Last updated on Feb 20, 2026

US-136-AZ free printable template

Show details

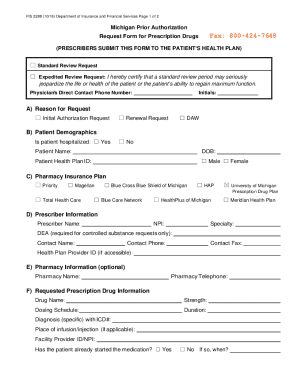

CREDIT MEMO REQUEST FORM END USER PURCHASE PRICE VARIANCE TO / ACCOUNTS RECEIVABLE PLEASE ISSUE A CREDIT MEMO AND REFUND AS FOLLOWS CUSTOMER NAME AND ADDRESS REFUND BY CREDIT CARD CHECK Credit card number Exp. Date PURCHASED FROM Sales order number RESELLER Attach copy of receipt of purchase PURCHASE PRICE MAILER EXT. PART NUMBER DESCRIPTION PRICE PRICE DIFFERENCE SALES TAX TOTAL REFUND Requester Date Authorized Signature Supervisor/Mgr.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-136-AZ

US-136-AZ is a form used for reporting specific tax information and compliance needs in Arizona.

pdfFiller scores top ratings on review platforms

thankful for the 30 day free trial...so far fairly easy to use

This is a great tool well worth the money!

ottom line is that it does the job (so far)

easy to read and generate forms which made my experience less stressful - ty

I love this software. I can easily 'sign' a document to approve vendor bids, etc. This really keeps the ball rolling. Thanks.

Easy as it gets. Used it successfully with no prior experience...very user friendly and forgiving.

Who needs US-136-AZ?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Using the US-136-AZ Form

Filling out a US-136-AZ form involves understanding its purpose, navigating its key sections, and accurately providing the required information. This comprehensive guide walks you through the essential steps to ensure you effectively manage your credit memo requests.

What is the purpose of the credit memo request form?

The CREDIT MEMO REQUEST FORM serves as an official document used to initiate a request for a credit memo. It is essential when customers are eligible for a refund or a price adjustment due to variances during a transaction.

-

The primary aim of the form is to standardize the process of requesting refunds or adjustments in a documented manner.

-

It typically applies to situations such as price changes or refunds initiated by the customer.

-

Understanding the associated legal and compliance requirements ensures the process is conducted without regulatory issues.

What are the key sections and fields of the US-136-AZ form?

The US-136-AZ form has several essential sections that require careful attention to detail.

-

This includes the 'Customer Name and Address', ensuring accurate identification for request processing.

-

You must specify 'Refund By', which outlines how the refund will be processed.

-

Mandatory documents like receipts or proofs of purchase need to be attached for verification.

How to complete the US-136-AZ form step by step?

Completing the US-136-AZ form correctly involves a sequence of careful steps.

-

Ensure all mandatory fields are completed to prevent delays in processing.

-

Keep an eye out for frequent errors such as incomplete fields or missing attachments.

-

Don’t forget to double-check your entries before signing and submitting.

Why use pdfFiller for the US-136-AZ form?

pdfFiller enhances the paperwork experience by offering tools specifically designed for efficient form handling.

-

Users can seamlessly edit the US-136-AZ form to ensure all information is correct and up to date.

-

The e-signature feature allows for faster processing and reduces the time spent on paperwork.

-

Enhance teamwork with collaborative features that enable multiple users to manage the document efficiently.

What are the common scenarios for credit memo requests?

Credit memo requests can arise in various situations ranging from price adjustments to item returns.

-

Users often submit requests when the price paid does not match the advertised price.

-

Customers may need to request refunds for returned merchandise or errors.

-

Thorough documentation is crucial to ensure that each request is validated smoothly.

What are best practices for managing credit memo requests?

Effective management of credit memo requests can streamline operations and improve response times.

-

Maintain a system to track all submitted requests for follow-ups.

-

Keep comprehensive records to provide necessary documentation when needed.

-

Evaluate existing processes to identify areas for improvement in handling refunds.

How to stay updated with regulatory changes?

Staying informed about industry regulations impacts the compliance of any refund process.

-

Perform ongoing checks to ensure adherence to evolving regulations surrounding the US-136-AZ form.

-

Pay attention to announcements regarding updates to the US-136-AZ form and its requirements.

-

Utilize resources such as newsletters or bulletins that provide the latest regulatory information.

How to fill out the US-136-AZ

-

1.Download the US-136-AZ form from the official tax website or pdfFiller.

-

2.Open the PDF file in pdfFiller to access the document editing tools.

-

3.Fill in your personal information in the designated sections, including your name, address, and Social Security number.

-

4.Enter the required financial information based on the specific tax year for which you are filing.

-

5.Double-check all entries to ensure accuracy and completeness of the information provided.

-

6.Use pdfFiller's options to add any necessary signatures or dates if required.

-

7.Review the entire form once more before submitting or printing it.

-

8.Save the filled-out form to your pdfFiller account or download it for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.