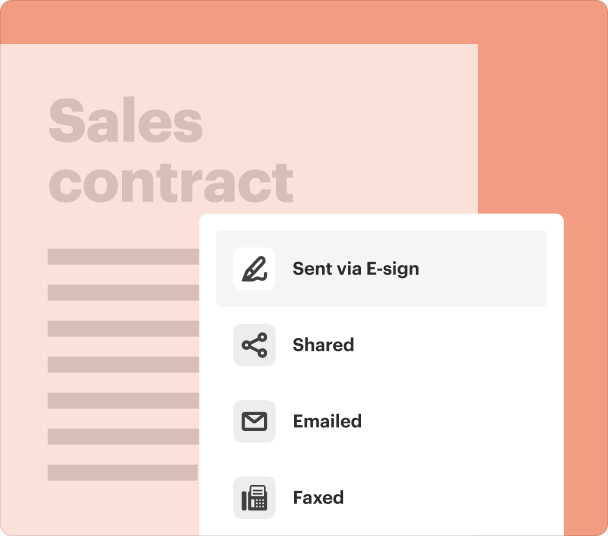

Get the free sample letter to beneficiaries distribution of funds

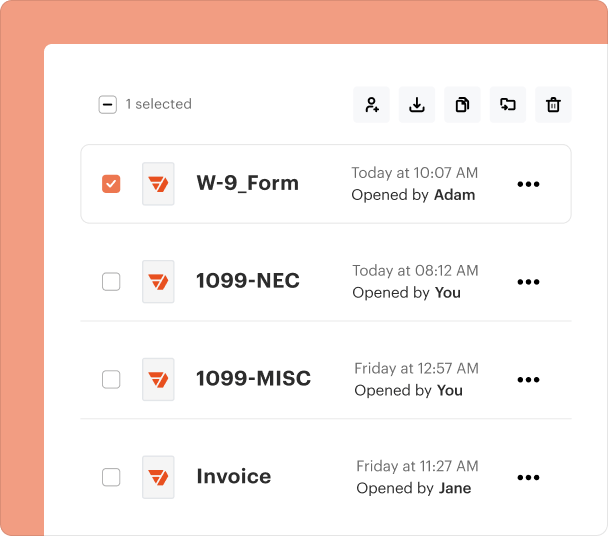

Fill out, sign, and share forms from a single PDF platform

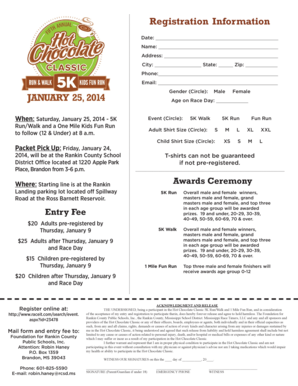

Edit and sign in one place

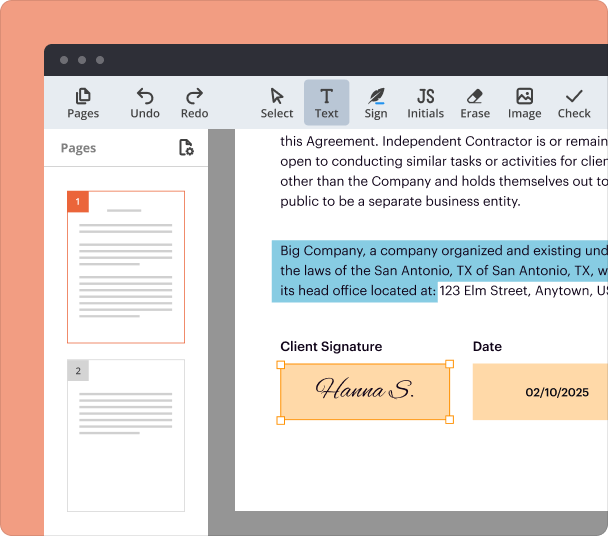

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

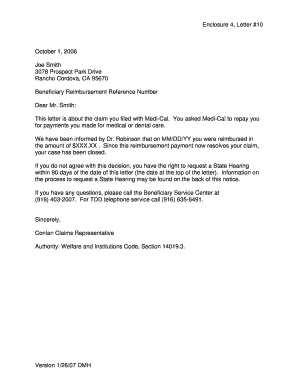

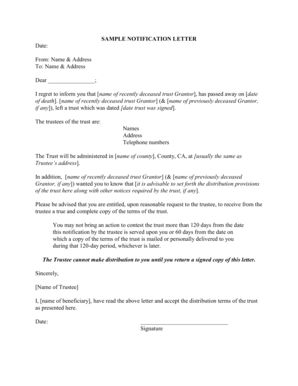

Comprehensive Guide to Writing a Sample Letter to Beneficiaries

To fill out a sample letter to beneficiaries form, begin by clarifying the deceased's intent for asset distribution, including specific details about each beneficiary and their respective shares. Provide a proper salutation, an introduction of your relationship to the deceased, and clearly outline any special wishes or instructions. Finally, conclude with contact information for future assistance.

Understanding the purpose of an inheritance letter

An inheritance letter is crucial as it clarifies the intentions of the deceased regarding asset distribution. It offers a formal way to communicate their last wishes, providing both executors and beneficiaries legal protection and transparency. Not only does it articulate how assets should be allocated, but it also helps beneficiaries find closure after a loss.

What are the key components of an inheritance letter?

A well-crafted inheritance letter includes several essential components. First, it starts with a proper salutation and an introduction that establishes the sender's relationship to the deceased. The letter should confirm the completion of probate, followed by a detailed list of assets and explicit distribution details. Additionally, any special instructions or wishes should be included to ensure the deceased’s desires are honored.

How do you write your inheritance letter step-by-step?

Writing an inheritance letter involves several structured steps that ensure clarity and respect. Begin with a proper salutation, introducing yourself and your relationship to the deceased, followed by clearly stating the purpose of the letter. Deliver precise details about the assets being inherited, any special instructions from the deceased, and conclude by offering your contact information for further queries.

-

Begin with a proper salutation, addressing the beneficiaries respectfully.

-

Introduce yourself and state your relationship to the deceased to establish trust.

-

Clearly state the purpose of the letter to set the tone for the following information.

-

Provide meticulous details about the inheritance, including the distribution of assets.

-

Explain any special instructions or wishes left by the deceased.

-

Offer your assistance and contact details for any questions.

-

Conclude with a sincere expression of sympathy to convey your care.

What is included in a sample inheritance letter template?

A sample inheritance letter template helps facilitate the writing process. pdfFiller provides an editable cloud-based template that users can customize easily. Additionally, included instructions guide users through the personalization of the template, and a sample letter filled with relatable fictional details showcases a practical example.

What legal considerations should you keep in mind?

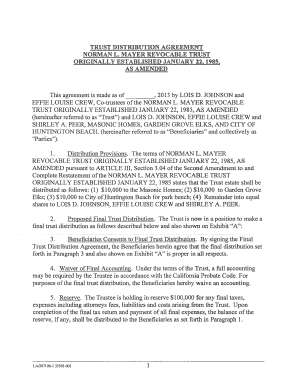

When writing an inheritance letter, understanding the legal implications is essential. Depending on local laws, there may be requirements for notarization or the need for a legal witness to validate the document's authenticity. It is crucial to ensure accuracy and compliance, as discrepancies can lead to disputes among heirs and complications during the probate process.

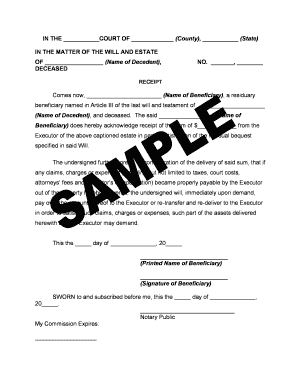

How to execute the letter delivery process effectively?

Delivering the inheritance letter can be as significant as writing it. Best practices suggest various options, such as delivering it in person or mailing it securely. Documenting receipt of the letter by beneficiaries ensures accountability, and following up with each beneficiary can help clarify any points of confusion, fostering an open line of communication.

-

Deliver the letter in-person where possible to add a personal touch.

-

Use a reliable mailing option that provides tracking to confirm delivery.

-

Document receipt by having beneficiaries acknowledge receipt formally.

-

Follow up with beneficiaries to address any questions or concerns regarding the letter.

What are alternatives to the inheritance letter?

While an inheritance letter serves a distinct purpose, there are alternative documents that can provide similar information. Additional legal documents like a will or trust may be considered, especially if more complex arrangements exist. The executor's role is also crucial, as they are responsible for communicating the estate's intentions, which can include delivering summaries, status updates, and clarifications about asset distribution.

Frequently Asked Questions about trustee letter to beneficiaries sample form

What is the main purpose of an inheritance letter?

The main purpose of an inheritance letter is to clearly express the deceased's wishes regarding the distribution of their assets. It provides legal protection for both executors and beneficiaries and helps bring closure to the latter.

Do I need a lawyer to write an inheritance letter?

While it's not strictly necessary to involve a lawyer for writing an inheritance letter, consulting one can help ensure that your letter complies with local laws. This can safeguard against potential legal challenges in the future.

Can an inheritance letter be contested?

Yes, an inheritance letter can potentially be contested, particularly if its contents are ambiguous or contradict a more formal will. Beneficiaries may challenge the letter if they believe it does not reflect the true intentions of the deceased.

How long after a death should the inheritance letter be sent?

Best practices suggest sending the inheritance letter shortly after completing the probate process, ideally within a few weeks. This timeframe ensures beneficiaries receive timely communication about their inheritance.

What should I do if a beneficiary refuses to accept the inheritance?

If a beneficiary refuses to accept an inheritance, it's essential to have open communication with them to understand their concerns. In some cases, mediation may be necessary, or legal advice might be sought to address the situation effectively.

pdfFiller scores top ratings on review platforms