved in your leasing decision.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.