Last updated on Feb 10, 2026

Get the free Collection Report template

Show details

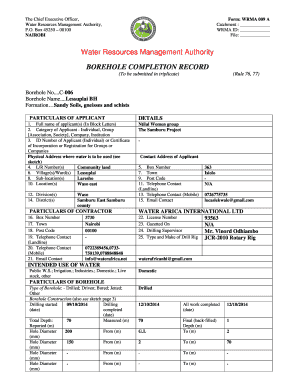

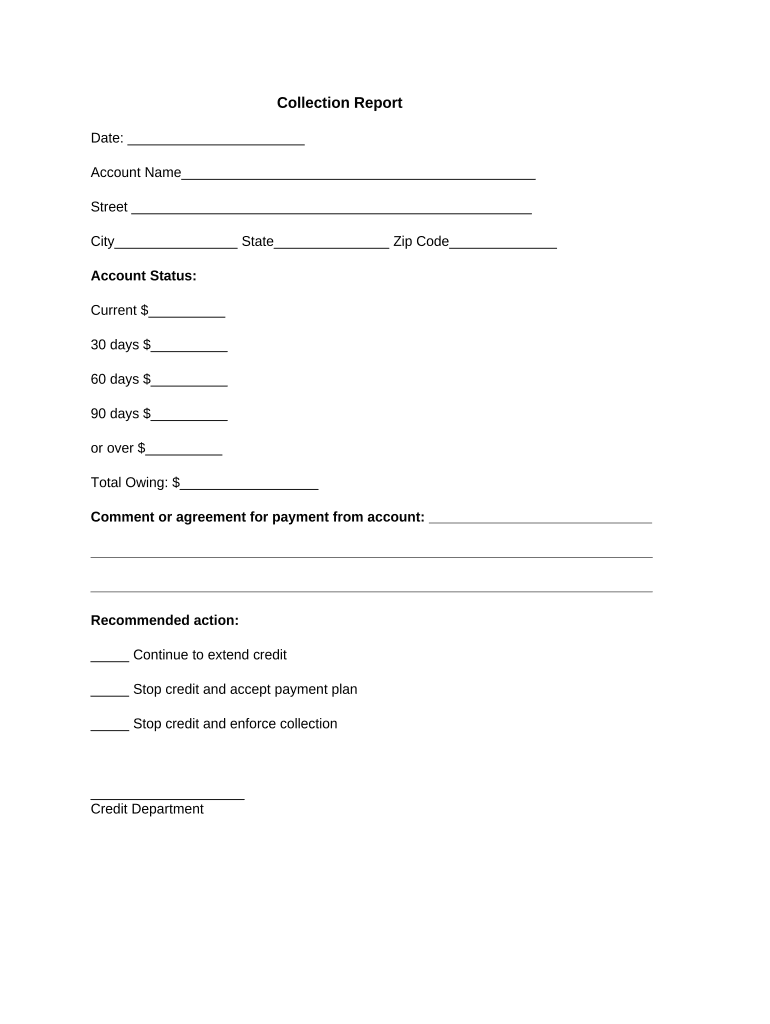

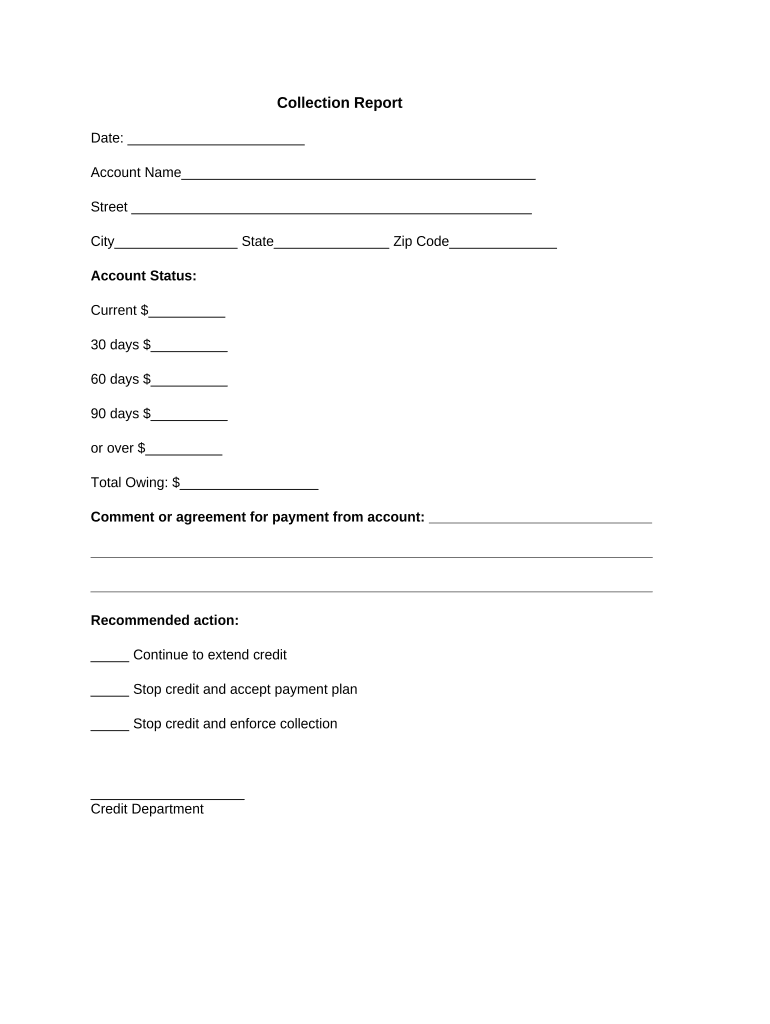

This form gives the status of an unpaid account along with recommended action.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is collection report

A collection report is a document that summarizes the status of accounts receivable and collections made by a business or organization.

pdfFiller scores top ratings on review platforms

Great editing capabilities!

Very swift and helpful responses

Very swift and helpful responses, excellent customer service.

I had wonderful experience

I had wonderful experience. Anna helped me alot. Thankyou again.

So far so good

So far so good, I use Adobe Acrobat Pro DC at home and at work, I am still on my first day of my 30 day trial of PDFFILLER but I'm impressed so far. I particularly like the library and search features. More to come as my experience develops.

great

Very effective for what I need to do. Saves me lots of time and aggravation in correcting documents.

Who needs collection report template?

Explore how professionals across industries use pdfFiller.

Collection Report Form Guide

What is a collection report and why is it important?

A collection report is a critical document used by organizations to track outstanding debts and manage accounts effectively. Accurate reporting is crucial for credit management, enabling businesses to make informed decisions about extending credit and managing risk. Utilizing platforms like pdfFiller enhances document management through customizable templates that streamline the reporting process.

What are the key components of a collection report?

-

The date the report is generated, offering a timeline for debt management.

-

Identifies the debtor to whom the report pertains, essential for clarity.

-

Accurate address information crucial for follow-ups and communications.

-

Indicates whether the account is current, overdue, or in collections, impacting strategic decisions.

-

The total debt amount, guiding financial decisions and priorities.

How do you fill out a collection report form?

Filling out the collection report requires following structured steps to ensure accuracy. Start by accessing the template on pdfFiller. Enter essential details such as date and account information, detailing the account status and the total owed.

-

Incorporate any notes regarding payment terms to clarify the agreement.

-

Select appropriate actions based on account status and company's collection policies.

How can you edit and customize your collection report?

pdfFiller offers robust editing tools that allow users to personalize their collection reports easily. You can collaborate with team members in real-time, improving the process's efficiency and accuracy. eSigning features help securely share documents, while version management provides a reliable way to track changes.

What are best practices for collection reporting?

Best practices include ensuring accuracy and timeliness in reporting. It is crucial to understand compliance regulations specific to your region, as failure to comply can lead to legal implications. Using the collection report effectively can guide credit decisions and foster regular follow-ups to maintain account status.

-

Verify all entries to minimize mistakes and enhance reliability in reporting.

-

Stay updated on the regional guidelines to avoid potential fines.

How can pdfFiller aid in collection management?

pdfFiller's cloud-based platform allows users to manage forms remotely, providing flexibility in handling collection reports. The benefits of managing documents from anywhere ensures that teams can stay organized. Additionally, integrating collection reports into broader financial workflows enhances efficiency.

-

Utilize the platform's features to tailor your document management according to your specific needs.

-

Engage team members by sharing access to the collection report for better team synergy.

How to fill out the collection report template

-

1.Open the collection report template in pdfFiller.

-

2.Start by entering the date of the report at the top of the document.

-

3.Fill in the name and contact details of your organization in the designated fields.

-

4.In the 'Client Information' section, complete the client's name, address, and account number.

-

5.List all outstanding invoices with details including invoice numbers, due dates, and amounts owed.

-

6.If applicable, note any partial payments received and their corresponding dates in the payment records section.

-

7.Calculate the total amount outstanding at the end of the list of invoices.

-

8.Review the report for accuracy and completeness, ensuring all necessary fields are filled.

-

9.Use the built-in tools in pdfFiller to make any necessary edits or annotations.

-

10.Once finalized, save the document and send it to relevant parties via email or export options available in pdfFiller.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.