Last updated on Feb 20, 2026

Get the free Joint Trust with Income Payable to Trustors During Joint Lives template

Show details

Joint revocable trusts have been used historically as a mechanism for married persons to combine assets and control their disposition in a uniform manner.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is joint trust with income

A joint trust with income is a legal arrangement where two or more individuals manage and benefit from shared assets while retaining the right to receive income generated from those assets.

pdfFiller scores top ratings on review platforms

Best app ive ever used in PDF document editing software. beats adobe hands down.

The only way I could fill in form was in preview mode.

Areas for agent name and address, and customer name and address do not allow to be filled out

Could be easier to navigate, but overall- one of the best out there.

it worked great for what i needed at the time

great tool have been using it for years!

Who needs joint trust with income?

Explore how professionals across industries use pdfFiller.

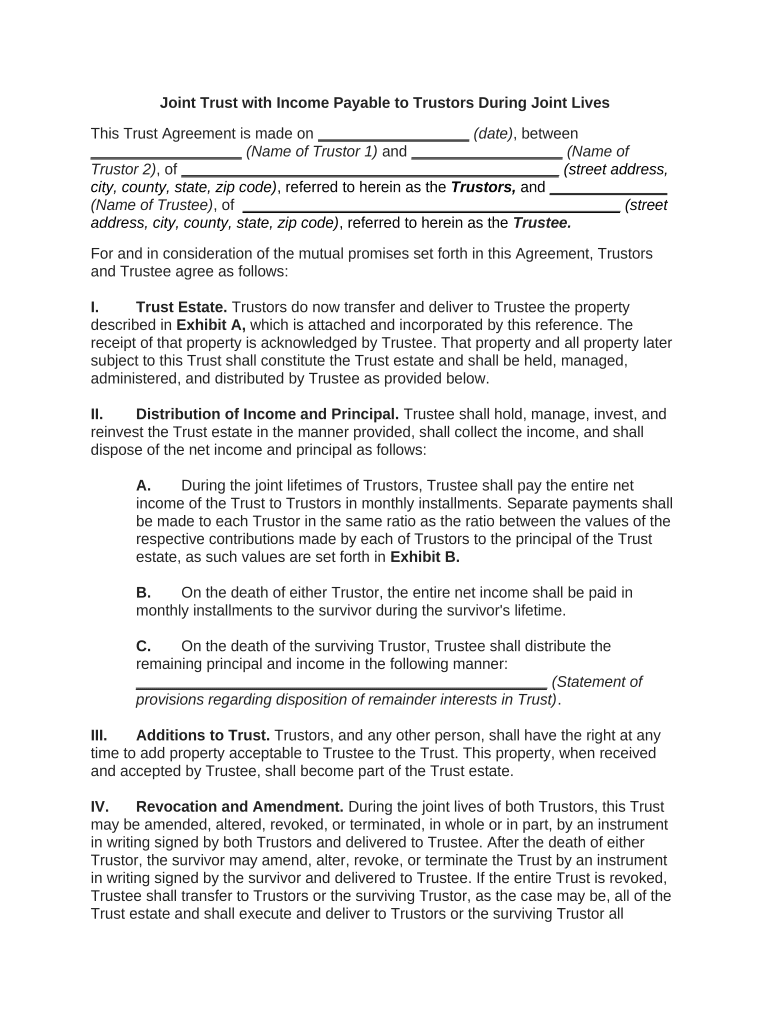

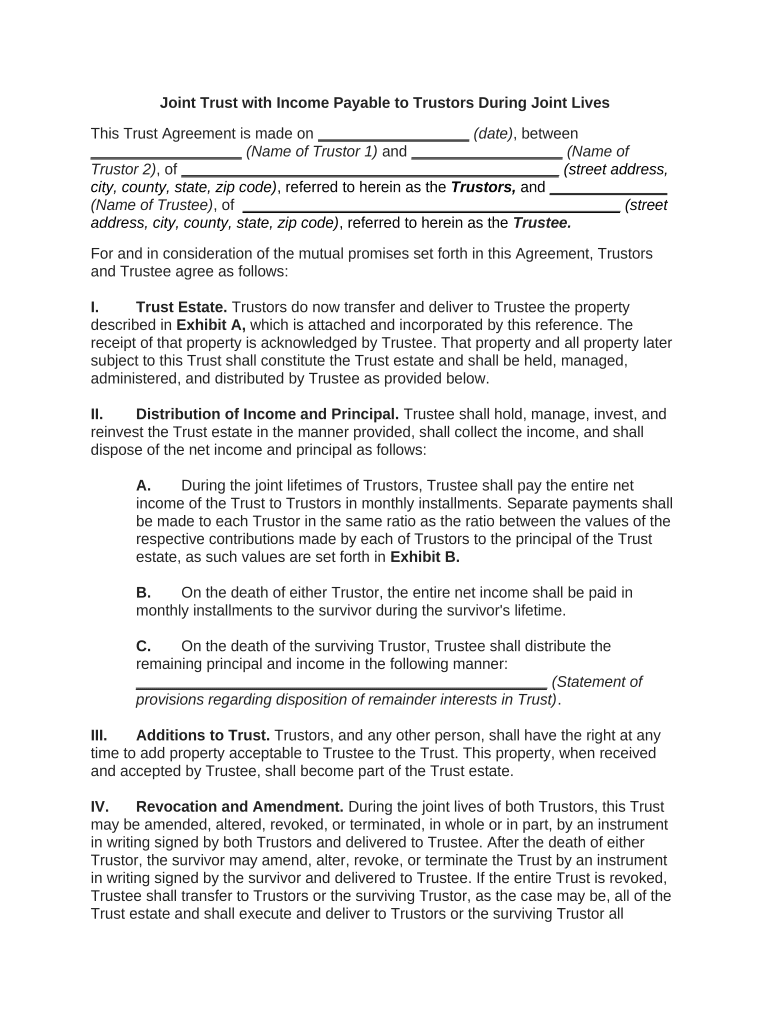

Guide to Establishing a Joint Trust with Income Payable to Trustors

How do joint trusts work?

A joint trust is a legal arrangement where two or more individuals, typically spouses, manage assets together for mutual benefit. The primary purpose is to streamline estate planning and asset management while providing income to the trustors during their lifetimes. Essentially, a joint trust simplifies the transfer of assets and offers potential tax benefits, making it a popular choice for many families.

What are the key components of the joint trust agreement?

-

The joint trust agreement typically involves Trustors (the individuals creating the trust) and a Trustee (the entity responsible for managing the trust).

-

It is critical to provide a comprehensive description of the Trust Estate, encompassing all assets involved, which may include real estate, bank accounts, and investment portfolios.

-

The document should explicitly outline the process for transferring assets into the trust, ensuring all legal requirements are met to avoid any issues.

How is income distributed in a joint trust?

During their joint lifetimes, income generated from trust assets is typically distributed evenly between Trustors, promoting financial equality. Payment amounts can depend on each Trustor's contributions to the Trust estate, ensuring fairness and transparency. Additionally, the distribution processes are often designed to ensure that income continues flowing smoothly even after the death of one Trustor.

What are the responsibilities of the Trustee?

-

The Trustee is responsible for overseeing the day-to-day management of trust assets, ensuring they are protected and yield income as intended.

-

Trustees should adhere to best investing practices, diversifying investments to minimize risk while maximizing returns for income generation.

-

Trustees must stay informed about regulatory considerations and ensure that all trust activities comply with relevant laws and tax regulations.

What happens to income and principal after the Trustors' death?

After the passing of the surviving Trustor, the principal remaining in the Trust must be distributed according to the established guidelines. This distribution may include considerations for remainder interests, which define who receives the remaining assets. Understanding the legal implications under IRS regulations is crucial in ensuring the beneficiaries are treated fairly and in compliance with tax obligations.

What are the common misconceptions about joint trusts?

-

Joint trusts are often misunderstood, with many believing they eliminate all estate taxes, which isn’t always the case.

-

Risks such as unexpected income tax liabilities can arise if the trust earnings exceed certain thresholds.

-

Neglecting regular reviews of the trust and its investments can lead to costly mistakes, diminishing the financial benefits intended.

How can pdfFiller assist in managing joint trust documents?

pdfFiller offers robust features for creating, editing, and managing joint trust forms and documents. Users can efficiently collaborate, securely manage files in the cloud, and access them from anywhere, making it easier for individuals and teams to stay on top of their estate planning obligations. Empowering users with tools to streamline document handling aligns perfectly with the need for clear and accessible trust management.

What compliance and regulatory considerations must be addressed?

-

Understanding IRS guidelines related to joint trusts can provide insight into tax responsibilities and filing requirements.

-

Each state may have unique laws affecting joint trusts; staying compliant is essential to prevent legal issues.

-

Implementing best practices for maintaining records ensures ongoing compliance and preparedness for potential audits.

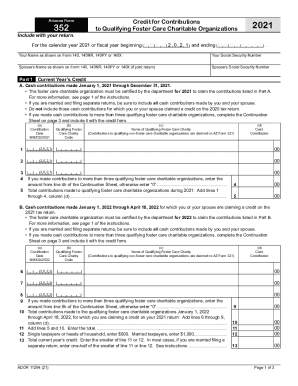

How to fill out the joint trust with income

-

1.Start by obtaining the correct template for a joint trust with income from pdfFiller.

-

2.Open the document in pdfFiller and review the fields that need to be filled out.

-

3.Enter the names of all parties involved in the trust, ensuring accurate spelling and order.

-

4.Fill in the address and identification details of each trustee and beneficiary.

-

5.Specify the assets being placed into the trust by listing them clearly with descriptions.

-

6.Indicate how the income generated from the trust assets will be distributed among the beneficiaries.

-

7.Review all entered information for accuracy and completeness before final submission.

-

8.Finalize the document by signing as required and date the signatures appropriately.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.