Get the free removal form template

Show details

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

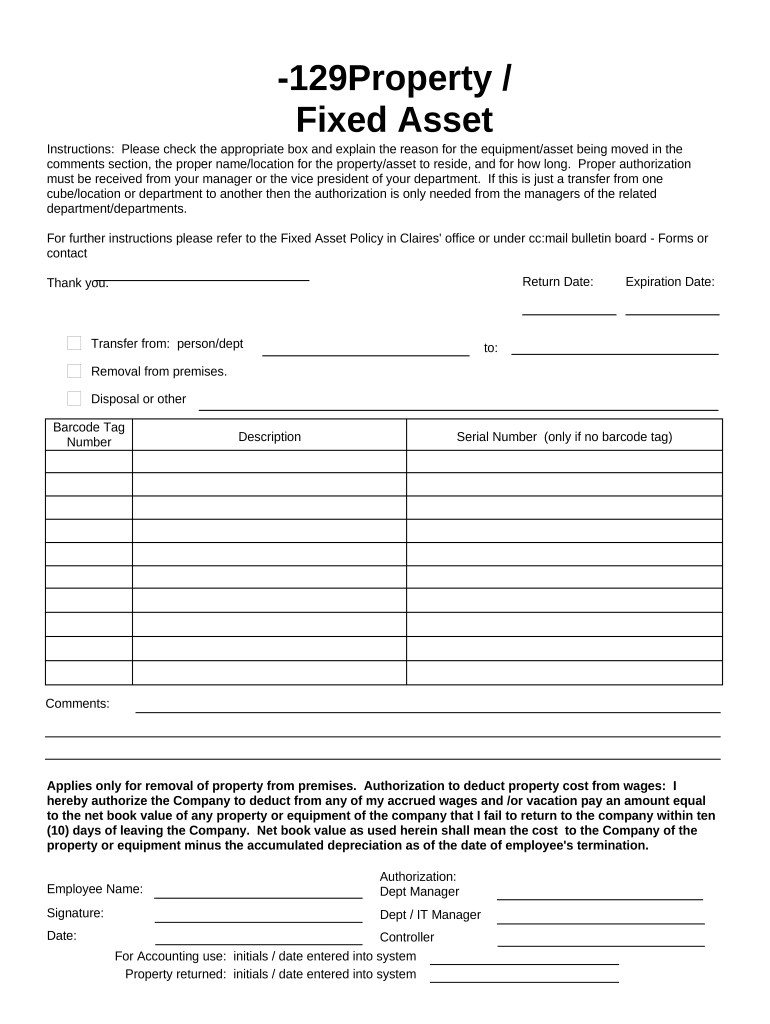

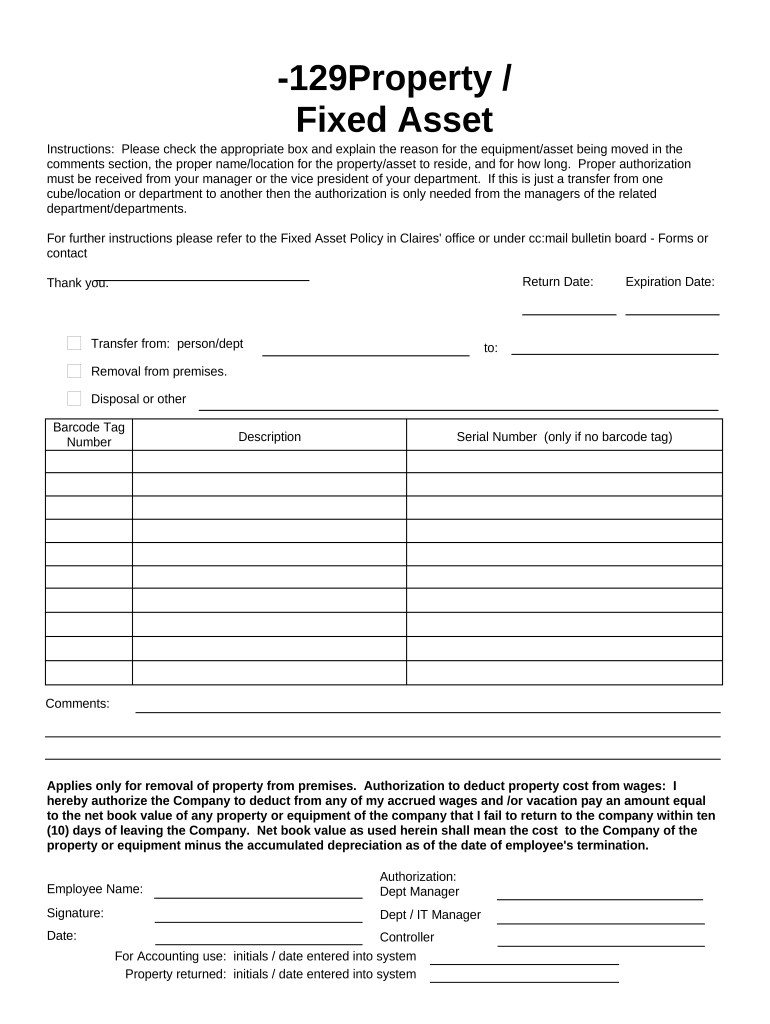

What is fixed asset removal form

A fixed asset removal form is a document used to formally request the removal or disposal of fixed assets from a company's inventory.

pdfFiller scores top ratings on review platforms

GREAT WORK TODAY GOOD PROGRAM NO WEBINAR NEEDED THANK YOU FOR YOUR HELP

Perfect!!! Easy to use

great

great experience

Easy to use.

Easy to use.

Who needs removal template template?

Explore how professionals across industries use pdfFiller.

How to fill out a fixed asset removal form effectively

Understanding the fixed asset removal form

A fixed asset removal form is a crucial document used to record the transfer or disposal of company assets. It serves as legal proof that an asset has been officially removed from the company's inventory. This form ensures that businesses remain compliant with their asset management policies and regulations.

-

The form is used to document the removal of fixed assets, providing transparency in asset tracking.

-

It helps companies maintain accurate records and ensure compliance with audits and regulations.

-

This form is typically required when assets are sold, transferred to another location, or discarded due to damage.

Key components of the fixed asset removal form

A well-structured fixed asset removal form consists of several critical components that facilitate the process of asset management.

-

Understanding each section is key to ensuring complete and accurate submissions.

-

Step-by-step guidance helps users navigate the filling process without errors.

-

This section requires specifics about the asset's origin and destination, crucial for tracking.

-

Signatures from authorized personnel are needed to validate the asset removal.

-

Users can elaborate on the reasons for asset movement, providing context for auditors.

-

Adherence to the company’s fixed asset policy is mandatory to ensure secure and reliable transactions.

Filling out the form: Step-by-step instructions

Completing the fixed asset removal form requires attention to detail. Following instructions meticulously will prevent delays.

-

Select the appropriate option indicating whether the asset is being sold, transferred, or disposed of.

-

Include barcodes or serial numbers along with a brief description of the asset for verification.

-

Clearly state the reason for removal, which is critical for internal records and audits.

-

Specifying this date ensures that all parties are aware of the time frame for the transaction.

-

Ensure that you meet requirements for any wage deductions related to asset removal, as applicable.

Common challenges and solutions

Filling out the fixed asset removal form can present various challenges, from clerical errors to authorization bottlenecks.

-

Miscalculations or omissions in form details can lead to compliance issues.

-

Getting approvals can take time, impacting the timely removal of assets.

-

Issues can arise when reconciliation of asset records is mismatched without proper documentation.

-

Edit and correct forms digitally using pdfFiller to eliminate errors before submission.

Compliance and best practices

Managing fixed assets proactively can enhance your business's operational efficiency and compliance standing. Regular audits and adherence to best practices are essential.

-

Establish standard operating procedures for fixed asset management within your organization.

-

Stay up to date with federal and state regulations that pertain to asset removals and transfers.

-

Conduct periodic audits to ensure documentation is complete and accurately reflects asset status.

-

Keep a detailed record of all asset transfers for transparency and accountability.

Using pdfFiller for fixed asset management

pdfFiller streamlines the process of managing fixed asset removal forms, making it easier for users to keep track of their assets.

-

The platform offers tools to fill out fixed asset forms efficiently and correctly.

-

Cloud storage ensures that forms are secure yet easily accessible from any location.

-

Seamlessly integrate with existing enterprise resource planning systems for enhanced data coherence.

Conclusion

In conclusion, the fixed asset removal form is essential for accurate asset management and compliance. Utilizing a structured approach to fill out this form ensures you're fulfilling all regulatory requirements and maintaining accountability. By leveraging tools like pdfFiller, organizations can streamline their asset management processes effectively.

How to fill out the removal template template

-

1.Open the fixed asset removal form on pdfFiller.

-

2.Fill in the date of the removal request at the top of the form.

-

3.Enter the name of the asset you wish to remove, including its identification number.

-

4.In the provided section, state the reason for the asset removal in clear terms.

-

5.Specify the method of disposal (e.g., sale, donation, recycling) in the designated area.

-

6.Include details about the asset's current location and department responsible for it.

-

7.If necessary, provide any additional comments or justifications in the comments section.

-

8.Ensure that the form is signed by the responsible personnel and authorized approver.

-

9.Review all entries for accuracy before submitting the form electronically through pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.