US-04517BG free printable template

Show details

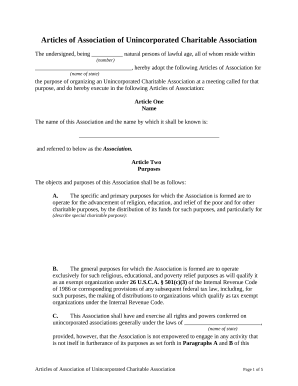

Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-04517BG

US-04517BG is a standardized form used for reporting financial transactions to the IRS.

pdfFiller scores top ratings on review platforms

Great app for filling out pdf documents.

self explanatory bar, 24X7 live chat support and by phone. very user friendly and efficient workload

So far so good. Program is easy to use. And price seems reasonable. I can't comment on customer service as I haven't had to use it as of yet.

It's made it possible for me to fill in a form in a

PDF without having to fork out for Acrobat. Very useful

Very user friendly and amazing amount of forms to search and use.

PDFfiller is a very helpful tool. However, I do feel there are aspects that could be improved. For example, it would be useful to be able to fill in ovals.

Who needs US-04517BG?

Explore how professionals across industries use pdfFiller.

How to fill out the US-04517BG

-

1.Access pdfFiller and upload the US-04517BG form from your computer or select it from your documents.

-

2.Begin by filling out the personal information section at the top of the form, including your name, address, and contact information.

-

3.Next, move to the financial transaction details section where you will provide specifics about the transactions being reported.

-

4.If applicable, include any identification numbers, such as social security or tax identification numbers relevant to the transactions.

-

5.Double-check all entries for accuracy, ensuring that each box is filled out appropriately and legibly.

-

6.Preview the filled form to confirm all information appears correctly before finalizing it.

-

7.Once satisfied, save your completed document to your pdfFiller account or download it for submission to the IRS.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.