US-04048 free printable template

Show details

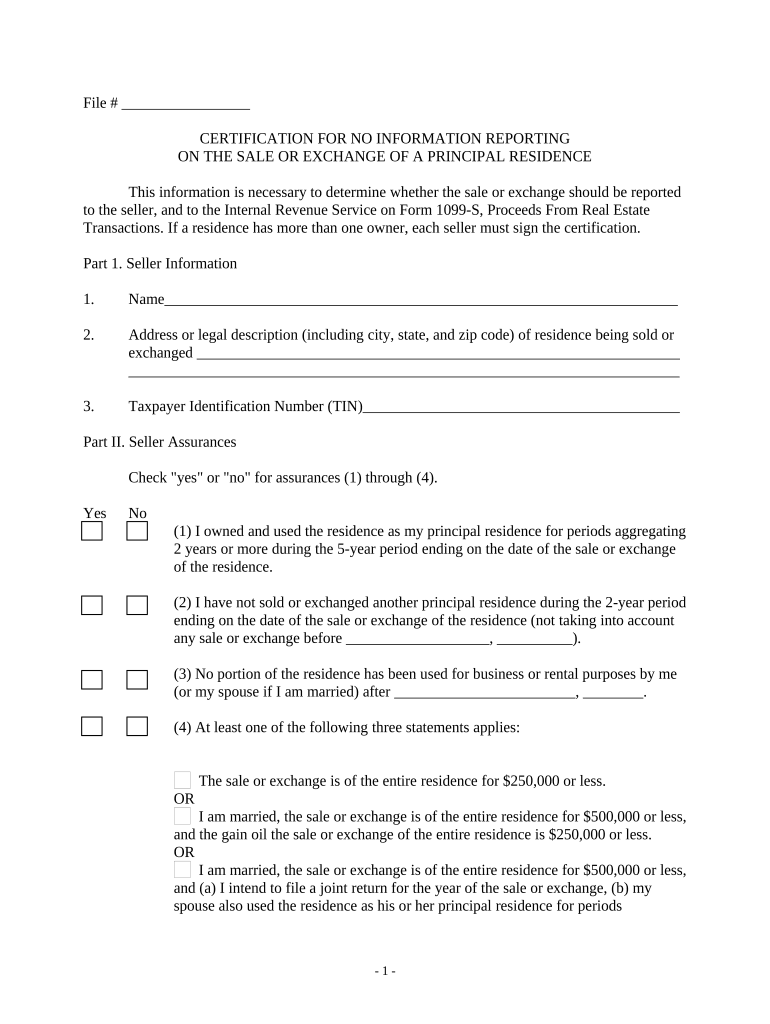

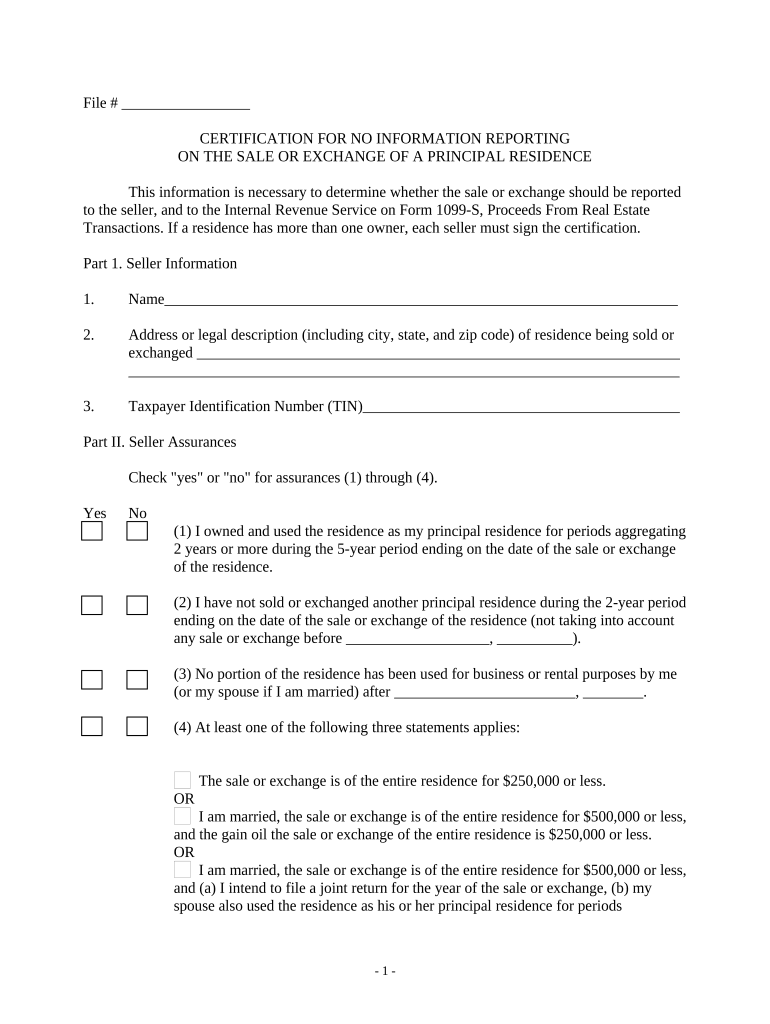

Cetification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption: This Certification is necessary to determine whether the sale or exchange should be reported to

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-04048

US-04048 is a form used for reporting specific financial information to the Internal Revenue Service.

pdfFiller scores top ratings on review platforms

Form format was helpful; a little difficult to align filler information.

small business. Now I can do anything without having to print and scan. even works from phone. Mainly use with gmail and google apps and it is awesome.

I had some frustrations with PDFfiller.com, but they went beyond my expectations to make it right. Nice to see that level of customer service. Thank you!

VERY GOOD TOOL FOR EDITING PDF'S AND KEEPING ONLINE

GREAT PROGRAM HELPED ME FILL OUT MY FORMS WITH EASE.

I like the product and how easy it is to use. PDF is the easiest document to use. Thank you for supplying such a wonderful product.

Who needs US-04048?

Explore how professionals across industries use pdfFiller.

Complete Guide to the US-04048 Form: Filling Out the Certification Correctly

What is the US-04048 form and why is it important?

The US-04048 form is a certification necessary for certain real estate transactions, particularly when reporting information related to the principal residence. This form ensures compliance with tax regulations, offering a crucial mechanism for buyers and sellers to report accurate information about property ownership and occupancy. Anyone involved in real estate transactions may need this form to avoid potential penalties.

Who needs to complete the US-04048 form?

Typically, sellers of real estate who have owned their property as their principal residence must fill out this form. If you are involved in selling or purchasing a property, you may be required to submit this certification to ensure correct reporting, especially in transactions involving a 'no information reporting' situation.

Why is the certificate critical for real estate transactions?

Filling out the US-04048 form accurately is foundational for validating tax statuses and ensuring that all involved parties meet legal obligations. It protects both the seller from unforeseen tax liabilities and the buyer from potential legal issues regarding ownership claims within the real estate transaction.

How do you navigate the certification for no information reporting?

The certification process begins by gathering necessary personal and property-related information. It's crucial to ensure all details are accurate to avoid delays or complications in selling or transferring the property. Review each requirement thoroughly to ensure a smooth certification process.

What must be done to complete the US-04048 form?

-

Including proof of residence, identification, and previous tax filings.

-

Ensure accuracy especially regarding Taxpayer Identification Number (TIN) to avoid issues.

-

This can help eliminate potential errors that could lead to complications.

How to properly verify residence information?

Verification involves cross-checking personal records and legal documents that prove residence. Utilize documents like utility bills or tax returns that explicitly state your residence to ensure all provided data is consistent and truthful, which is vital for compliance with local regulations.

What are the seller information fields in the US-04048 form?

Part I of the form requires specific seller information. You'll need to provide personal details such as name, address, and legal descriptions. Accurate input here is essential, especially regarding the Taxpayer Identification Number (TIN), which links the transaction to your tax records effectively.

How do you fill in seller information correctly?

-

This provides precise details regarding the location, which is fundamental for real estate transactions.

-

Double-check all names and addresses to avoid mismatches in records.

-

This number is crucial for tax purposes and must be accurate to prevent future liabilities.

What are seller assurances and why do they matter?

Seller assurances are declarations that certain facts about the property are true. They establish trust in the transaction and are often required to be checked as 'yes' or 'no' based on ownership or usage conditions of the residence. Understanding when and how to provide these assurances is vital for compliance.

What do you need to know about checking 'Yes' or 'No'?

-

This will determine the appropriate assurance check needed, impacting your credibility.

-

Being honest about ownership usage can protect you from legal issues down the line.

-

Keep records that support your answers, as you may need them for future verification.

Under what conditions is the US-04048 form applicable?

The form applies primarily when selling or exchanging property that has served as a principal residence. It's crucial to clarify the phrase 'entire residence' as it impacts ownership claims, especially regarding joint returns for married couples, necessitating both parties' participation in the form.

How does pdfFiller enhance the form completion process?

Using pdfFiller, users can easily digitally edit the US-04048 form with convenient features such as eSignature and secure sharing. This platform is designed for collaboration, making it straightforward for teams to work on drafts simultaneously. With pdfFiller, completing the form becomes more efficient and hassle-free.

What are the benefits of using pdfFiller?

-

Enhance accuracy when filling out forms, reducing errors.

-

Legitimize your documents with a click, ensuring compliance and acceptance.

-

Allows multiple users to work together seamlessly on form submissions.

Conclusion: Completing the US-04048 form successfully

In summary, the US-04048 form is an essential document for real estate transactions involving principal residences. Understanding how to accurately complete this form can relieve stress and ensure compliance with tax regulations. Utilizing tools like pdfFiller can simplify the process, making form completion more efficient and effective. Remember, staying informed and organized is key when handling the US-04048 form form.

How to fill out the US-04048

-

1.Access pdfFiller and log in to your account.

-

2.Search for the ‘US-04048’ form using the search bar on the dashboard.

-

3.Once located, click on the form to open it for editing.

-

4.Begin filling in the required fields, starting with your personal information, including name, address, and Social Security Number.

-

5.Proceed to input the financial details as requested, ensuring accuracy in figures and details.

-

6.Review the form for any additional documentation requirements or signatures if needed.

-

7.Once completed, check for any errors and correct them before finalizing the document.

-

8.Click on ‘Save’ to store your filled form, and choose to print or share electronically as per your needs.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.